Qantas 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

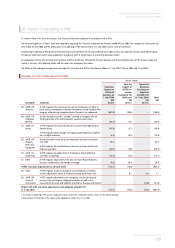

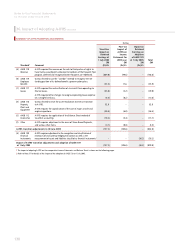

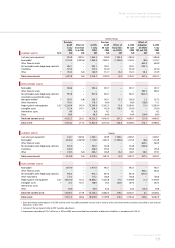

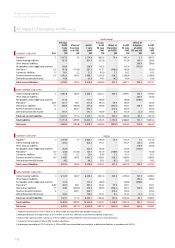

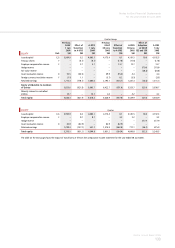

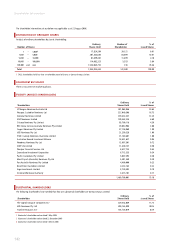

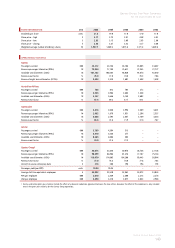

37. Change in Accounting Policy

RECONCILIATION OF FINANCIAL INSTRUMENTS AS IF AASB 139 WAS APPLIED AT 1 JULY 2005

In the current year, the Qantas Group adopted AASB 132 and AASB 139. This change in accounting policy has been adopted in accordance with the

transition rules contained in AASB 1, which does not require the restatement of comparative information for financial instruments within the scope of

AASB 132 and AASB 139.

The adoption of AASB 139 has resulted in the Qantas Group recognising available-for-sale investments and all derivative financial instruments as assets and

liabilities at fair value. This change has been accounted for by adjusting the opening balance of equity at 1 July 2005.

The impact on the Balance Sheets in the comparative period is set out below as an adjustment to the opening Balance Sheets at 1 July 2005. The transitional

provisions will not have any effect in future reporting periods.

APPLICATION OF AASB 132 AND AASB 139 PROSPECTIVELY FROM 1 JULY 2005

Qantas Group Qantas

Refs

Previous

GAAP

$M

Impact of

Change in

Accounting

Policy

$M

A-IFRS

$M

Previous

GAAP

$M

Impact of

Change in

Accounting

Policy

$M

A-IFRS

$M

Receivables 1,130.3 (0.6) 1,129.7 1,135.5 (0.6) 1,134.9

Other financial assets A – 1,550.1 1,550.1 – 1,527.7 1,527.7

Net hedge/swap receivable 1,038.8 (1,038.8) – 1,016.4 (1,016.4) –

Other assets 237.3 34.0 271.3 225.0 34.0 259.0

Investments accounted for using the equity method 356.0 1.3 357.3 – – –

Other investments B 99.9 (28.8) 71.1 746.6 – 746.6

Property, plant and equipment 12,684.5 (1.1) 12,683.4 11,299.6 (1.1) 11,298.5

Payables (1,902.0) (5.3) (1,907.3) (1,722.3) (5.3) (1,727.6)

Interest-bearing liabilities (5,914.7) (58.8) (5,973.5) (6,511.5) (58.8) (6,570.3)

Other financial liabilities A – (571.6) (571.6) – (593.6) (593.6)

Net hedge/swap payable (592.8) 592.8 – (614.8) 614.8 –

Deferred tax liabilities (518.2) (150.9) (669.1) (497.2) (150.9) (648.1)

Deferred lease benefits (141.0) 2.7 (138.3) (124.1) 2.7 (121.4)

Issued capital (4,181.5) (10.8) (4,192.3) (4,181.5) (10.8) (4,192.3)

Hedge reserve A – (379.0) (379.0) – (377.9) (377.9)

Fair value reserve – 28.8 28.8 – – –

Retained earnings (1,347.4) 36.0 (1,311.4) (712.1) 36.2 (675.9)

A Under previous GAAP, the Qantas Group did not recognise derivatives at fair value on the Balance Sheet. In accordance with A-IFRS derivatives are now recognised at fair value.

B Under previous GAAP, the Qantas Group recorded available-for-sale equity securities at cost. In accordance with A-IFRS they are now recognised at fair value.