Qantas 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

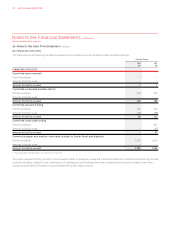

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

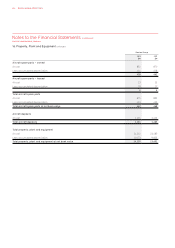

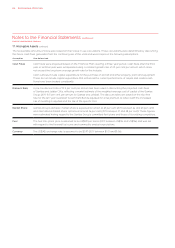

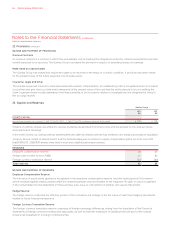

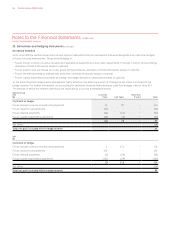

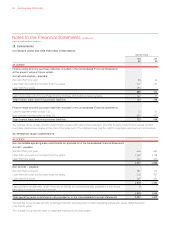

FAIR VALUE CALCULATION

The estimated value of Rights granted with the Total Shareholder Return (TSR) performance hurdle component was determined

at grant date using a Monte Carlo model.

A Black Scholes model was used to value the Rights with the Earnings Per Share (EPS) performance hurdle. The weighted average

fair value of Rights granted during the year was $0.85 (2011: $1.56).

2012 2011

Inputs into the Models

28 October

2011

23 August

2011

29 October

2010

12 August

2010

Weighted average share value $. $. $. $.

Expected volatility % % % %

Dividend yield .% .% .% .%

Risk-free interest rate .% .% .% .%

The expected volatility for the 2011/2012 award was determined having regard to the historical one year volatility of Qantas shares

and the implied volatility on exchange traded options. The risk-free rate was the yield on an Australian Government Bond at the

grant date matching the remaining life of the plan. The yield is converted into a continuously compounded rate in the model.

The expected life assumes immediate exercise after vesting.

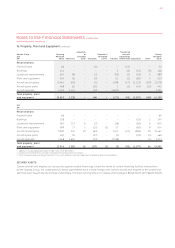

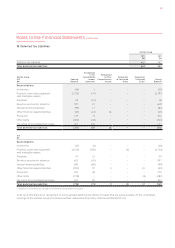

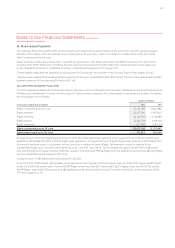

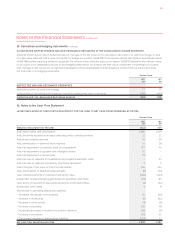

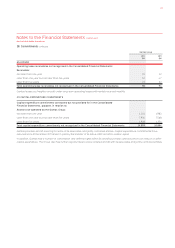

B SHORT TERM INCENTIVE PLAN STIP

The following awards were made under the STIP during the year ended 30 June 2012:

2012 2011

Shares Granted

Number of

Shares

Weighted

Average

Fair Value

$

Number of

Shares

Weighted

Average

Fair Value

$

Performance shares granted – August ,, . – –

Performance shares granted – August – – ,, .

Shares are valued based on the volume weighted average price of Qantas shares as traded on the ASX for the seven calendar days

up to and including the date of allocation. Expected dividends are not specifically taken into account when calculating the fair value

but are implicit in the weighted average price of Qantas shares. Shares are issued or purchased on-market and are held subject to

a restriction period. For further detail on the operation of the STIP, see pages 50 to 54.

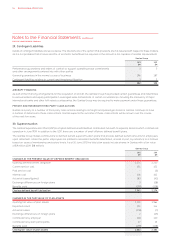

C MANAGEMENT INCENTIVE PLAN MIP

The following awards were made under the MIP during the year ended 30 June 2012:

2012 2011

Shares Granted

Number of

Shares

Weighted

Average

Fair Value

$

Number of

Shares

Weighted

Average

Fair Value

$

Performance shares granted – 31 August 2011 4,923,441 1.58 – –

Shares are valued based on the volume weighted average price of Qantas shares as traded on the ASX for the seven calendar days

up to and including the date of allocation. Expected dividends are not specifically taken into account when calculating the fair value

but are implicit in the weighted average price of Qantas shares. Shares are issued or purchased on-market and are held subject to

a restriction period.

24. Share-based Payments continued

QANTAS ANNUAL REPORT 2012106