Qantas 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

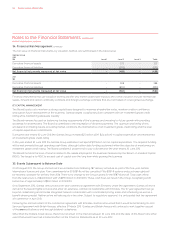

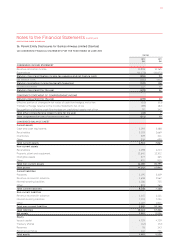

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

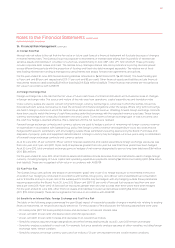

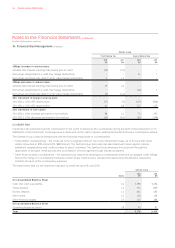

The Qantas Group minimises the concentration of credit risk by undertaking transactions with a large number of customers and

counterparties in various countries in accordance with Board approved policy. As at 30 June 2012 the credit risk of the Qantas Group

to counterparties in relation to other financial assets, cash and cash equivalents, and other financial liabilities where a right of offset

exists, amounted to $3,423 million (2011: $3,607 million) and was spread over a number of regions, including Australia, Asia, Europe

and the United States. Excluding associated entities, the Qantas Group’s credit exposure is with counterparties that have a minimum

credit rating of A-/A3, unless individually approved by the Board.

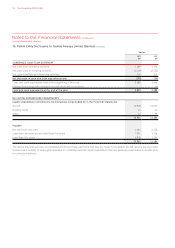

D FAIR VALUE

The fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value

due to their short maturity. The fair value of financial assets and liabilities is determined by valuing them at the present value of future

contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard

to the timing of the cash flows.

The fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by

reference to market exchange rates and fuel prices. The fair value of interest rate swaps is determined as the present value of future

contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard

to the timing of the cash flows. The fair value of options is determined using standard valuation techniques.

Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated

Balance Sheet in accordance with AASB 139.

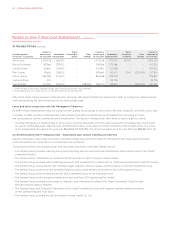

Carrying Amount Fair Value

Qantas Group Notes

2012

$M

2011

$M

2012

$M

2011

$M

Financial assets

Cash and cash equivalents , , , ,

Trade debtors

Sundry debtors

Other loans

Other financial assets

Other investments

, , , ,

Financial liabilities

Trade creditors

Other creditors and accruals , , , ,

Bank loans – secured , , , ,

Bank loans – unsecured

Other loans – unsecured , , , ,

Other financial liabilities

Lease and hire purchase liabilities

, , , ,

Net financial liabilities , , , ,

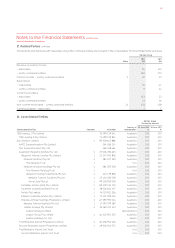

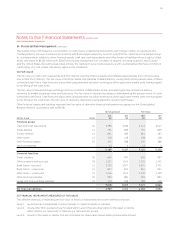

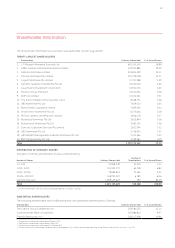

E FINANCIAL INSTRUMENTS MEASURED AT FAIR VALUE

The different methods of estimating the fair value of financial instruments have been defined as follows:

Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: inputs other than quoted prices included within Level 1 that are observable for the asset or liability,

either directly (i.e. as prices) or indirectly (i.e. derived from prices)

Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs)

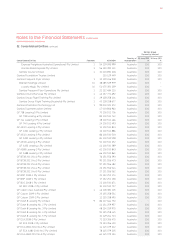

34. Financial Risk Management continued

129