Qantas 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

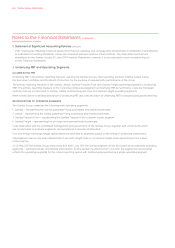

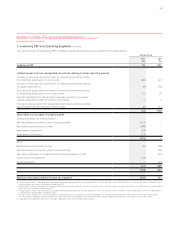

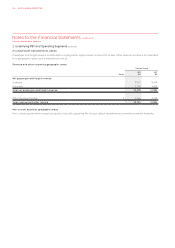

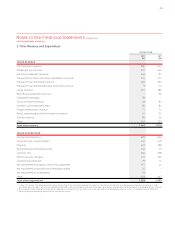

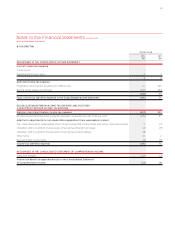

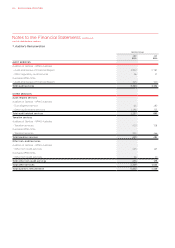

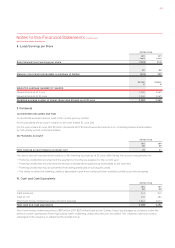

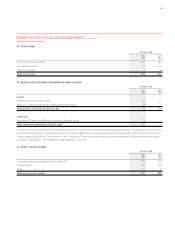

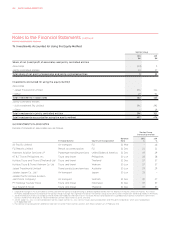

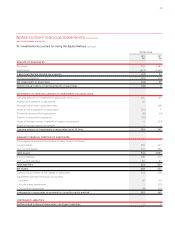

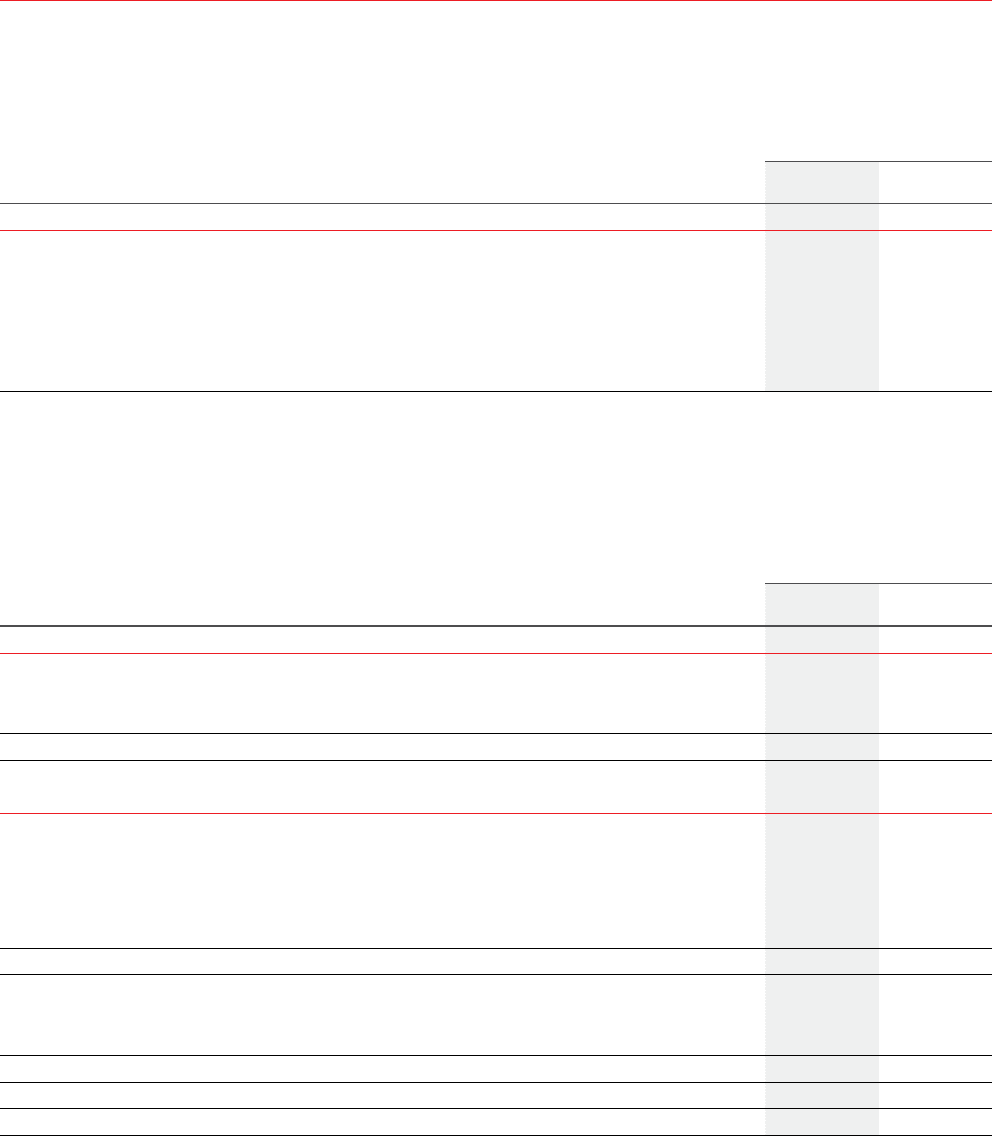

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

The following are included in statutory (loss)/profit before income tax expense and net finance costs:

Qantas Group

2012

$M

2011

$M

OTHER ITEMS REQUIRING DISCLOSURE

Changes in estimate of discount rates1()

Legal provisions2 ()

Net loss on disposal of investments and related transaction costs3– ()

Net loss on disposal of property, plant and equipment () ()

Net foreign currency gain/(losses) ()

Non-aircraft operating lease rentals () ()

1 During the year ended 30 June 2012 the Qantas Group changed its estimate of the discount rates used to calculate the present value of provisions and employee benefits

resulting in an increase in net expenses. (Refer to Note 1(C)).

2 Legal provisions represent provisions for freight regulatory fines and third party class action.

3 During the year ended 30 June 2011 the Qantas Group disposed of its investments in DPEX Group and Harvey Holidays Pty Ltd. Additionally, the Group deconsolidated

