Qantas 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOR THE YEAR ENDED 30 JUNE 2012

Review of Operations continued

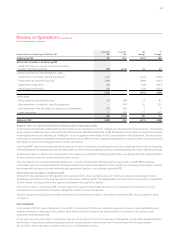

Reconciliation of Underlying to Statutory PBT

June 2012

$M

June 2011

$M

$M

Change

%

Change

Underlying PBT () ()

Items not included in Underlying PBT

- AASB mark-to-market movements relating

to other reporting periods () ()

Qantas International Transformation costs

- Impairment of property, plant & equipment () – () >()

- Redundancies and restructuring () – () >()

- Impairment of goodwill () – () >()

- Write down of inventory () – () >()

() – () >()

Other Items

- Redundancies and restructuring () ()

- Net impairment of property, plant & equipment – ()

- Net impairment and net losses on disposal of investments () ()

- Legal provisions () >

() ()

Statutory PBT () () >()

AASB 139 mark-to-market movements relating to other reporting periods

All derivative transactions undertaken by the Qantas Group represent economic hedges of underlying risk and exposures. The Qantas

Group does not enter into speculative derivative transactions. Notwithstanding this, AASB 139 requires certain mark-to-market movements

in derivatives which are classified as ”ineffective” to be recognised immediately in the Consolidated Income Statement. The recognition

of derivative valuation movements in reporting periods which differ from the designated transaction causes volatility in statutory profit

that does not reflect the hedging nature of these derivatives.

Underlying PBT reports all hedge derivative gains and losses in the same reporting period as the underlying transaction by adjusting

the reporting period’s statutory profit for derivative mark-to-market movements that relate to underlying exposures in other reporting periods.

All derivative mark-to-market movements which have been excluded from Underlying PBT will be recognised through Underlying PBT

in future periods when the underlying transaction occurs.

The International Accounting Standards Board are currently redrafting IAS 39 (international equivalent of AASB 139) to address

anomalies in the accounting treatment of hedge transactions. Qantas has lobbied for this redraft and is actively pursuing an outcome

that aligns with the principles and methodology applied by Qantas in calculating Underlying PBT.

Other items not included in Underlying PBT

Items which are identified by Management and reported to the chief operating decision-making bodies, as not representing the

underlying performance of the business are not included in Underlying PBT. The determination of these items is made after consideration

of their nature and materiality and is applied consistently from period to period.

Items not included in Underlying PBT primarily result from major transformational/restructuring initiatives, transactions involving

investments and impairments of assets outside the ordinary course of business.

The key initiatives resulting in the Qantas International Transformation costs not included in Underlying PBT are discussed in detail

on page 21.

ASIC GUIDANCE

In December 2011 ASIC issued Regulatory Guide 230. To comply with this Guide, Qantas is required to make a clear statement about

whether information disclosed in documents other than the financial report has been audited or reviewed in accordance with

Australian Auditing Standards.

In line with previous years and in accordance with the Corporations Act 2001, the Review of Operations is unaudited. Notwithstanding

the Review of Operations contains disclosures which are extracted or derived from the Financial Report for the year ended

30 June 2012, which has been audited by the Group’s Independent Auditor.

025