Qantas 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

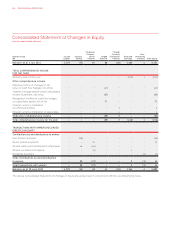

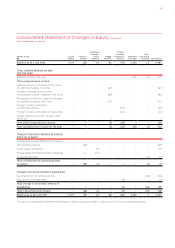

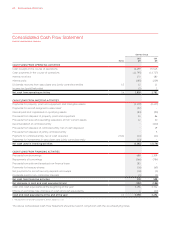

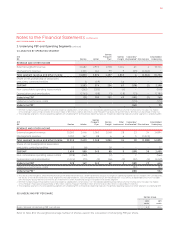

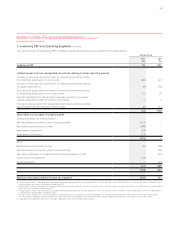

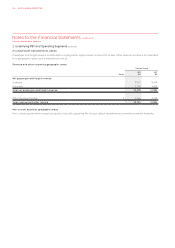

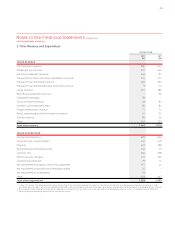

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

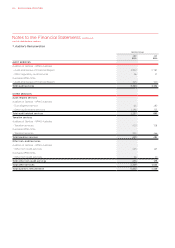

Defined Benefit Superannuation Plans

The Qantas Group’s net obligation with

respect to defined benefit superannuation

plans is calculated separately for each

plan. The Qantas Superannuation Plan

has been split based on the divisions

which relate to accumulation members

and defined benefit members. Only defined

benefit members are included in the

Qantas Group’s net obligation calculations.

The calculation estimates the amount

of future benefit that employees have

earned in return for their service in

the current and prior periods, which

is discounted to determine its present

value and the fair value of any plan

assets is deducted.

The discount rate used is the yields at

balance sheet date on State Government

Bonds which have maturity dates

approximating the terms of Qantas’

obligations. The calculation is performed

by a qualified actuary using the projected

unit credit method.

In calculating the Qantas Group’s obligation

with respect to a plan, to the extent that

any cumulative unrecognised actuarial

gain or loss exceeds 10 per cent of the

greater of the present value of the defined

benefit obligation and the fair value of

plan assets, that portion is recognised in

the Consolidated Income Statement over

the expected average remaining working

lives of the active employees participating

in the plan. Otherwise, the actuarial gain

or loss is not recognised.

Where the calculation results in plan assets

exceeding plan liabilities, the recognised

asset is limited to the net total of any

unrecognised actuarial losses and past

service costs and the present value

of any future refunds from the plan

or reductions in future contributions

to the plan.

Past service cost is the increase in the

present value of the defined benefit

obligation for employee services in prior

periods, resulting in the current period

from the introduction of, or changes to,

post-employment benefits or other long-

term employee benefits. Past service

costs may either be positive (where

benefits are introduced or improved)

or negative (where existing benefits

are reduced).

Various actuarial assumptions underpin

the determination of the Qantas Group’s

defined benefit obligation and are

discussed in Note 30.

Employee Termination Benefits

Provisions for termination benefits

are only recognised when there

is a detailed formal plan for the

termination and where there is no

realistic possibility of withdrawal.

T PROVISIONS

A provision is recognised if, as a result

of a past event, there is a present legal

or constructive obligation that can be

measured reliably, and it is probable

that an outflow of economic benefits

will be required to settle the obligation.

If the effect is material, a provision is

determined by discounting the expected

future cash flows required to settle the

obligation at a pre-tax rate that reflects

current market assessments of the time

value of money and the risks specific

to the liability. The unwinding of the

discount is treated as a finance charge.

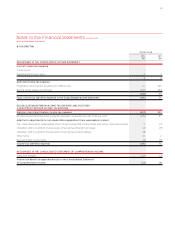

Dividends

A provision for dividends is recognised

in the financial year in which the dividends

are declared, for the entire amount,

regardless of the extent to which the

dividend will be paid in cash.

Workers’ Compensation Insurance

The Qantas Group is a licensed self-insurer

under the New South Wales Workers’

Compensation Act, the Victorian Accident

Compensation Act and the Queensland

Workers’ Compensation and Rehabilitation

Act. Qantas has made provision for all

notified assessed workers’ compensation

liabilities, together with an estimate of

liabilities incurred but not reported, based

on an independent actuarial assessment.

The provision is discounted using pre-

tax rates that reflect current market

assessments of the time value of money

and the risks specific to the liabilities and

have maturity dates approximating the

terms of Qantas’ obligations. Workers’

compensation for all remaining employees

is commercially insured.

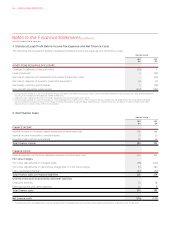

U EARNINGS PER SHARE

Basic earnings per share is determined

by dividing the Qantas Group’s net profit

attributable to members of the Qantas

Group by the weighted average number

of shares on issue during the year.

Diluted earnings per share is calculated

after taking into account the number

of ordinary shares to be issued for

no consideration in relation to dilutive

potential ordinary shares.

V CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash

at bank and on hand, cash at call and

short-term money market securities and

term deposits that are readily convertible

to a known amount of cash and are

subject to an insignificant risk of change

in value.

W NET FINANCE COSTS

Net finance costs comprise interest

payable on borrowings calculated

using the effective interest method,

unwinding of the discount on provisions

and receivables, interest receivable

on funds invested, gains and losses

on mark-to-market movement in fair

value hedges.

Finance income is recognised in

the Consolidated Income Statement

as it accrues, using the effective

interest method.

Finance cost is recognised in the

Consolidated Income Statement as

incurred, except where interest costs

relate to qualifying assets in which case

they are capitalised to the cost of the

assets. Qualifying assets are assets that

necessarily take a substantial period of

time to be made ready for intended use.

Where funds are borrowed generally,

borrowing costs are capitalised using

the average interest rate applicable

to the Qantas Group’s debt facilities.

X INTERESTBEARING LIABILITIES

Interest-bearing liabilities are recognised

initially at fair value less attributable

transaction costs. Subsequent to initial

recognition, interest-bearing liabilities

are stated at amortised cost, with any

difference between cost and redemption

value being recognised in the Consolidated

1. Statement of Significant Accounting Policies continued

QANTAS ANNUAL REPORT 2012078