Qantas 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

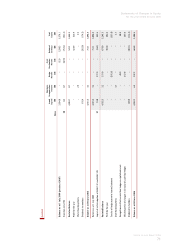

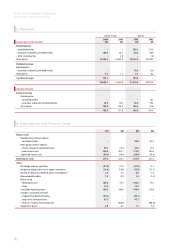

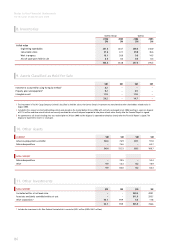

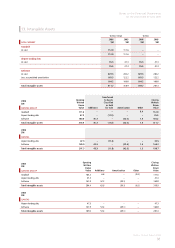

(X) EARNINGS PER SHARE

Basic earnings per share is determined by dividing the Qantas Group’s net profi t

attributable to members of Qantas by the weighted average number of shares on

issue during the current fi nancial year (refer Note 32).

Diluted earnings per share is calculated after taking into account the

number of ordinary shares to be issued for no consideration in relation

to dilutive potential ordinary shares (refer Note 32).

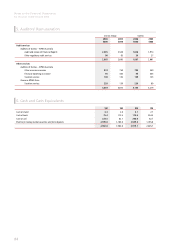

(Y) CASH AND CASH EQUIVALENTS

Cash and cash equivalents includes cash at bank and on hand, cash at call,

short-term money market securities and term deposits with an original

maturity of three months or less.

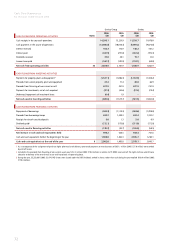

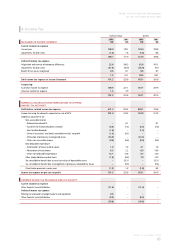

(Z) NET FINANCE COSTS

Current Policy

Net finance costs comprise interest payable on borrowings calculated using

the effective interest method, interest receivable on funds invested,

dividend and coupon income, and foreign exchange gains and losses.

Interest income is recognised in the Income Statement as it accrues, using

the effective interest method. Where interest costs relate to qualifying

assets they are capitalised to the cost of the assets. Qualifying assets are

assets that necessarily take a substantial period of time to be made ready

for intended use. Where funds are borrowed generally, borrowing costs are

capitalised using the average interest rate applicable to the Qantas Group’s

debt facilities being 7.2 per cent (2005: 7.3 per cent) in the current year.

During the year, borrowing costs totalling $68.4 million (2005: $74.4

million) were capitalised into the cost of qualifying assets.

In accordance with AASB 137, a charge of $16.8 million (2005: $16.3

million) representing the unwinding of present value discounting of

employee benefits provisions has been recognised as a financing cost.

Comparative Period Policy

Borrowing costs include interest, amortisation of discounts or premiums

relating to borrowings, amortisation of ancillary costs incurred in

connection with arrangement of borrowings and foreign exchange losses

net of hedged amounts on borrowings. Where interest rates are hedged or

swapped, the borrowing costs are recognised net of any effect of the hedge

or swap.

Borrowing costs are expensed as incurred unless they relate to qualifying

assets. Qualifying assets are assets that necessarily take a substantial

period of time to get ready for their intended use. In these circumstances,

borrowing costs are capitalised to the cost of the assets.

