Qantas 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Directors’ Report

for the year ended 30 June 2006

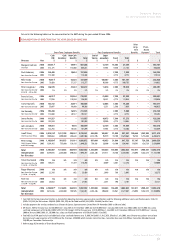

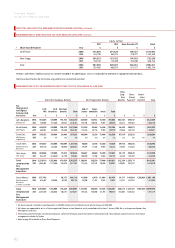

DIRECTOR AND EXECUTIVE REMUNERATION DISCLOSURES (AUDITED) CONTINUED

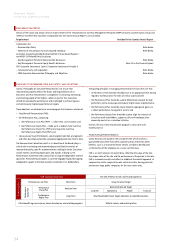

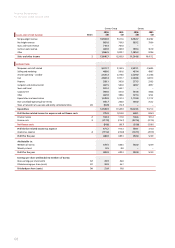

SUMMARY OF PERFORMANCE CONDITIONS

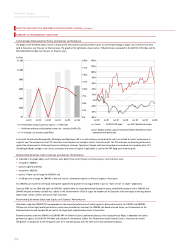

Link between Remuneration Policy and Qantas’ performance

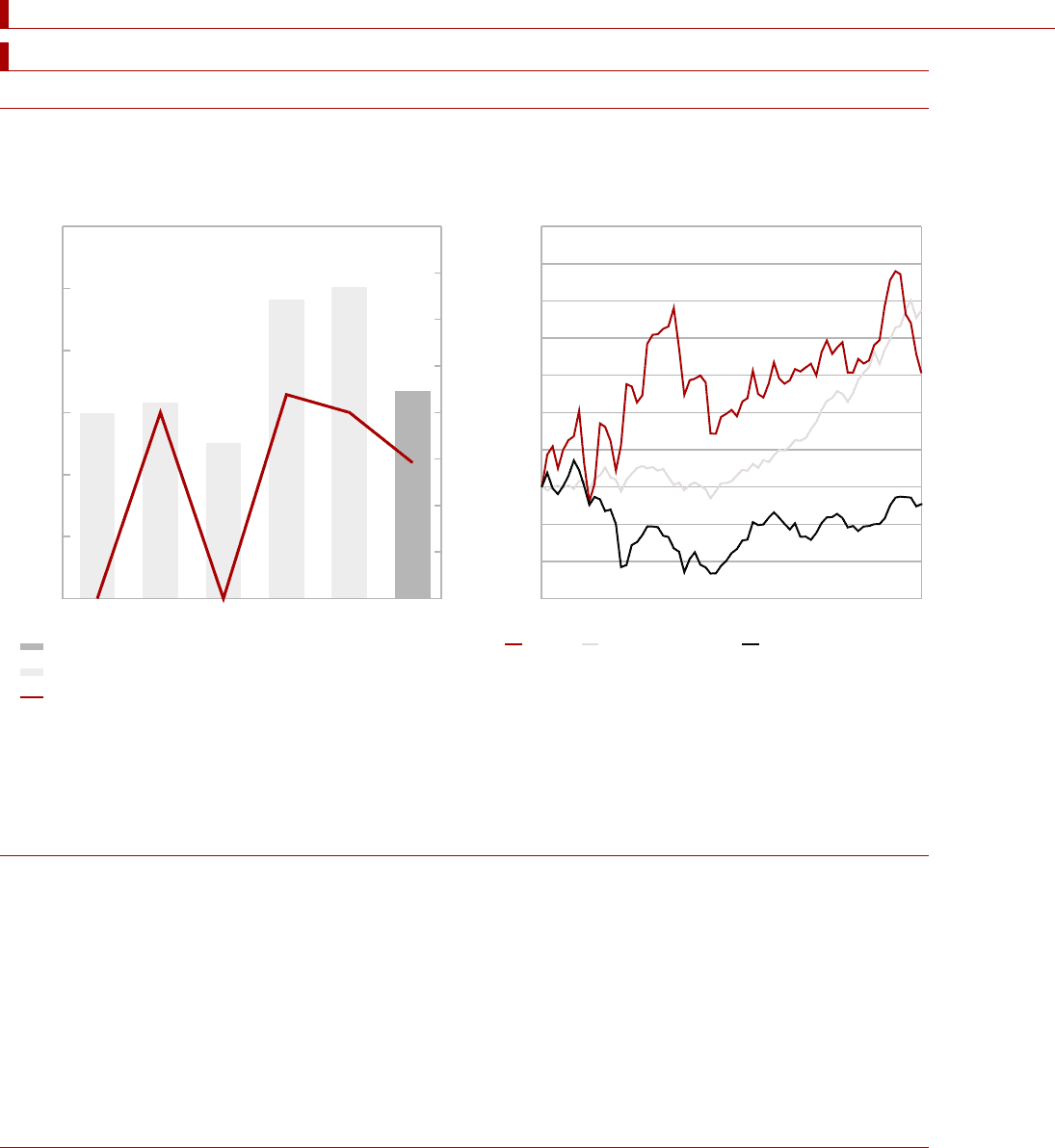

The graph on the left below shows Qantas’ full-year profit from ordinary activities before income tax and the percentage of target cash incentives that were

paid to Executives over the past six financial years. The graph on the right below shows Qantas’ TSR performance compared to the S&P/ASX 100 Index and the

MSCI World Airline Index over the past six financial years.

In line with the Executive Remuneration Philosophy and Objectives, FAR is set with reference to market data and is not related to Qantas’ performance in

a specific year. The outcomes for the PCP (short-term incentive plan) are related to Qantas’ financial results. The PSP outcomes are driven by performance

against the achievement of a Balanced Scorecard relating to Customer, Operational, People and Financial performance (medium-term incentive plan). TSR

(including dividends, changes in the Qantas share price and return of capital if applicable) is used for the PRP (long-term incentive plan).

Relationship Between Cash Incentives and Qantas’ Performance

As indicated in the graph above, cash incentives were paid in four out of the past six financial years. Cash incentives were:

• not paid for 2000/01;

• paid at target for 2001/02;

• not paid for 2002/03;

• paid at 110 per cent of target for 2003/04; and

• at 100 per cent of target for 2004/05 in line with Qantas’ achievement against its financial targets in these years.

