Qantas 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

137

QANTAS ANNUAL REPORT 2013

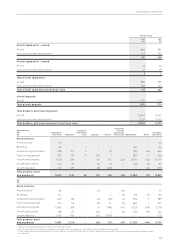

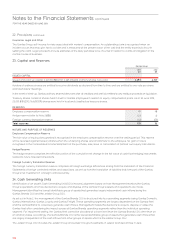

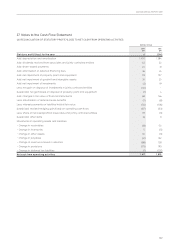

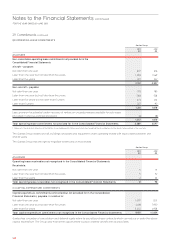

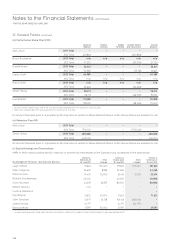

27. Notes to the Cash Flow Statement

A RECONCILIATION OF STATUTORY PROFIT/LOSS TO NET CASH FROM OPERATING ACTIVITIES

Qantas Group

2013

$M

2012

$M

Statutory prot/(loss) for the year 6(244)

Add: depreciation and amortisation 1,450 1,384

Add: dividends received from associates and jointly controlled entities 142 22

Add: share-based payments 20 31

Add: amortisation of deferred nancing fees 26 24

Add: net impairment of property, plant and equipment 93 157

Add: net impairment of goodwill and intangible assets 24 20

Add: net impairment of investments (2) 19

Less: net gain on disposal of investments in jointly controlled entities (30) –

(Less)/add: net gain/(loss) on disposal of property, plant and equipment (1) 4

Add: changes in fair value of nancial instruments 68 146

Less: amortisation of deferred lease benets (7) (8)

Less: interest payments on liabilities held at fair value (56) (106)

(Less)/add: realised hedging gain/(loss) on operating cash ows (87) (33)

Less: share of net loss/(prot) of associates and jointly controlled entities 39 (3)

(Less)/add: other items 18 9

Movements in operating assets and liabilities:

– Change in receivables (18) 50

– Change in inventories 5 (5)

– Change in other assets 30 (3)

– Change in payables (41) 132

– Change in revenue received in advance (88) 128

– Change in provisions (173) 193

– Change in deferred tax liabilities (1) (107)

Net cash from operating activities 1,417 1,810