Qantas 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

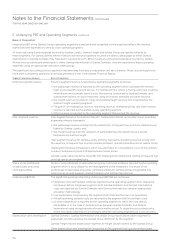

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013

N IMPAIRMENT

Non-nancial Assets

The carrying amounts of non-nancial assets (other than

inventories and deferred tax assets) are reviewed at each

balance date to determine whether there is any indication of

impairment. If any such indication exists, the assets’ recoverable

amount is estimated. For goodwill and intangible assets with

indenite lives, the recoverable amount is estimated each year.

The recoverable amount of assets is the greater of their fair

value less costs to sell and its value in use. Assets which

primarily generate cash ows as a group, such as aircraft, are

assessed on a cash generating unit (CGU) basis inclusive of

related infrastructure and intangible assets and compared to

net cash ows for the CGU. Estimated net cash ows used in

determining recoverable amounts are discounted to their net

present value using a pre-tax discount rate that reects current

market assessments of the time value of money and the risks

specic to the asset.

An appropriate impairment charge is made if the carrying

amount of an asset or CGU exceeds its recoverable amount.

Impairment losses recognised in respect of CGUs are allocated

rst to reduce the carrying amount of any goodwill allocated

to the CGU and then to reduce the carrying amounts of the

other assets in the CGU on a pro-rata basis. The impairment

is expensed in the year in which it occurs. An impairment loss

is reversed if there has been a change in the estimates used

to determine the recoverable amount. An impairment loss with

respect to goodwill is not reversed.

Financial Assets

The carrying value of nancial assets is assessed at each

reporting date to determine whether there is any objective

evidence that it is impaired. A nancial asset is considered to be

impaired if objective evidence indicates that one or more events

have had a negative effect on the estimated future cash ows

of that asset.

An impairment loss in respect of a nancial asset measured

at amortised cost is calculated as the difference between its

carrying amount and the present value of the estimated future

cash ows discounted at the asset’s original effective interest rate.

O ASSETS CLASSIFIED AS HELD FOR SALE

Non-current assets, or disposal groups comprising assets and

liabilities, that are expected to be recovered primarily through

sale rather than through continued use are classied as held

for sale. Immediately before classication as held for sale,

the measurement of the assets or components of a disposal

group is remeasured in accordance with the Qantas Group’s

accounting policies. Thereafter, the assets, or disposal group,

are measured at the lower of carrying amount and fair value

less costs to sell. Any impairment loss on a disposal group is

rst allocated to goodwill and then to remaining assets and

liabilities on a pro-rata basis except that no loss is allocated

to inventories, nancial assets or deferred tax assets, which

continue to be measured in accordance with the Qantas Group’s

accounting policies. Impairment losses on initial classication as

held for sale and subsequent gains or losses on remeasurement

are recognised in the Consolidated Income Statement.

P PROPERTY, PLANT AND EQUIPMENT

Owned Assets

Items of property, plant and equipment are stated at cost or

deemed cost less accumulated depreciation and impairment

losses. Items of property, plant and equipment are initially

recorded at cost, being the fair value of the consideration provided

plus incidental costs directly attributable to the acquisition.

The cost of acquired assets includes the initial estimate at

the time of installation and during the period of use, when

relevant, the costs of dismantling and removing the items and

restoring the site on which they are located, and changes in the

measurement of existing liabilities recognised for these costs

resulting from changes in the timing or outow of resources

required to settle the obligation or from changes in the discount

rate. Subsequent expenditure is capitalised when it is probable

that future economic benets associated with the expenditure

will ow to the Group.

The unwinding of the discount is treated as a nance charge.

The cost also may include transfers from hedge reserve of any

gain or loss on qualifying cash ow hedges of foreign currency

purchases of property, plant and equipment in accordance

with Note 1(F).

Borrowing costs associated with the acquisition of qualifying

assets, such as aircraft and the acquisition, construction or

production of signicant items of other property, plant and

equipment, are capitalised as part of the cost of the asset

to which they relate.

Depreciation

Depreciation is provided on a straight-line basis on all items of

property, plant and equipment except for freehold land which

is not depreciated. The depreciation rates of owned assets are

calculated so as to allocate the cost or valuation of an asset,

less any estimated residual value, over the asset’s estimated

useful life to the Qantas Group. Assets are depreciated from

the date of acquisition or, with respect to internally constructed

assets, from the time an asset is completed and available for

use. The costs of improvements to assets are depreciated over

the remaining useful life of the asset or the estimated useful

life of the improvement, whichever is the shorter. Assets under

nance lease are depreciated over the term of the relevant

lease or, where it is likely the Qantas Group will obtain ownership

of the asset, the life of the asset.

1. Statement of Signicant Accounting Policies

c

ontinue

d