Qantas 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

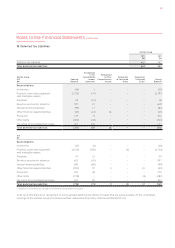

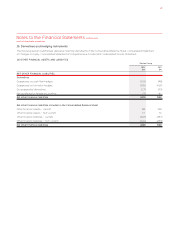

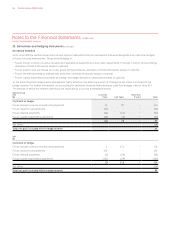

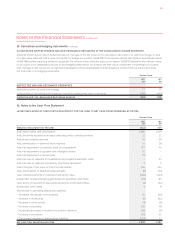

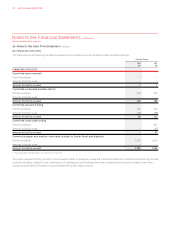

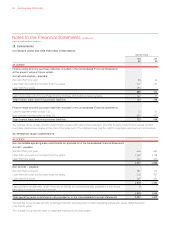

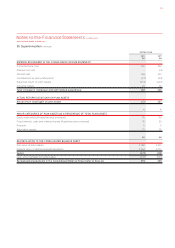

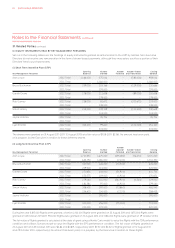

FOR THE YEAR ENDED 30 JUNE 2012

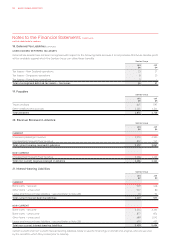

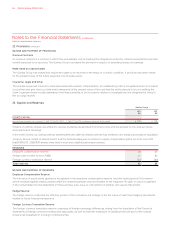

Notes to the Financial Statements continued

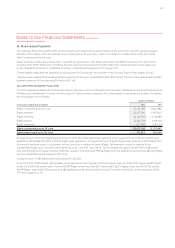

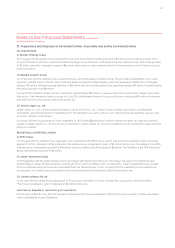

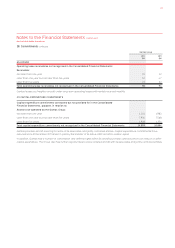

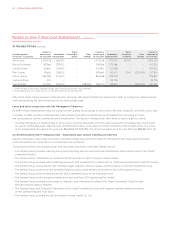

A ACQUISITIONS

(i) Wishlist Holdings Group

On 5 August 2011 the Qantas Group acquired 100 per cent of the Wishlist Holdings Group for $11 million (net of cash acquired). From

31 July 2011 (date of effective control) the Wishlist Holdings Group has been consolidated into the Qantas Group. Other than goodwill

of $5 million and other intangible assets of $8 million, there were no other material effects of this transaction on the Qantas Group’s

financial position.

(ii) Network Aviation Group

On 11 February 2011 the Qantas Group acquired 100 per cent of the Network Aviation Group. The purchase consideration, net of cash

acquired, was $21 million. The fair value of the net assets acquired includes property, plant and equipment of $26 million, intangible

assets of $4 million, interest-bearing liabilities of $18 million and net working capital and operating assets of $1 million. Goodwill arising

from this acquisition was $8 million.

During 2011 the Network Aviation Group contributed approximately $19 million in revenue and other income and a break-even profit

before tax. If the transaction had occurred on 1 July 2010, the Network Aviation Group would have contributed $45 million in revenue

and other income and a break-even profit before tax.

(iii) Jetstar Japan Co., Ltd.

Jetstar Japan Co., Ltd., a venture between Qantas, Japan Airlines Co., Ltd., Century Tokyo Leasing Corporation and Mitsubishi

Corporation, was incorporated on 5 September 2011. The Qantas Group owns a 33 per cent voting interest representing a 42 per cent

economic interest in this venture.

In October 2011 the Group made an initial investment of JPY2 billion ($28 million) to fund the operational start-up costs and working

capital in Jetstar Japan Co., Ltd. The Group’s investment in Jetstar Japan Co., Ltd. is accounted for as an investment in associate and

equity accounted.

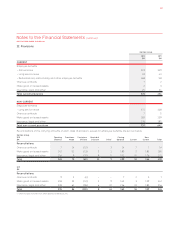

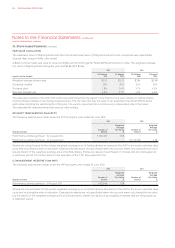

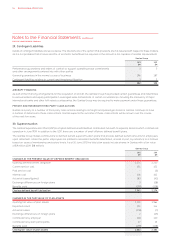

B DISPOSALS OR RESTRUCTURING

(i) DPEX Group

On 9 August 2010 the Qantas Group disposed of its ownership in the DPEX Group, which was part of the Qantas Freight operating

segment. On the completion of the transaction, the Qantas Group recognised a gain of $5 million before tax. The assets of the DPEX

disposal group represented goodwill of $16 million and receivables and other assets of $6 million. The liabilities of the DPEX disposal

group represented payables of $4 million.

(ii) Jetset Travelworld Group

On 30 September 2010 the Jetset Travelworld Group merged with Stella Travel Services. The merger resulted in the Qantas Group’s

shareholding in Jetset Travelworld Group reducing to 29 per cent from 58 per cent. Consequently, Jetset Travelworld Group ceased

to be a controlled entity and was deconsolidated from the Qantas Group. From 1 October 2010 the investment is accounted for as

an associate. The Qantas Group recognised a net loss arising from this transaction of $29 million before tax.

(iii) Harvey Holidays Pty Ltd

On 30 June 2011 the Qantas Group disposed of its 50 per cent ownership in Harvey Holidays Pty Ltd (a jointly controlled entity).

The Group recognised a gain on disposal of $4 million before tax.

Gain/loss on disposal or restructuring of investments

For the year ended 30 June 2011, the net loss on disposal of the above investments of $20 million was included in Other expenditure

in the Consolidated Income Statement.

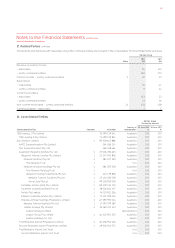

27. Acquisitions and Disposals of Controlled Entities, Associates and Jointly Controlled Entities

111