Qantas 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

Notes to the Financial Statements

for the year ended 30 June 2006

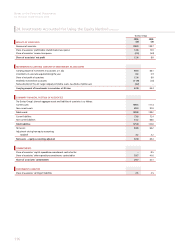

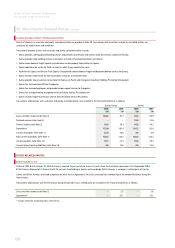

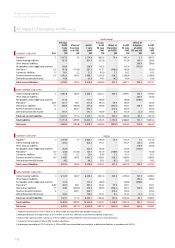

34. Notes to the Cash Flow Statements continued

2006

$M

2005

$M

2006

$M

2005

$M

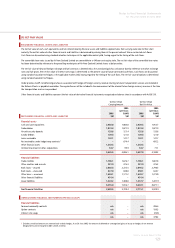

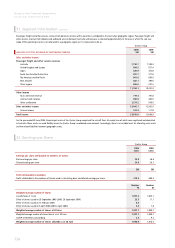

ENTITIES ACQUIRED DURING THE YEAR

Consideration –14.5 ––

Cash acquired –0.1 ––

–14.6 ––

Fair value of net assets of entity acquired ––––

Property, plant and equipment –14.3 ––

Deferred tax assets –0.3 ––

Cash and cash equivalents –0.7 ––

Receivables –2.6 ––

Inventories –0.2 ––

Other assets –3.8 – –

Payables –(2.3) ––

Loans from related parties –(8.3) ––

Current tax liability –(0.2) ––

Provision for restructuring –(0.4) ––

Other provisions –(2.9) ––

–7.8 ––

Goodwill on acquisition –6.8 ––

Cash consideration –14.6 ––

Caterair Airport Services Pty. Limited acquired the remaining 49 per cent of Caterair Airport Services (Sydney) Pty Limited on 22 October 2004 for a purchase

price of $14.5 million. As a result of this acquisition, additional goodwill on acquisition of $6.8 million was recognised by the Qantas Group.

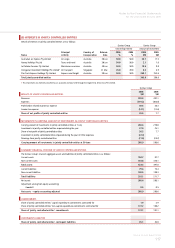

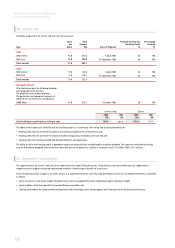

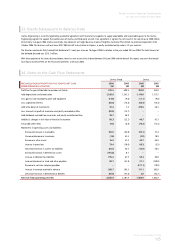

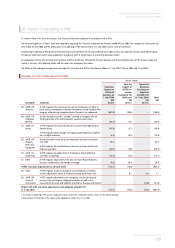

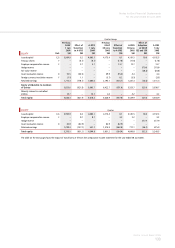

FINANCING FACILITIES

The total amount of committed financing facilities available to the Qantas Group as at balance date are detailed below:

COMMITTED FINANCING FACILITIES

Bank overdraft

Facility available 7.0 7.0 7.0 7.0

Amount of facility used ––––

Amount of facility unused 7.0 7.0 7.0 7.0

Syndicated revolving facility1

Facility available 770.0 770.0 770.0 770.0

Amount of facility used ––––

Amount of facility unused 770.0 770.0 770.0 770.0

Syndicated standby facility2

Facility available 500.0 500.0 500.0 500.0

Amount of facility used ––––

Amount of facility unused 500.0 500.0 500.0 500.0

Commercial paper and medium-term notes

Facility available 1,000.0 1,000.0 1,000.0 1,000.0

Amount of facility used 120.0 120.0 120.0 120.0

Amount of facility unused 880.0 880.0 880.0 880.0

1 In August 2006, the syndicated revolving facility was reduced and extended, with $335.0 million maturing on 8 February 2011 and $335.0 million maturing on 8 February 2012.

2 In August 2006, the syndicated standby facility was extended, with $300.0 million maturing on 8 August 2010 and $200.0 million maturing on 8 August 2011.

The bank overdraft facility held with Commonwealth Bank of Australia covers the combined balances of Qantas and its wholly-owned controlled entities.

Subject to the continuance of satisfactory credit ratings, the bank overdraft facility may be utilised at any time. Commonwealth Bank of Australia may

terminate this facility without notice.