Qantas 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

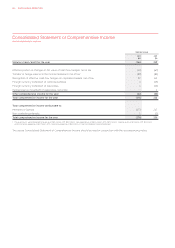

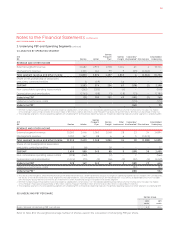

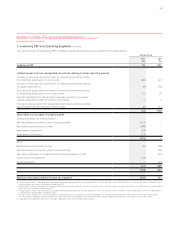

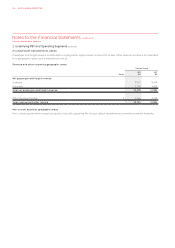

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

which is not depreciated. The depreciation

rates of owned assets are calculated so

as to allocate the cost or valuation of an

asset, less any estimated residual value,

over the asset’s estimated useful life to

the Qantas Group. Assets are depreciated

from the date of acquisition or, with

respect to internally constructed assets,

from the time an asset is completed

and available for use. The costs of

improvements to assets are depreciated

over the remaining useful life of the

asset or the estimated useful life of the

improvement, whichever is the shorter.

Assets under finance lease are

depreciated over the term of the relevant

lease or, where it is likely the Qantas

Group will obtain ownership of the asset,

the life of the asset.

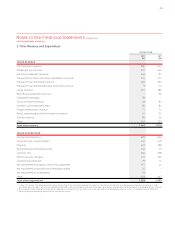

The principal asset depreciation periods

and estimated residual value

percentages are:

Years

Residual

Value (%)

Buildings

and leasehold

improvements –

Plant and equipment –

Passenger aircraft

and engines . – –

Freighter aircraft

and engines . – –

Aircraft spare parts – –

1 Certain leases allow for the sale of leasehold

improvements for fair value. In these instances

the expected fair value is used as the estimated

residual value.

Depreciation rates and residual values

are reviewed annually and reassessed

having regard to commercial and

technological developments, the

estimated useful life of assets to

the Qantas Group and the long-term

fleet plan.

Finance Leased and Hire

Purchase Assets

Leased assets under which the Qantas

Group assumes substantially all the risks

and benefits of ownership are classified

as finance leases. Other leases are

classified as operating leases.

Linked transactions involving the legal

form of a lease are accounted for as one

transaction when a series of transactions

are negotiated as one or take place

concurrently or in sequence and cannot

be understood economically alone.

Finance leases are capitalised. A lease

asset and a lease liability equal to the

present value of the minimum lease

payments and guaranteed residual

value are recorded at the inception

of the lease. Any gains and losses arising

under sale and leaseback arrangements

are deferred and depreciated over the

lease term. Capitalised leased assets

are depreciated on a straight-line basis

over the period in which benefits are

expected to arise from the use of those

assets. Lease payments are allocated

between the reduction in the principal

component of the lease liability and the

interest element.

The interest element is charged to the

Consolidated Income Statement over the

lease term so as to produce a constant

periodic rate of interest on the remaining

balance of the lease liability.

Fully prepaid leases are classified in

the Consolidated Balance Sheet as hire

purchase assets, to recognise that the

financing structures impose certain

obligations, commitments and/or restrictions

on the Qantas Group, which differentiate

these aircraft from owned assets.

Leases are deemed to be non-cancellable

if significant financial penalties associated

with termination are anticipated.

Operating Leases

Rental payments under operating leases

are charged to the Consolidated Income

Statement on a straight-line basis over

the term of the lease.

Any gains and losses arising under sale

and leaseback arrangements where the

sale price is at fair value are recognised

in the Consolidated Income Statement

as incurred. Where the sale price is

below fair value, any gains and losses

are immediately recognised in the

Consolidated Income Statement, except

where the loss is compensated for by

future lease payments at below market

price, it is deferred and amortised in

proportion to the lease payments over

the period for which the asset is expected

to be used. Where the sale price is above

fair value, the excess over fair value is

deferred and amortised over the period

for which the asset is expected to be used.

With respect to any premises rented

under long-term operating leases, which

are subject to sub-tenancy agreements,

provision is made for any shortfall between

primary payments to the head lessor less

any recoveries from sub-tenants. These

provisions are determined on a discounted

cash flow basis, using a rate reflecting

the cost of funds.

Maintenance and Overhaul Costs

An element of the cost of an acquired

aircraft (owned and finance leased

aircraft) is attributed to its service

potential, reflecting the maintenance

condition of its engines and airframe.

This cost is depreciated over the shorter

of the period to the next major inspection

event or the remaining life of the asset

or remaining lease term.

The costs of subsequent major cyclical

maintenance checks for owned and

leased aircraft (including operating

leases) are capitalised and depreciated

over the shorter of the scheduled usage

period to the next major inspection event

or the remaining life of the aircraft or

lease term (as appropriate).

Maintenance checks, which are covered

by the third party maintenance agreements

where there is a transfer of risk and legal

obligation, are expensed on the basis

of hours flown.

All other maintenance costs are expensed

as incurred.

Modifications that enhance the operating

performance or extend the useful lives of

aircraft are capitalised and depreciated

over the remaining estimated useful life

of the asset or remaining lease term (as

appropriate). Manpower costs in relation

to employees who are dedicated to major

modifications to aircraft are capitalised

as part of the cost of the modification to

which they relate.

With respect to operating lease agreements,

where the Qantas Group is required to

return the aircraft with adherence to

certain maintenance conditions, provision

1. Statement of Significant Accounting Policies continued

QANTAS ANNUAL REPORT 2012076