For 2005/06 cash incentives were paid, having been approved for payment on 22 August 2006, in part at 73 per cent of “at target” opportunity.

From July 2001 to June 2003 and again for 2005/06, a profit before tax target determined the pool of money available for payment and in 2003/04 and

2004/05 the pool of money available was subject to the achievement of a RoTGA target for members of the Executive Team and target of earnings before

depreciation, rentals, interest and tax for other Executives.

Relationship Between Employee Equity and Qantas’ Performance

Allocations under the 2005/06 PSP are dependent on the corporate performance of Qantas against a Balanced Scorecard. For 2003/04 and 2004/05,

100 per cent of the target level of performance shares were awarded to Executives. For 2005/06, the Board assessed 95 per cent achievement on the

Balanced Scorecard and awarded 95 per cent of the target level of performance shares to Executives.

Reward outcomes under the 2004/05 and 2005/06 PRP are linked to Qantas’ performance because the vesting of these Rights is dependent on Qantas’

performance against the S&P/ASX 100 Index and a basket of international airlines. This Performance Hurdle rewards Qantas’ Executives for Qantas’

TSR growth in comparison to the TSR growth rates of its two peer groups over the three to five-year performance period.

$200

$400

$600

$800

$1,000

$1,200

$ million

Jun 06Jun 05Jun 04 Jun 03Jun 02Jun 01Jun 00

Qantas S&P/ASX 100 Index

MSCI World Airline Index

-60%

-40%

-20%

0%

20%

40%

60%

80%

140%

120%

100%

$0

Jun 05 Jun 06

Jun 04Jun 03Jun 02Jun 01

% of target cash incentives paid (RHS)

Profit from ordinary activities before income tax – previous GAAP (LHS)

Profit before related income tax expense – A-IFRS (LHS)

0%

25%

50%

75%

100%

125%

150%

175%

200%

Source: Morgan Stanley Capital International (MSCI) World Airline Index

– reproduced with permission.