Qantas 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

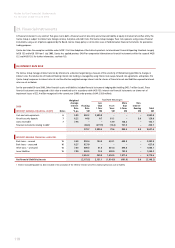

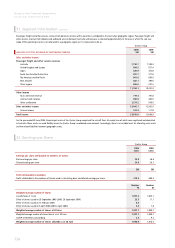

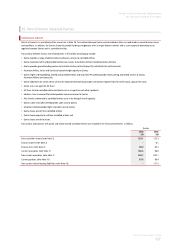

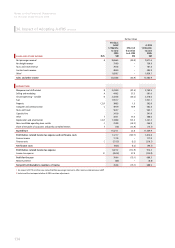

33. Events Subsequent to Balance Date

Qantas Engineering is currently negotiating a potential agreement with two external suppliers to supply expendable and recoverable spares to the Qantas

Engineering segment to support the maintenance of Qantas and third party aircraft. If an agreement is signed, this will result in the sale of up to $300 million

of inventory. In August 2006, Qantas launched a new domestic air freight business, Express Freighters Australian Pty Limited, to commence operations from

October 2006. This business will wet lease B737-300 aircraft to Australian air Express, a jointly controlled entity under a 12 year contract.

The Directors declared a fully franked final dividend of 11 cents per share on 16 August 2006 in relation to the year ended 30 June 2006. The total amount of

the dividend declared was $215.1 million.

With the exception of the items disclosed above, there has not arisen in the interval between 30 June 2006 and the date of this report, any event that would

have had a material effect on the Financial Statements at 30 June 2006.

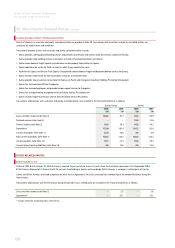

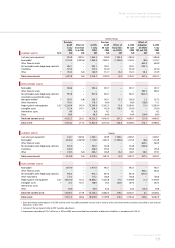

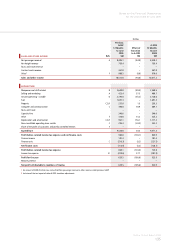

34. Notes to the Cash Flow Statements

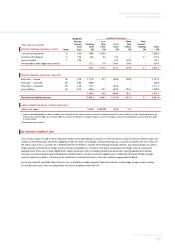

Qantas Group Qantas

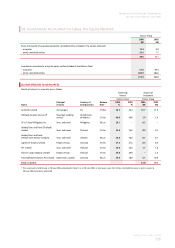

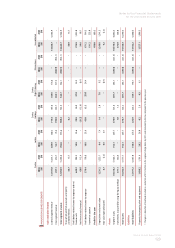

RECONCILIATION OF PROFIT FOR THE YEAR TO NET CASH

FROM OPERATING ACTIVITIES

2006

$M

2005

$M

2006

$M

2005

$M

Profit for the year attributable to members of Qantas 479.5 688.5 392.0 523.9

Add: depreciation and amortisation 1,249.8 1,241.3 1,110.0 1,117.2

Less: gain on sale of property, plant and equipment (13.9) (9.6) (11.1) (9.8)

Less: capitalised interest (68.4) (74.4) (68.4) (74.4)

Add: write-down of investments 22.4 7.4 220.6 56.3

Less: share of net profit of associates and jointly controlled entities (38.9) (15.7) ––

Add: dividends received from associates and jointly controlled entities 33.7 26.8 ––

Add/(less): changes in fair value of financial instruments 88.3 (23.2) 40.7 81.3

(Less)/add: other items (9.3) (8.4) (76.3) (72.4)

Movements in operating assets and liabilities:

Decrease/(increase) in receivables (58.1) (44.0) (92.1) 37.4

(Increase)/decrease in inventories (1.8) 42.4 (2.0) 10.9

Decrease in other assets 16.9 57.4 40.7 64.9

Increase in provisions 73.4 (10.6) 66.3 (3.5)

(Decrease)/increase in current tax liabilities (20.7) 53.5 (12.9) 56.5

Decrease/(increase) in deferred tax assets (165.8) 0.7 ––

Increase in deferred tax liabilities 195.4 67.9 50.3 84.0

Increase/(decrease) in trade and other payables 80.7 (41.8) 21.1 (148.8)

Decrease in net inter-company payables ––(271.1) (19.8)

Increase in revenue received in advance 208.7 195.3 171.1 202.9

(Decrease)/increase in deferred lease benefits (45.9) (51.6) 2.0 (43.7)

Net cash from operating activities 2,026.0 2,101.9 1,580.9 1,862.9