Qantas 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Qantas Annual Report 2006

Directors’ Report

for the year ended 30 June 2006

2006 EXECUTIVE REMUNERATION PHILOSOPHY AND OBJECTIVES CONTINUED

Performance Plan

The alignment of Executive remuneration outcomes with the performance

of both Qantas and the individual is a key part of the Qantas People Plan.

Relevant performance hurdles, agreed in advance of the allocation of

incentives, are a key element in an appropriately structured performance

plan. Vesting should be over a period that is consistent with the realisation

of the short, medium and long-term strategic objectives approved by the

Board. The Performance Plan has been implemented within Qantas to

achieve these objectives.

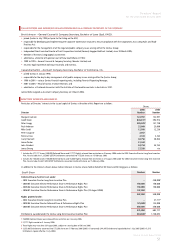

Performance Cash Plan

The PCP is designed to reward Executives when key performance measures

are achieved over the 12-month business cycle.

The target reward is a percentage of FAR dependent on each individual’s

level of responsibility. The actual incentive earned is based on a

combination of Qantas’ results and individual performance and may be

greater than or less than the target amount.

Performance against a financial target determines the amount (if any)

of the pool of money available for payment. The target is set with an

inherent stretch component. It is anticipated that the target would be

achieved 75 per cent of the time.

Once a pool has been approved, based on Qantas’ performance, the

assessment of the performance of individuals against their specific annual

goals takes place along with a further assessment of the relative

contribution of Executives. This results in a differentiated distribution of the

bonus pool between participating Executives.

Performance Equity Plan

The Performance Equity Plan comprises the PSP (a medium-term incentive)

and the PRP (a long-term incentive). Both elements are designed to

strengthen the alignment of the interests of the Executives with those

of shareholders.

Performance Share Plan

The medium-term incentive component is delivered via an award of

deferred shares under the Terms & Conditions of the Qantas Deferred Share

Plan (DSP) approved by shareholders at the 2002 AGM, subject to

satisfactory results on a balanced scorecard basis.

The target reward is a percentage of FAR dependent on each individual’s

level of responsibility. The actual incentive earned is based on a

combination of Qantas’ results adjusted by an individual performance

factor on the same basis as the cash plan.

Performance of the Qantas Group against the balanced scorecard

determines the amount (if any) of the pool of shares available for payment.

The Balanced Scorecard for 2006/07 contains target measures from the

corporate Key Performance Indicator measures set by the Board (ie

Customer, Operational, People and Financial performance). The targets are

approved by the Board at the beginning of the year with a focus on

business improvement. It is anticipated that the target would be achieved

75 per cent of the time.

The Board has the capacity to adjust reward outcomes based on

performance if it feels it is appropriate to recognise an extraordinary effort

in performance or as a way of providing specific retention allocations of

deferred shares.

Assessment of the performance of individuals against their specific annual

goals and a further assessment of the relative contribution of Executives,

results in a differentiated distribution in the number of deferred shares.

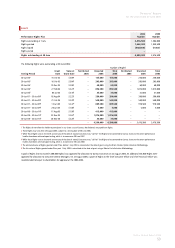

Deferred shares awarded under this Plan are purchased on-market or issued

and are held subject to a holding lock for 10 years. Participants may “call

for” the shares prior to the expiration of the holding lock but not before the

end of the financial year in relation to up to one-half of the shares and the

end of the following financial year in relation to the remaining shares.

Generally, any deferred shares held subject to the holding lock are forfeited

on cessation of employment.

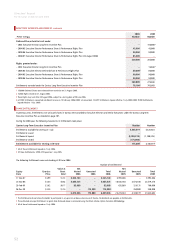

Performance Rights Plan

The aims of the PRP as the long-term incentive component are to:

• align the interests of eligible Executives and of shareholders;

• provide targeted but competitive remuneration and a long-term

incentive for the retention of key Executives; and

• support a culture of employee share ownership.

As a retention tool, the program is specifically targeted to Senior Executives

in key roles or other participants who have been identified as high

potential Executives.

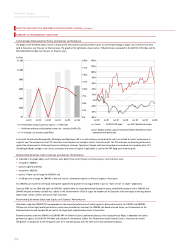

Rights granted under this Plan are subject to a performance hurdle, being

Total Shareholder Return (TSR) in comparison to a basket of listed global

airlines and the largest Australian listed public companies as measured by

the S&P/ASX 100 Index. The TSR will first be tested three years after the

Rights are granted and re-tested, if necessary, at quarterly intervals over

the subsequent two-year period.

The Plan allows for limited periodic re-testing of the TSR hurdle because:

• the impacts of long-term decision making may not neatly coincide with

a fixed three-year period; and

• it is based on an extension of the performance period, with no reduction

in the rigour and performance requirement of the original test. The re-

test recognises that the Qantas share price is more volatile in the short-

run than the long-run, when compared to the S&P/ASX 100 Index.

Retention Reward Plan

Selected Executives may also be invited to participate in a retention plan

with a required service period of three years.

The award to any individual under the Retention Reward Plan (RRP) can be

delivered either in deferred shares or by way of a deferred cash award.

Any award made under this Plan will be forfeited if the retention period

for service is not met. Satisfactory performance, including achievement

of personal key performance indicators, is a further requirement under

this Plan.

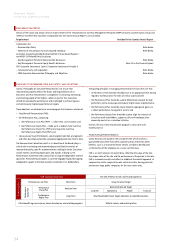

Employee Share Ownership Plan

To encourage greater share ownership, an Employee Share Ownership Plan

was approved by the Board at its July 2006 Meeting. Directors and

employees will be able to purchase shares at no discount to market price on

a salary sacrifice basis. The initial offering under this Plan will be launched

in 2006/07.

The Employee Share Ownership Plan is to operate under the Terms &

Conditions of the DSP.