Qantas 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

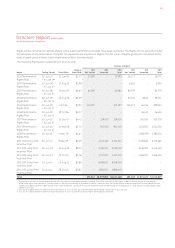

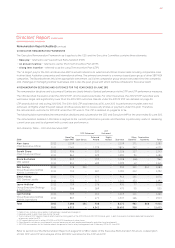

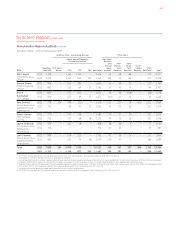

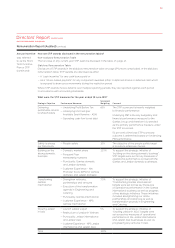

FOR THE YEAR ENDED 30 JUNE 2012

Directors’ Report continued

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2012

The Remuneration Report sets out remuneration information for Non-Executive Directors, the CEO and Executive Committee.

The Key Management Personnel (KMP) for the 2011/2012 financial year includes some members of the Executive Committee.

1 EXECUTIVE REMUNERATION OBJECTIVES AND APPROACH

In determining Executive remuneration the Board aims to do the following:

— Attract, retain and appropriately reward a capable Executive team

— Motivate the Executive team to meet the unique challenges it faces as a major international airline based in Australia

— Link remuneration to performance

To achieve this, Executive remuneration is set with regard to the size and nature of the role (with reference to market benchmarks)

and the performance of the individual in the role. In addition, remuneration includes “at risk” or performance related elements for

which the objectives are to:

— Link Executive reward with Qantas’ business objectives and financial performance

— Align the interests of Executives with shareholders

— Support a culture of employee share ownership

— Support the retention of participating Executives

2 ROLE OF THE REMUNERATION COMMITTEE

The Remuneration Committee (a Committee of the Board, whose members are detailed on pages 12 to 15) has the role of reviewing

and making recommendations to the Board on specific Executive remuneration matters at Qantas and ensuring remuneration

decisions are appropriate from the perspectives of business performance, governance, disclosure, reward levels and market conditions.

In fulfilling its role, the Remuneration Committee is specifically concerned with ensuring that its approach will:

— Motivate the CEO, Executive Committee and broader Executive team to pursue the long-term growth and success of Qantas

— Demonstrate a clear relationship between pay and performance

— Ensure an appropriate balance between “fixed” and “at risk” remuneration, reflecting the short and long-term performance

objectives of Qantas

— Differentiate between higher and lower performers through the use of a performance management framework

The Remuneration Committee appointed PricewaterhouseCoopers (PwC) as its primary remuneration consultant for 2011/2012.

It also appointed JWS Consulting (JWSC) to provide remuneration advice where this advice may be linked to specific legal and

regulatory requirements.

Before appointing PwC and JWSC, the Remuneration Committee considered the nature and quantum of work to be provided by

these companies to the Qantas Group and also established protocols to ensure that it would be confident that the companies

could fulfil their role as independent advisors to the Remuneration Committee. These protocols also ensure compliance in respect

to the appointment and use of remuneration consultants under the Corporations Act 2001.

During 2011/2012, the Remuneration Committee directly engaged PwC in accordance with its protocols to perform a review of the STIP

and recommend the design of a STIP model, performance measures and targets. The total fee for this engagement was $82,500.

PwC completed the review, reported directly to the Remuneration Committee and did not provide their report to any member of

management. PwC has declared to the Remuneration Committee that their report was not unduly influenced by any Qantas KMP

throughout the course of the engagement and outlined the process they followed to form their recommendation in their report.

As the agreed protocols were followed, the Board is satisfied that the remuneration recommendation was made free from undue

influence of the KMP.

The Remuneration Committee also engaged PwC to provide general and technical remuneration advice, review committee papers,

attend committee meetings and provide information on market practice for which fees amounted to $224,125.

PwC has provided a range of other consulting services (advisory, risk, internal audit, tax and legal services) to the Qantas Group

in 2011/2012 for fees totalling $6.2 million.

Total fees payable to PwC for services provided during 2011/2012 amounted to $6.5 million.

Remuneration Report (Audited) continued

QANTAS ANNUAL REPORT 2012046