Qantas 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

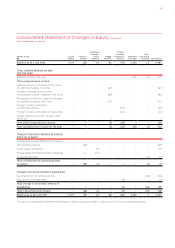

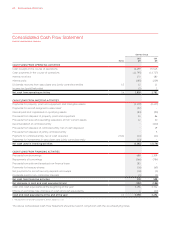

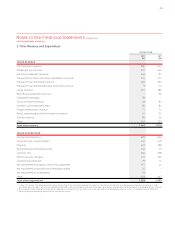

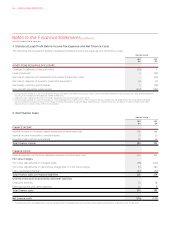

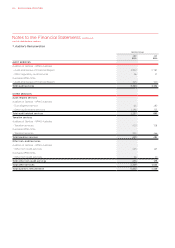

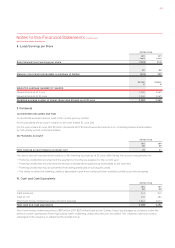

FOR THE YEAR ENDED 30 JUNE 2012

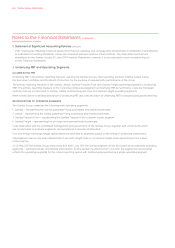

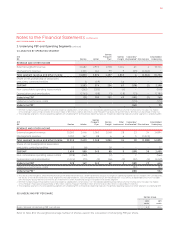

Notes to the Financial Statements continued

Income Statement over the period of the

borrowings on an effective interest basis.

Interest-bearing liabilities that are

designated as hedged items are subject

to measurement under the hedge

accounting requirements.

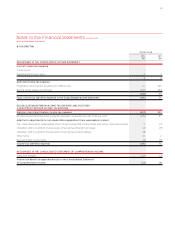

Y SHARE CAPITAL

Ordinary Shares

Incremental costs directly attributable

to issue of ordinary shares are recognised

as a deduction from equity, net of any

related income tax benefit.

Repurchase of Share Capital

When share capital recognised as

equity is repurchased, the amount

of the consideration paid, including

directly attributable costs, is recognised

as a deduction from equity.

Treasury Shares

Shares held by the Qantas sponsored

employee share plan trust are

recognised as treasury shares

and deducted from equity.

Z COMPARATIVES

Various comparative balances have

been reclassified to align with current

year presentation. These amendments

have no material impact on the

Financial Statements.

AA NEW STANDARDS AND

INTERPRETATIONS NOT YET ADOPTED

The following standards, amendments to

standards and interpretations have been

identified as those which may impact

the Qantas Group in the period of initial

application. They are available for early

adoption at 30 June 2012, but have

not been applied in preparing these

Financial Statements.

— AASB 9 Financial Instruments and

consequential amendments in AASB

2009-11 Amendments to Australian

Accounting Standards and AASB

2010-7 Amendments to Australian

Accounting Standards (December

2010), includes requirements for the

classification, measurement and

derecognition of financial assets

and financial liabilities. Retrospective

application is required. The Qantas

Group has not yet determined the

effect of the amendments to AASB 9,

which will become mandatory for the

Qantas Group’s 30 June 2013 Financial

Statements. In December 2011, the IASB

deferred the effective date of IFRS 9 to

1 January 2015. The AASB is also in the

process of deferring the effective date

for its endorsed equivalent, AASB 9.

— AASB 119 Employee Benefits (September

2011), and AASB 2011-10 Amendments

to Australian Accounting Standards,

have eliminated the use of the ‘corridor

approach’ and instead mandated

immediate recognition of all re-

measurements of a defined benefit

liability (asset) including gains and

losses in other comprehensive income.

The amendments, which are generally

to be applied retrospectively, will become

mandatory for the Qantas Group’s

30 June 2014 Financial Statements.

The Qantas Group’s accounting policy

utilises the ‘corridor approach’ to

account for actuarial gains and

losses with respect to defined benefit

superannuation plans. Upon adoption

of the amended AASB 119 for the

30 June 2014 Financial Statements, the

opening balance sheet (30 June 2012)

will be restated to a defined benefit

liability instead of a defined benefit

asset as a result of the immediate

recognition of the unrecognised actuarial

losses through retained earnings.

Subsequent actuarial gains and losses

will be recognised through other

comprehensive income. Refer to Note

30 for details of defined benefit

balances as at 30 June 2012.

— Amendments to IAS 1 Presentation of

Financial Statements – Presentation of

Items of Other Comprehensive Income,

makes a number of changes to the

presentation of other comprehensive

income including presenting separately

those items that would be reclassified

to profit or loss in the future and

those that would never be reclassified

to profit or loss and the impact of tax

on those items. The amendments are

generally to be applied retrospectively.

The amendments, along with

consequential amendments in AASB

2011-9 Amendments to Australian

Accounting Standards, which become

mandatory for the Qantas Group’s

30 June 2013 Financial Statements,

will only impact the presentation

of other comprehensive income

in the Consolidated Statement

of Comprehensive Income.

— AASB 10 Consolidated Financial

Statements, introduces a new

approach in determining which

investees should be consolidated.

AASB 11 Joint Arrangements, requires

a joint arrangement to be partially

consolidated when the parties have

rights and obligations for underlying

assets and liabilities. Otherwise, the

joint arrangement is considered a joint

venture and the equity method must

be used to account for the interest in

the joint venture. AASB 12 Disclosures

of Interests in Other Entities, contains

revised disclosure requirements for

entities that have interest in subsidiaries,

joint arrangements, associates and/or

unconsolidated structured entities.

AASB 127 Separate Financial Statements,

carries forward the existing accounting

and disclosure requirement for separate

financial statements with some minor

clarifications. AASB 128 Investments in

Associates, makes limited amendments

on how to account for changes in

interests in joint ventures and associates.

The above amendments, and

consequential amendments in AASB

2011-7 Amendments to Australian

Accounting Standards, which become

mandatory for the Qantas Group’s

30 June 2014 Financial Statements,

are not expected to have a material

impact on the Financial Statements.

— AASB 13 Fair Value Measurement, explains

how to measure fair value when

required to by other accounting

standards. The amendments are

generally to be applied prospectively.

This amendment, along with AASB 2011-8

Amendments to Australian Accounting

Standards, become mandatory for the

Qantas Group’s 30 June 2014 Financial

Statements, but are not expected to

have any impact on the Financial

Statements.

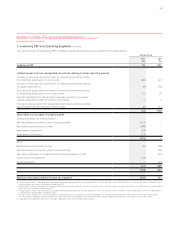

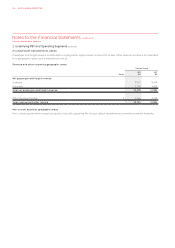

1. Statement of Significant Accounting Policies continued

079