Qantas 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

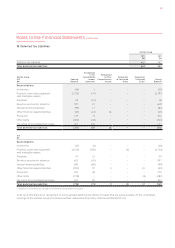

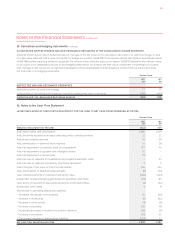

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

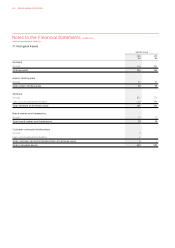

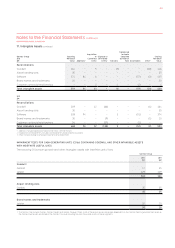

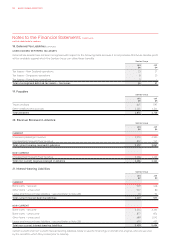

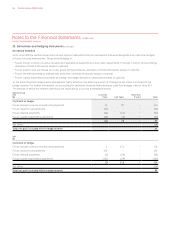

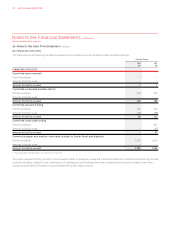

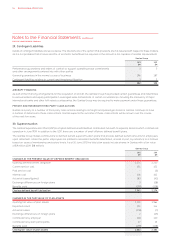

B HEDGE RESERVE

At 30 June 2012 the Qantas Group held various types of derivative financial instruments that were designated as cash flow hedges

of future forecast transactions. These were hedging of:

— Future foreign currency revenue receipts and operational payments by future debt repayments in foreign currency and exchange

derivative contracts (forwards, swaps or options)

— Future aviation fuel purchases by crude, gasoil and jet kerosene derivative contracts (forwards, swaps or options)

— Future interest payments by interest rate derivative contracts (forwards, swaps or options)

— Future capital expenditure payments by foreign exchange derivative contracts (forwards or options)

To the extent that the hedges were assessed as highly effective, the effective portion of changes in fair value is included in the

hedge reserve. For further information on accounting for derivative financial instruments as cash flow hedges, refer to Note 1(F).

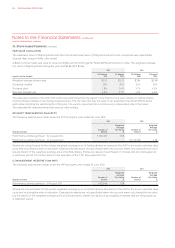

The periods in which the related cash flows are expected to occur are summarised below:

Qantas Group

2012

$M

Less than

1 Year 1 to 5 Years

More than

5 Years Total

Contracts to hedge

Future foreign currency receipts and payments –

Future aviation fuel payments () – – ()

Future interest payments () () – ()

Future capital expenditure payments () () – ()

() –

Tax effect ()

Total net gain included within hedge reserve

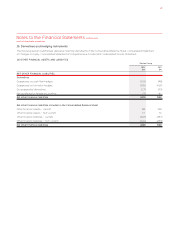

2011

$M

Contracts to hedge

Future foreign currency receipts and payments –

Future aviation fuel payments – –

Future interest payments () () – ()

Future capital expenditure payments () () – ()

() –

Tax effect ()

Total net gain included within hedge reserve

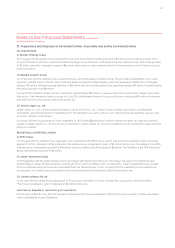

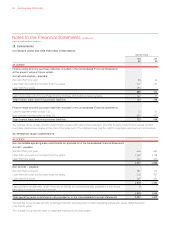

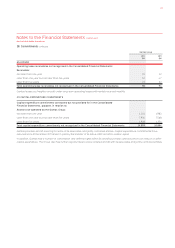

25. Derivatives and Hedging Instruments continued

QANTAS ANNUAL REPORT 2012108