Qantas 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Notes to the Financial Statements

for the year ended 30 June 2006

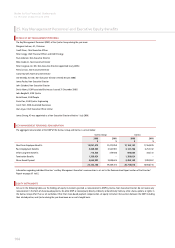

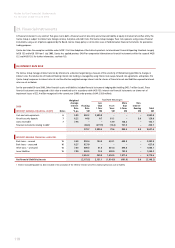

25. Key Management Personnel and Executive Equity Benefi ts continued

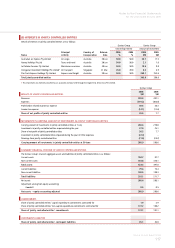

SHARE-BASED PAYMENT CONTINUED

PERFORMANCE SHARE PLAN

The PSP delivers deferred shares to employees upon the achievement of a Balance Scorecard relating to Customer, Operational, People and Financial

performance. The actual incentive earned is based on a combination of Qantas’ results and individual performance. Performance of the Qantas Group against

the Balanced Scorecard determines the amount (if any) of the pool of shares available for payment.

Deferred shares awarded under this Plan are purchased on-market or issued and are held subject to a holding lock for 10 years. Participants may “call for” the

deferred shares prior to the expiration of the holding lock but not before the end of the financial year in relation to up to one-half of the deferred shares and

the end of the following financial year in relation to the remaining deferred shares. Generally, any shares held subject to the holding lock are forfeited on

cessation of employment.

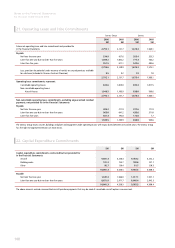

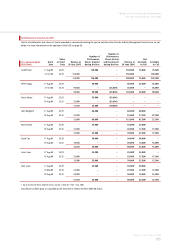

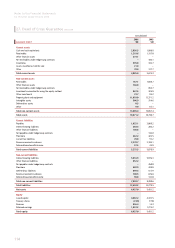

2006 2005

Number of

Shares

Weighted Average

Fair Value

Number of

Shares

Weighted Average

Fair Value

SHARES ISSUED

Performance shares granted – 17 Aug 2005 3,055,257 3.29 ––

Performance shares granted – 18 May 2005 ––25,000 3.18

Performance shares granted – 17 Dec 2004 ––215,660 3.66

Performance shares granted – 21 Oct 2004 ––240,000 3.34

Performance shares granted – 20 Aug 2004 ––1,862,743 3.25

Performance shares granted – 18 Aug 2004 ––335,000 3.32

Shares are valued based on the volume weighted average price of Qantas shares as traded on the ASX for the seven calendar days up to and including the

date of allocation. Expected dividends are not taken into account when calculating the fair value. For further detail on the operation of the PSP, see page 58.

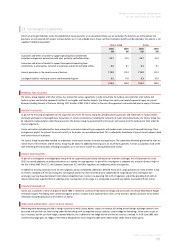

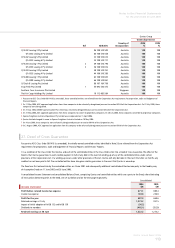

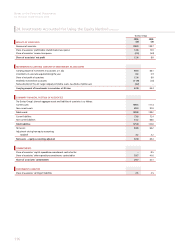

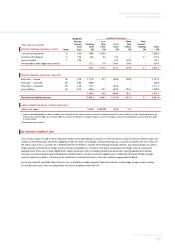

SENIOR MANAGER LONG-TERM INCENTIVE PLAN

Certain Executives were awarded a number of deferred shares subject to a four-year holding lock provided the Executive remains employed by the Qantas

Group. These shares are held on behalf of each Executive by the Trustee until the expiry of the holding lock period. No awards have been made under this plan

since April 2003. Additional detail on this plan is available on page 60.

2002 EXECUTIVE DIRECTOR LONG-TERM INCENTIVE PLAN

In 2002, the CEO and CFO sacrificed part of their bonus into deferred shares subject to a holding lock until 31 December 2005 for the CEO and 20 August 2006

for the CFO. These shares will be held on behalf of each Executive Director by the Trustee until the expiry of the holding lock period. Under a matching award,

they were granted one Right for every nine Shares allocated. No awards have been made under this plan since December 2002.

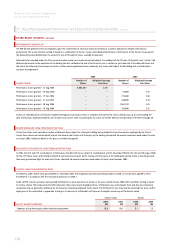

QANTAS LONG-TERM INCENTIVE PLAN

Entitlements under QLTEIP were granted before 7 November 2002. The recognition and measurement principles in AASB 2 have not been applied to these

Entitlements in accordance with the transitional provisions in AASB 1.

Under QLTEIP, certain Executives were granted Entitlements to unissued shares in Qantas in the years ended 30 June 2000, 2001 and 2002. Vesting is based

on Qantas relative TSR compared to ASX 200 Industrials Index and a basket of global airlines. Entitlements may vest between three and five years following

award date and are generally conditional on the Executive remaining employed. To the extent that Entitlements vest, they may be converted into shares within

eight years of the award date in proportion to the gain in share price. Entitlements will lapse on the eighth anniversary of the date of award.

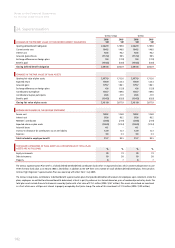

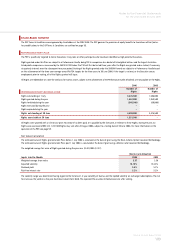

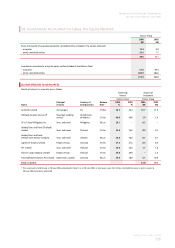

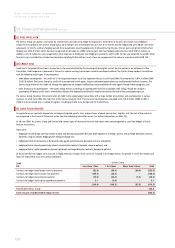

Qantas Group Qantas

2006

$M

2005

$M

2006

$M

2005

$M

EQUITY BENEFIT EXPENSES

Expenses arising from equity settled share-based payments 13.8 10.5 3.1 2.5