Qantas 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

Notes to the Financial Statements

for the year ended 30 June 2006

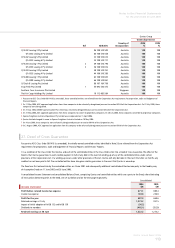

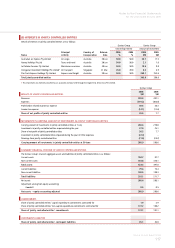

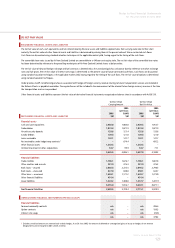

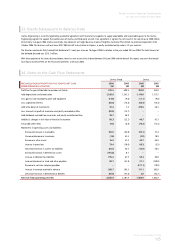

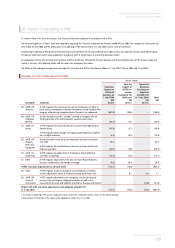

30. Dividends

Dividends recognised in the current and prior year by Qantas are:

Type

Cents

per

Share

Total

Amount

$M Date of Payment

Franked Tax Rate for

Franking Credit

%

Percentage

Franked

%

2006

2006 interim 11.0 212.2 5 April 2006 30 100

2005 final 10.0 189.9 28 September 2005 30 100

Total amount 21.0 402.1

2005

2005 interim 10.0 186.8 6 April 2005 30 100

2004 final 9.0 166.1 29 September 2004 30 100

Total amount 19.0 352.9

Subsequent Events

After the balance date the following dividends

were proposed by the Directors.

The dividends have not been provided.

The declaration and subsequent payment of

dividends has no income tax consequences.

2006 Final 11.0 215.1 4 October 2006 30 100

Qantas Group Qantas

2006

$M

2005

$M

2006

$M

2005

$M

Total franking account balance at 30 per cent 150.0 161.5 150.0 161.5

The above amount represents the balance of the franking accounts as at year end, after taking into account adjustments for:

• franking credits that will arise from the payment of income tax payable for the current fi nancial year;

• franking credits that will arise from the receipt of dividends recognised as receivables at the year end; and

• franking credits that may be prevented from being distributed in subsequent years.

The ability to utilise the franking credits is dependent upon there being sufficient available profits to declare dividends. The impact on the dividend franking

account of dividends proposed after the balance sheet date but not recognised as a liability is to reduce it by $57.8 million (2005: $79.1 million).

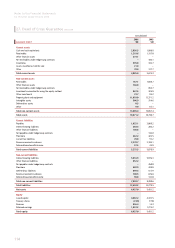

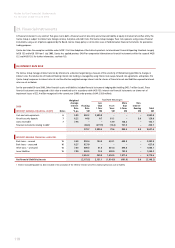

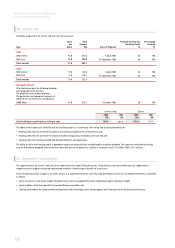

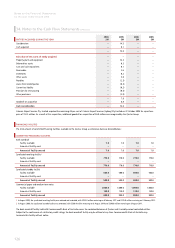

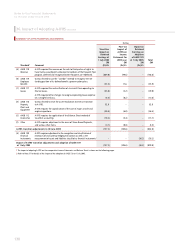

31. Segment Information

The segmentation of the Qantas Group into three separate business types (Flying Businesses, Flying Services and Associated Businesses) supported by a

corporate centre is progressively being implemented to deliver a broad range of benefits to the business.

Financial reporting system changes to transition Qantas to a segmented model are currently under development. Disclosure of segment information is provided

as follows:

• Qantas and Jetstar as the Qantas Group’s Flying Businesses, which are supported by Qantas Engineering, Airports and Qantas Freight;

• Qantas Holidays, which forms part of the Associated Businesses portfolio; and

• Catering, which refl ects the wholly-owned catering entities within the Airports and Catering segment which forms part of the Flying Services Businesses.