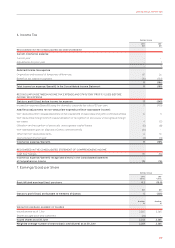

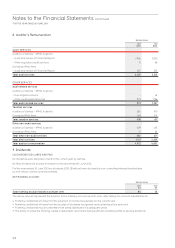

Qantas 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

X INTERESTBEARING LIABILITIES

Interest-bearing liabilities are recognised initially at fair value less

attributable transaction costs. Subsequent to initial recognition,

interest-bearing liabilities are stated at amortised cost, with any

difference between cost and redemption value being recognised

in the Consolidated Income Statement over the period of the

borrowings on an effective interest basis. Interest-bearing

liabilities that are designated as hedged items are subject to

measurement under the hedge accounting requirements.

Y SHARE CAPITAL

Ordinary Shares

Ordinary shares are classied as equity. Incremental costs

directly attributable to issue of ordinary shares are recognised

as a deduction from equity, net of any related income tax benet.

Repurchase of Share Capital

When share capital recognised as equity is repurchased, the

amount of the consideration paid, including directly attributable

costs is recognised as a deduction from equity.

Treasury Shares

Shares held by the Qantas sponsored employee share plan trust

are recognised as treasury shares and deducted from equity.

Z COMPARATIVES

Various comparative balances have been reclassied to

align with current year presentation. From 1 July 2012, the

Qantas Segment was restructured as two separate operating

segments – Qantas Domestic and Qantas International. The

presentation of the comparatives in Note 2 has been changed

to reect the current structure. In addition, the Qantas Group

reclassied amounts from Other revenue/income to Net

passenger revenue and Net freight revenue as discussed in

Note 3. Otherreclassications have no material impact on the

FinancialStatements.

AA NEW STANDARDS AND INTERPRETATIONS NOT YET ADOPTED

For new standards and interpretations not yet adopted, refer

toNote 38.

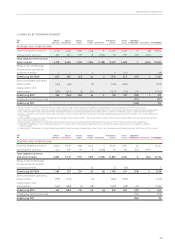

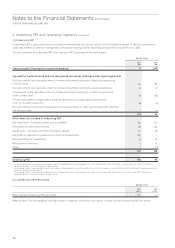

2. Underlying PBT and Operating Segments

A UNDERLYING PBT

Underlying PBT is the primary reporting measure used by the

Qantas Group’s chief operating decision-making bodies, being

the Chief Executive Ofcer, Group Management Committee

and the Board of Directors, for the purpose of assessing the

performance of the Group.

The primary reporting measure of the Qantas Domestic, Qantas

International, Qantas Loyalty, Qantas Freight and Jetstar Group

operating segments is Underlying EBIT. The primary reporting

measure of the Corporate/Unallocated segment is Underlying

PBT as net nance costs are managed centrally and are not

allocated to Qantas Domestic, Qantas International, Qantas

Loyalty, Qantas Freight and Jetstar Group operating segments.

Refer to Note 2(D) for a detailed description of Underlying PBT

and a reconciliation of Statutory prot/(loss) before tax to

underlying PBT.

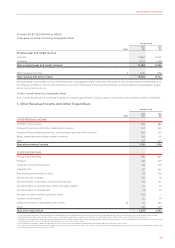

B DESCRIPTION OF OPERATING SEGMENTS

From 1 July 2012, the Qantas Segment was restructured as two

separate operating segments – Qantas Domestic and Qantas

International. The presentation of the comparatives has been

changed to reect the current structure. The Qantas Group

comprises the following operating segments:

Qantas Brands

Qantas Domestic, Qantas International, Qantas Loyalty and

Qantas Freight operating segments are collectively referred

to as Qantas Brands.

Qantas Brands is a cash generating unit (CGU) comprising those

operations of the Qantas Group which are dependent on the

Qantas eet and the Qantas brand to collectively generate cash

inows and derive value.

To drive business focus, assign accountability and monitor

performance, the Qantas Brands operations are managed

through four operating segments. This management approach

has not involved separating the operating segments into

stand alone operations or implying the capital structuring or

transactions that would be required for such a separation.

The Qantas eet and the Qantas Brand together support all

the operating segments within Qantas Brands. In order to set

targets and assess the performance, including accountability

of the operating segments (as measured by Underlying EBIT),

Qantas Domestic and Qantas International report depreciation

expense for passenger aircraft and Qantas Freight reports

depreciation expense for freighters.

»Qantas Domestic The Australian domestic passenger

ying business of Qantas Brands.

»Qantas International The International passenger ying

business of Qantas Brands.

»Qantas Loyalty Operates the Qantas customer loyalty

program for Qantas Brands

(Qantas Frequent Flyer) as well as

other marketing services, loyalty

and recognition programs.

»Qantas Freight The air cargo and express freight

business of Qantas Brands.

Jetstar Group

The Jetstar Group are those operations of the Qantas Group

which are dependent on the Jetstar eet and the Jetstar Brand

being the Jetstar passenger ying businesses (including Jetstar

Group’s investments in Jetstar branded airlines in Asia).

Corporate/Unallocated

Costs associated with the centralised management and

governance of the Qantas Group, together with certain items

which are not allocated to business segments and other

businesses of the Qantas Group which are not considered

tobesignicant reportable segments are reported in

Corporate/Unallocated segment.

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013

1. Statement of Signicant Accounting Policies

c

ontinue

d