Qantas 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

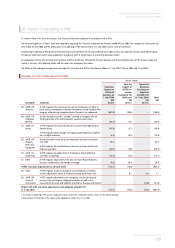

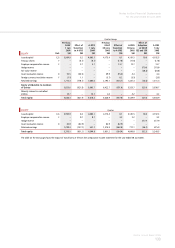

Qantas Group

Refs

Previous

GAAP

1 July

2004

$M

Effect of

Transition

to A-IFRS

$M

A-IFRS

1 July

2004

$M

Previous

GAAP

30 June

2005

$M

Effect of

Transition

to A-IFRS

$M

A-IFRS

30 June

2005

$M

Effect of

Adoption

of AASB

132 and 139

$M

A-IFRS

1 July

2005

$M

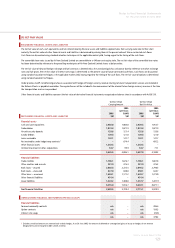

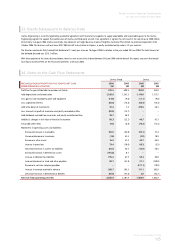

CURRENT ASSETS

Cash and cash equivalents1 335.9 1,029.4 1,365.3 198.0 1,705.8 1,903.8 – 1,903.8

Receivables1 2,116.3 (1,029.4) 1,086.9 2,836.1 (1,705.8) 1,130.3 (0.6) 1,129.7

Other financial assets – – – – – – 664.8 664.8

Net receivable under hedge/swap contracts 302.1 – 302.1 185.1 – 185.1 (185.1) –

Inventories 375.5 – 375.5 333.0 – 333.0 – 333.0

Other F 192.2 (5.3) 186.9 157.7 (5.2) 152.5 58.4 210.9

Total current assets 3,322.0 (5.3) 3,316.7 3,709.9 (5.2) 3,704.7 537.5 4,242.2

NON-CURRENT ASSETS

Receivables 304.6 – 304.6 287.7 – 287.7 – 287.7

Other financial assets – – – – – – 885.3 885.3

Net receivable under hedge/swap contracts 997.0 – 997.0 853.7 – 853.7 (853.7) –

Investments accounted for using

the equity method F 339.7 (1.0) 338.7 343.7 12.3 356.0 1.3 357.3

Other investments 110.1 – 110.1 99.9 – 99.9 (28.8) 71.1

Property, plant and equipment C,D,F 12,256.6 142.4 12,399.0 12,612.5 72.0 12,684.5 (1.1) 12,683.4

Intangible assets F 152.4 141.7 294.1 142.0 176.9 318.9 – 318.9

Deferred tax assets 0.9 – 0.9 0.2 – 0.2 – 0.2

Other 90.9 – 90.9 84.8 – 84.8 (24.4) 60.4

Total non-current assets 14,252.2 283.1 14,535.3 14,424.5 261.2 14,685.7 (21.4) 14,664.3

Total assets 17,574.2 277.8 17,852.0 18,134.4 256.0 18,390.4 516.1 18,906.5

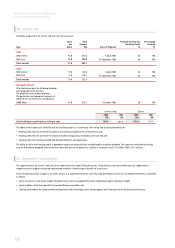

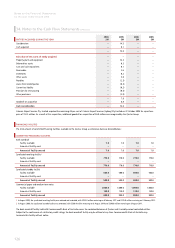

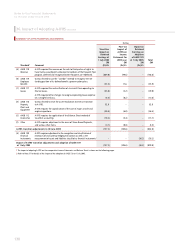

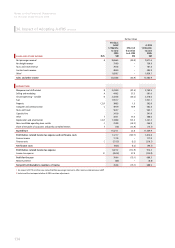

CURRENT ASSETS Qantas

Cash and cash equivalents1254.7 1,029.4 1,284.1 339.9 1,705.8 2,045.7 – 2,045.7

Receivables1 2,203.4 (1,029.4) 1,174.0 2,841.3 (1,705.8) 1,135.5 (0.6) 1,134.9

Other financial assets – – – – – – 664.5 664.5

Net receivable under hedge/swap contracts 301.8 – 301.8 184.8 – 184.8 (184.8) –

Inventories 348.4 – 348.4 295.5 – 295.5 – 295.5

Other F 210.5 (5.3) 205.2 165.9 (5.2) 160.7 58.4 219.1

Total current assets 3,318.8 (5.3) 3,313.5 3,827.4 (5.2) 3,822.2 537.5 4,359.7

NON-CURRENT ASSETS

Receivables31,977.9 – 1,977.9 952.7 – 952.7 – 952.7

Other financial assets – – – – – – 863.2 863.2

Net receivable under hedge/swap contracts 952.3 – 952.3 831.6 – 831.6 (831.6) –

Other investments 777.2 – 777.2 746.6 – 746.6 – 746.6

Property, plant and equipment C,D,F 10,673.0 132.2 10,805.2 11,242.0 57.6 11,299.6 (1.1) 11,298.5

Intangible assets F 47.2 141.7 188.9 45.3 162.0 207.3 – 207.3

Deferred tax assets – – – – – – – –

Other 64.9 – 64.9 64.3 – 64.3 (24.4) 39.9

Total non-current assets 14,492.5 273.9 14,766.4 13,882.5 219.6 14,102.1 6.1 14,108.2

Total assets 17,811.3 268.6 18,079.9 17,709.9 214.4 17,924.3 543.6 18,467.9

1 Short-term money market deposits of $1,705.8 million at 30 June 2005 convertible into cash with a maturity of less than three months have been reclassified as cash and cash

equivalents under A-IFRS.

2 Inclusive of the tax impact of other A-IFRS transition adjustments.

3 Intercompany receivables of $16.7 million as at 30 June 2005 were reclassified from receivables to deferred tax liabilities in accordance with UIG 52.