Qantas 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

Qantas Group

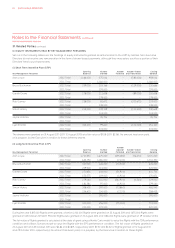

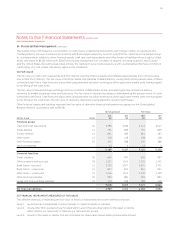

Profit Before Tax Equity (Before Tax)

2012

$M

2011

$M

2012

$M

2011

$M

bps increase in interest rates

Variable rate interest-bearing instruments (net of cash) () () – –

Derivatives designated in a cash flow hedge relationship – –

Derivatives and fixed rate debt in a fair value hedge relationship – –

bps decrease in interest rates

Variable rate interest-bearing instruments (net of cash) – –

Derivatives designated in a cash flow hedge relationship – – ()

Derivatives and fixed rate debt in a fair value hedge relationship () () – –

% movement in foreign currency pairs

% (: %) USD depreciation () () () ()

% (: %) USD appreciation

% movement in fuel indices

% (: %) increase per barrel in fuel indices

% (: %) decrease per barrel in fuel indices () () () ()

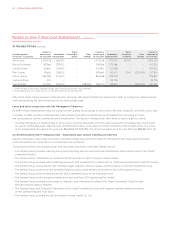

(C) CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by the counterparty during the term of the transaction or on

settlement of the transaction. Credit exposure is measured as the cost to replace existing transactions should a counterparty default.

The Qantas Group conducts transactions with the following major types of counterparties:

— Trade debtor counterparties – the credit risk is the recognised amount, net of any impairment losses. As at 30 June 2012 trade

debtor amounted to $794 million (2011: $839 million). The Qantas Group has credit risk associated with travel agents, industry

settlement organisations and credit provided to direct customers. The Qantas Group minimises this credit risk through the

application of stringent credit policies and accreditation of travel agents through industry programs

— Other financial asset counterparties – the Qantas Group restricts its dealings to counterparties that have acceptable credit ratings.

Should the rating of a counterparty fall below certain levels, internal policy dictates that approval by the Board is required to

maintain the level of the counterparty exposure

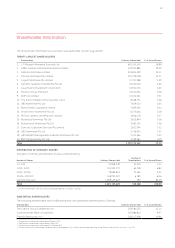

The table below sets out the maximum exposure to credit risk as at 30 June 2012:

Qantas Group

Notes

2012

$M

2011

$M

On Consolidated Balance Sheet

Cash and cash equivalents , ,

Trade debtors

Sundry debtors

Other loans

Other financial assets

Off Consolidated Balance Sheet

Operating leases as lessor

Total , ,

34. Financial Risk Management continued

QANTAS ANNUAL REPORT 2012128