Qantas 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Directors’ Report

for the year ended 30 June 2006

REMUNERATION REPORT

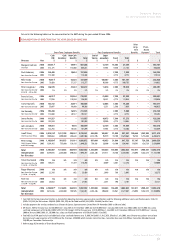

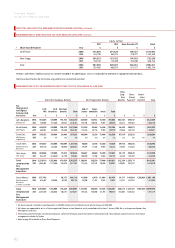

Details of the nature and amount of each major element of the remuneration of each Key Management Personnel (KMP) of Qantas and the Qantas Group and

reference to where they have been incorporated into the Qantas Annual Report is set out below:

Requirement Included in the Qantas Annual Report

Corporations Act

– Remuneration Policy Refer below

– elements of remuneration for each required individual Refer below

Australian Accounting Standards Board (AASB) 2 Share-based Payment

and AASB 124 Related Party Disclosures

– Key Management Personnel Remuneration disclosures Refer below

– Key Management Personnel Equity Benefit disclosures Note 25 to the Financial Report

ASX Corporate Governance Council: Corporate Governance Principle 9

– remunerate fairly and responsibly Refer below

– 2006 Executive Remuneration Philosophy and Objectives Refer below

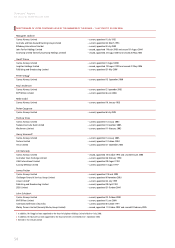

2006 EXECUTIVE REMUNERATION PHILOSOPHY AND OBJECTIVES

Qantas’ Philosophy for Executive Remuneration is to ensure that

remuneration properly reflects the duties and responsibilities of its

Executives and that remuneration is competitive in attracting, motivating

and retaining people of the highest calibre. As part of this, Executives

should be rewarded for performance and challenged to achieve rigorous

and continuously improving performance targets.

These objectives are achieved via a reward program that involves a mixture of:

• Fixed Annual Remuneration (FAR);

• the Performance Plan, comprising:

i. the Performance Cash Plan (PCP) – a short-term cash incentive; and

ii. the Performance Equity Plan – made up of a medium-term incentive,

the Performance Share Plan (PSP) and a long-term incentive,

the Performance Rights Plan (PRP); and

• Concessionary Travel Entitlements, some targeted retention arrangements

and other discretionary benefi ts considered appropriate from time to time.

The Remuneration Committee (which is a Committee of the Board) plays a

critical role in reviewing and recommending to the Board on matters of

remuneration policy, specifi c recommendations relating to Senior Executives

and all matters concerning equity plans and awards. In doing so, the

Remuneration Committee seeks advice from a range of independent external

specialists. PricewaterhouseCoopers is currently engaged to provide ongoing

independent support to the Remuneration Committee in its deliberations.

The guiding principles in managing remuneration for Executives are that:

• all elements of remuneration should be set at an appropriate level having

regard to market practice for roles of similar scope and skill;

• the Performance Plan should be used to differentiate rewards for high

performers and to encourage continuously higher levels of performance;

• the Performance Plan should be clearly linked to appropriate goals via

a robust performance management system; and

• the Performance Equity Plan should be used to align the interests of

Executives with shareholders, support a culture of employee share

ownership and act as a retention initiative.

Overall, the mix of the remuneration program is consistent with

market practice.

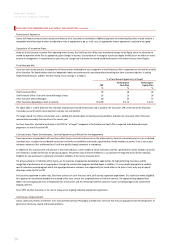

Fixed Annual Remuneration

Salary decisions are based on the concept of FAR, which involves a

guaranteed salary level from which superannuation and certain other

benefits, such as a maintained motor vehicle, are able to be deducted

at the election of the employee on a salary sacrifice basis.

FAR is set with reference to market data, reflecting the scope of the role,

the unique value of the role and the performance of the person in the role.

FAR is reviewed annually and reflects a middle-of-the-market approach, as

compared to similar comparative roles within Australia, having particular

reference to large public companies for the most senior roles.

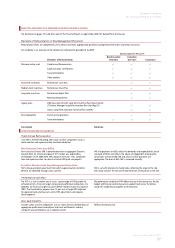

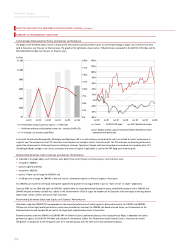

Reflects industry and market practiceOther benefits eg concessionary travel, discretionary and retention programs

Total Shareholder Return Target allocations to selected Executives

Set with reference to role, market and experience

Group Financial Target

Balanced Scorecard Target

Fixed Annual Remuneration

Performance

Share Plan Operational

Medium-Term

Performance Cash Plan Short-Term

Long-Term

Performance

Rights Plan

Customer People Financial

Performance

Equity Plan

Performance Plan