Qantas 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

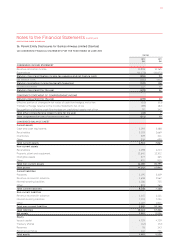

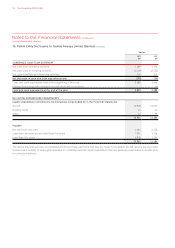

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

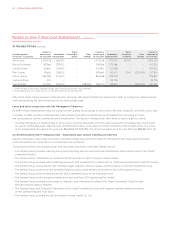

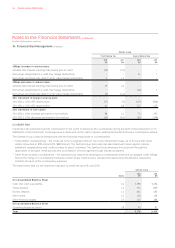

The fair value of financial instruments, by valuation method, are summarised in the table below:

Qantas Group

2012

$M Level 1 Level 2 Level 3 Total

Derivative financial assets – –

Derivative financial liabilities – () – ()

Net financial instruments measured at fair value – () – ()

2011

$M

Derivative financial assets – –

Derivative financial liabilities – () – ()

Net financial instruments measured at fair value – () – ()

Financial instruments that use valuation techniques with only market observable inputs to the overall valuation include interest rate

swaps, forward and option commodity contracts and foreign exchange contracts that are not traded on a recognised exchange.

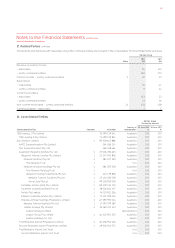

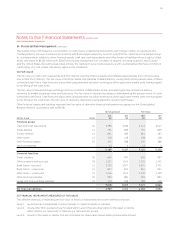

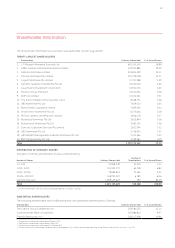

F CAPITAL MANAGEMENT

The Board’s policy is to maintain a strong capital base designed to maximise shareholder value, maintain creditor confidence

and sustain future development of the business. Qantas targets a capital structure consistent with an investment grade credit

rating while maintaining adequate liquidity.

The Board remains focused on balancing funding requirements of the business and investing for future growth with providing

dividends for shareholders. The Board is committed to the resumption of dividend payments. The quantum and timing of this

will depend on trading results, prevailing market conditions, the maintenance of an investment grade credit rating and the level

of capital expenditure commitments.

During the year ended 30 June 2012 the Qantas Group invested $2.3 billion (2011: $2.4 billion) in capital expenditure and maintained

an investment grade credit rating.

In the year ended 30 June 2013 the Qantas Group estimates it will spend $1.9 billion on net capital expenditure. The required funding

will be met primarily through operating cash flows, although further debt funding is planned within the objective of maintaining an

investment grade credit rating. The Board considers it prudent not to pay a dividend for the year ended 30 June 2012.

The Board monitors the level of returns relative to the assets employed in the business measured by the Return on Invested Capital

(ROIC). The target is for ROIC to exceed cost of capital over the long term while growing the business.

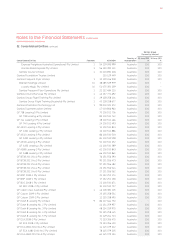

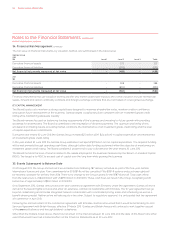

35. Events Subsequent to Balance Date

On 23 August 2012, the Group announced it would restructure its Boeing 787 delivery schedule as part of the five-year Qantas

International turnaround plan. Firm commitments for 35 B787-9s will be cancelled. Fifty B787-9 options and purchase rights will

be retained, available for delivery from 2016. There is no change to the Group’s plans for the B787-8 aircraft. Total cash inflow

from the restructure is US$433 million with US$355 million in 2012/2013. These cash flows will result in the Group recognising profit

before tax of approximately US$140 million in 2012/2013.

On 6 September 2012, Qantas announced a ten year commercial agreement with Emirates. Under the agreement, Qantas will move

its hub for European flights to Dubai and enter an extensive commercial relationship with Emirates. The 10-year agreement will go

beyond codesharing and includes integrated network collaboration with coordinated pricing, sales and scheduling as well as a

benefit-sharing model. Neither airline will take equity in the other. Subject to regulatory approval, it is anticipated that the agreement

will commence in April 2013.

Following the announcement of the commercial agreement with Emirates, Qantas announced that it would be terminating its Joint

Services Agreement with British Airways, effective 31 March 2013. Qantas and British Airways will continue to work together as part

of the oneworld alliance and through bilateral codeshares.

Other than the matters noted above, there has not arisen in the interval between 30 June 2012 and the date of this Report any other

event that would have had a material effect on the Financial Statements as at 30 June 2012.

34. Financial Risk Management continued

QANTAS ANNUAL REPORT 2012130