Qantas 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

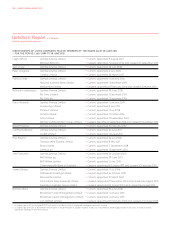

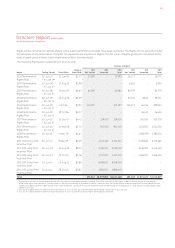

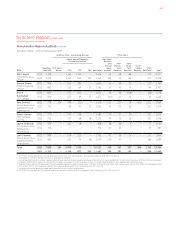

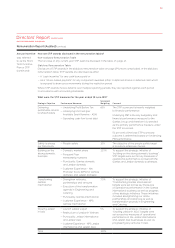

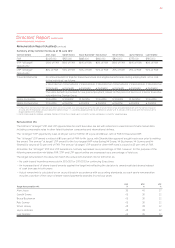

FOR THE YEAR ENDED 30 JUNE 2012

Directors’ Report continued

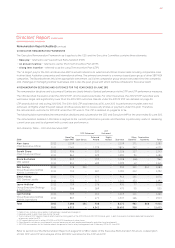

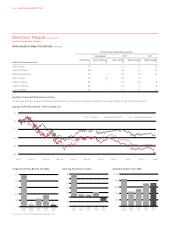

5 STATUTORY REMUNERATION DISCLOSURES FOR THE YEAR ENDED 30 JUNE 2012

The statutory remuneration disclosures for the year ended 30 June 2012 are detailed below and are prepared in accordance

with Australian Accounting Standards (AASBs) and differ significantly from the 2011/2012 remuneration decisions and outcomes

outlined on page 47.

These differences arise due to the accounting treatment of share-based payments (such as the STIP and LTIP). The statutory

disclosures include an accounting remuneration value for:

—Prior years’ STIP awards

Accounting standards require STIP remuneration to be expensed (and therefore included as remuneration) in financial years

which differ from the year of scorecard performance. This creates a disconnect between reported remuneration and the

corresponding years’ financial and non-financial scorecard performance.

In both 2009/2010 and 2010/2011 the Board made considered decisions to not pay a cash bonus and instead awarded entirely

deferred STIP awards.

Deferred shares granted under the STIP have a future service period, during which the recipient must remain employed by

the Group for the awards to vest. The consequence of these decisions is that the 2011/2012 remuneration disclosures include

a value of part of prior year awards. These values are significantly higher than the 2011/12 STIP outcome as outlined on page 47.

In the case of the CEO, the statutory remuneration include a value for prior years STIP awards of $2.163 million, even though

the CEO did not receive an award under the 2011/12 STIP.

—LTIP awards that have not vested

Accounting standards require LTIP remuneration to be expensed (and therefore included as remuneration) notwithstanding

that the Rights have not met the performance hurdles and have lapsed.

No LTIP awards vested during 2011/2012 and the performance against target for all remaining LTIP plans are below the level

required for vesting, however, an accounting value is still required by accounting standards to be included in these disclosures.

Additionally, LTIP awards that will be assessed for vesting in future years are expensed over the three year testing period.

Therefore, the statutory disclosures include an accounting value for part of the 2011-2013 and the 2012-2014 LTIP awards,

even though no LTIP awards vested during 2011/2012.

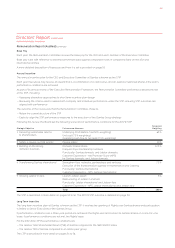

Remuneration Report (Audited) continued

QANTAS ANNUAL REPORT 2012048