Jetset Travelworld Group as a result of the merger of Jetset Travelworld Group with Stella Travel Services. These transactions resulted in a net loss of $20 million after

transaction costs. Refer to Note 27(B) for further details.

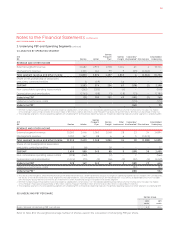

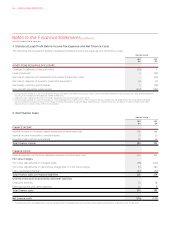

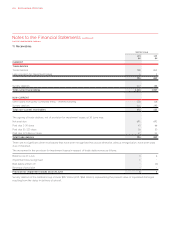

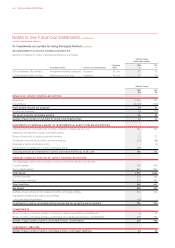

5. Net Finance Costs

Qantas Group

2012

$M

2011

$M

FINANCE INCOME

Interest income on financial assets measured at amortised cost

Interest income from jointly controlled entity

Unwind of discount on receivables

Total finance income

FINANCE COSTS

Interest expense on financial liabilities measured at amortised cost

Fair value hedges

Fair value adjustments on hedged items () ()

Fair value adjustments on derivatives designated in a fair value hedge

Less: capitalised interest1() ()

Total finance costs on financial liabilities

Unwind of discount on provisions and other liabilities

Employee benefits

Other provisions and other liabilities

Total finance costs

Net finance costs () ()

1 The borrowing costs are capitalised using the average interest rate applicable to the Qantas Group’s debt facilities being 7.2 per cent (2011: 6.8 per cent).

4. Statutory (Loss)/Profit Before Income Tax Expense and Net Finance Costs

QANTAS ANNUAL REPORT 2012086