Qantas 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

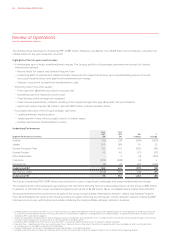

CEO’s Report

The 2011/2012 financial year was one

of transformation for the Qantas Group.

Our financial result was influenced

by three factors:

— A record fuel bill, up $645 million

to $4.3 billion

— The $194 million financial impact of last

year’s prolonged industrial dispute

and the grounding of the Qantas fleet

— Transformation costs of $376 million,

as we began to address our legacy

cost base and turn around Qantas’

international network

We have been through an exceptional

period, but our strong, diverse portfolio

means we are well positioned for the

future. And over the past year we have

made significant progress in our strategy.

The Qantas and Jetstar domestic networks

combined delivered Underlying EBIT

of over $600 million in 2011/2012, while

Jetstar and Qantas Frequent Flyer

achieved record results.

Qantas remains the airline of choice for

corporate travellers, with an estimated

84 per cent share of the domestic corporate

travel market. Our regional network has

expanded in mining regions through

charter operator Network Aviation.

Qantas Frequent Flyer grew to 8.6 million

members during the year as we enhanced

and expanded the program.

Jetstar’s pan-Asian growth story continues.

During 2011/2012, Jetstar Japan was

established and commenced operations

six months ahead of schedule –

complementing airlines based in Singapore

(Jetstar Asia) and Vietnam (Jetstar Pacific).

Subject to regulatory approval, Jetstar

Hong Kong will follow in 2013.

The transformation journey

In August 2011 we launched our five-year

turnaround plan for Qantas’ international

network – the one weak part of the

Group’s portfolio.

This is our biggest challenge, but

the transformation is on track.

During 2011/2012 we increased capacity

to our Dallas/Fort Worth and Santiago

hubs, reconfigured seven out of

a planned nine Boeing 747 aircraft,

strengthened alliance relationships

and withdrew from loss-making routes.

Major operational transformation

initiatives, such as heavy maintenance

consolidation, were also begun during

the year.

The benefits from these initiatives have

started to flow and will deliver annual

savings of approximately $300 million

when all the measures announced to

date have been implemented.

Fleet renewal

The Group’s fleet renewal program is now

largely complete.

Over the past three years we have taken

delivery of 114 new aircraft. Our average

passenger aircraft age reached 8.3 years

in 2011/2012, meaning we are operating

the youngest fleet since Qantas was

privatised in 1995.

This is a significant milestone because

it means we have a fleet that is attractive

to customers, operationally efficient and

competitive by international standards.

The financially prudent decision to cancel

35 firm orders for the B787-9 aircraft,

while bringing forward 50 options and

purchase rights, means that these

outstanding aircraft will be available

from 2016, in line with the timeframe of

the Qantas International turnaround plan.

After a period of high capital expenditure,

we are turning our focus to debt reduction.

Planned capital expenditure will be

$1.9 billion in 2012/2013 and remain

at the same level next financial year.

Great people

We remain absolutely committed

to making our company an exciting

and rewarding place to work for our

33,600 employees.

As well as continued investment in the

highest standards of safety and training,

2011/2012 saw the launch of major customer

service initiatives in areas such as cabin

crew and ground operations. We are

working closely with our people to ensure

that we deliver the best possible customer

experience in all parts of the business.

I’d like to thank all Qantas Group

employees for their vital contribution

at a pivotal time in our history.

Alan Joyce

QANTAS ANNUAL REPORT 2012008