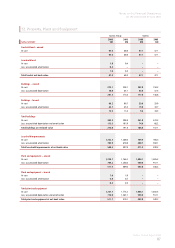

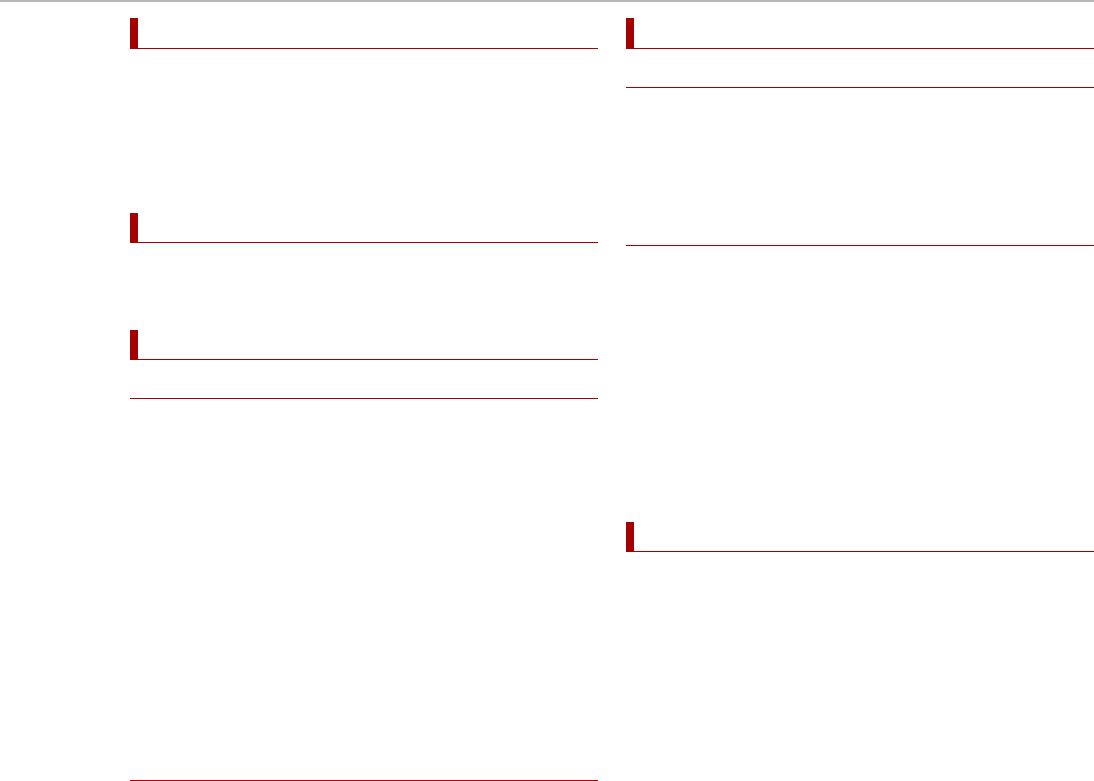

(AA) INTEREST-BEARING LIABILITIES

Current Policy

Interest-bearing borrowings are recognised initially at fair value less

attributable transaction costs. Subsequent to initial recognition, interest-

bearing borrowings are stated at amortised cost with any difference

between cost and redemption value being recognised in the Income

Statement over the period of the borrowings on an effective interest basis.

Comparative Period Policy

Bank and other loans are recognised at their principal amount, subject to

set-off arrangements. Interest expense is accrued at the contracted rate and

included in other creditors and accruals. Material items of expenditure are

deferred to the extent that the Qantas Group considers it is probable that

future economic benefits embodied in the expenditure will eventuate and

can be measured reliably, do not relate solely to revenue that has already

been brought to account and will contribute to the future earning capacity

of the Qantas Group. Deferred expenditure items include guarantee fees,

bank fees and other fees associated with the establishment of lending

facilities and are amortised over the period that the future economic

benefits will be received. The deferred expenditure in the Qantas Group

Balance Sheet at 30 June 2005 was $146.1 million.

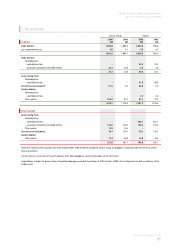

(AB) ASSETS CLASSIFIED AS HELD FOR SALE

Immediately before classification as held for sale, the measurement of the

assets is brought up-to-date in accordance with applicable accounting

standards. Then, on initial classification as held for sale, assets are

recognised at the lower of carrying amount and fair value less costs to sell.

Impairment losses on initial classification as held for sale are included in

profit or loss, even when there is a revaluation. The same applies to gains

and losses on subsequent re-measurement.