Qantas 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

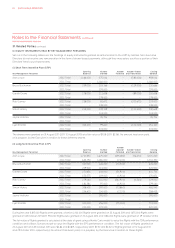

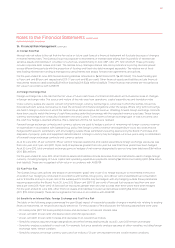

(i) Interest Rate Risk

Interest rate risk refers to the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes

in market interest rates. The Qantas Group has exposure to movements in interest rates arising from its portfolio of interest rate

sensitive assets and liabilities in a number of currencies, predominantly in AUD, GBP, USD, JPY, NZD and EUR. These principally

include corporate debt, leases and cash. The Qantas Group manages interest rate risk by reference to pricing intervals spread

across different time periods with the proportion of floating and fixed rate debt managed separately. The relative mix of fixed

and floating interest rate funding is managed by using interest rate swaps, forward rate agreements and options.

For the year ended 30 June 2012 interest-bearing liabilities amounted to $6,549 million (2011: $6,031 million). The fixed/floating split

is 11 per cent and 89 per cent respectively (2011: 17 per cent and 83 per cent). Other financial assets and liabilities include financial

instruments related to debt totalling $431 million (liability) (2011: $446 million (liability)). These financial instruments are recognised at

fair value in accordance with AASB 139.

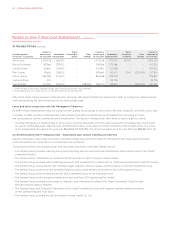

(ii) Foreign Exchange Risk

Foreign exchange risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes

in foreign exchange rates. The source and nature of this risk arise from operations, capital expenditures and translation risks.

Cross-currency swaps are used to convert long-term foreign currency borrowings to currencies in which the Qantas Group has

forecast sufficient surplus net revenue to meet the principal and interest obligations under the swaps. Where long-term borrowings

are held in foreign currencies in which the Qantas Group derives surplus net revenue, offsetting forward foreign exchange contracts

have been used to match the timing of cash flows arising under the borrowings with the expected revenue surpluses. These foreign

currency borrowings have a maturity of between one and 12 years. To the extent a foreign exchange gain or loss is incurred, and

the cash flow hedge is deemed effective, this is deferred until the net revenue is realised.

Forward foreign exchange contracts and currency options are used to hedge a portion of remaining net foreign currency revenue

or expenditure in accordance with Qantas Group policy. Net foreign currency revenue and expenditure out to two years may be

hedged within specific parameters, with any hedging outside these parameters requiring approval by the Board. Purchases and

disposals of property, plant and equipment denominated in a foreign currency may be hedged out to two years using a combination

of forward foreign exchange contracts and currency options.

As at 30 June 2012, 49 per cent (2011: 39 per cent) of forecast operational and capital expenditure foreign exchange exposures less

than one year and 1 per cent (2011: 12 per cent) of exposures greater than one year but less than three years have been hedged.

As at 30 June 2012, total unrealised exchange gains on hedges of net revenue designated to service long-term debt were $164 million

(2011: $234 million).

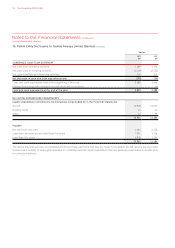

For the year ended 30 June 2012, other financial assets and liabilities include derivative financial instruments used to hedge foreign

currency, including hedging of future capital and operating expenditure payments, totalling $62 million (net liability) (2011: $226 million

(net liability)). These are recognised at fair value in accordance with AASB 139.

(iii) Fuel Price Risk

The Qantas Group uses options and swaps on jet kerosene, gasoil and crude oil to hedge exposure to movements in the price

of aviation fuel. Hedging is conducted in accordance with Qantas Group policy. Up to 80 per cent of estimated fuel consumption

out to 12 months and up to 40 per cent in the subsequent 12 months may be hedged, with any hedging outside these parameters

requiring approval by the Board. As at 30 June 2012, 58 per cent (2011: 53 per cent) of forecast fuel exposure less than one year

and 6 per cent (2011: 9 per cent) of forecast fuel exposures greater than one year but less than three years have been hedged.

For the year ended 30 June 2012, other financial assets and liabilities include fuel derivatives totalling $6 million (asset)

(2011: $170 million (asset)). These are recognised at fair value in accordance with AASB 139.

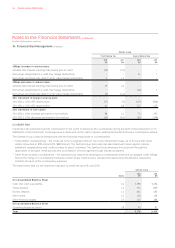

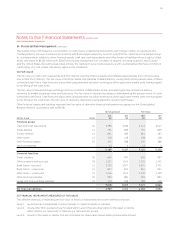

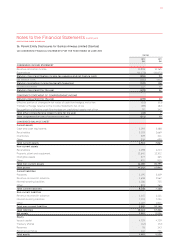

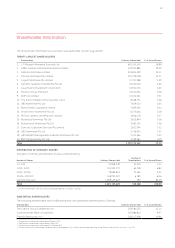

(iv) Sensitivity on Interest Rate, Foreign Exchange and Fuel Price Risk

The table on the following page summarises the gain/(loss) impact of reasonably possible changes in market risk, relating to existing

financial instruments, on net profit and equity before tax. For the purpose of this disclosure, the following assumptions were used:

— 100 basis points (2011: 100 basis points) increase and decrease in all relevant interest rates

— 20 per cent (2011: 20 per cent) USD depreciation and USD appreciation

— 20 per cent (2011: 20 per cent) increase and decrease in all relevant fuel indices

— Sensitivity analysis assumes hedge designations and effectiveness testing results as at 30 June 2012 remain unchanged

— Sensitivity analysis is isolated for each risk. For example, fuel price sensitivity analysis assumes all other variables, including foreign

exchange rates, remain constant

— Sensitivity analysis on foreign currency pairs and fuel indices of 20 per cent represent recent volatile market conditions

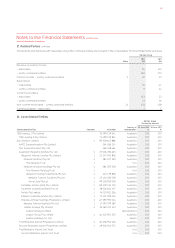

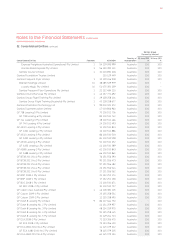

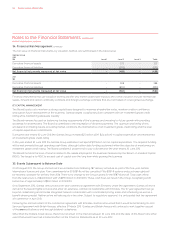

34. Financial Risk Management continued

127