Qantas 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

Notes to the Financial Statements

for the year ended 30 June 2006

29. Financial Instruments continued

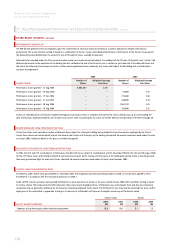

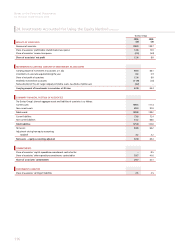

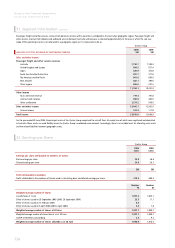

(C) FUEL PRICE RISK

The Qantas Group uses options and swaps on aviation fuel and crude oil to hedge the exposure to movements in the price of aviation fuel. Hedging is

conducted in accordance with Qantas Group policy. Up to 100 per cent of estimated fuel costs out to 12 months may be hedged and up to 50 per cent in the

subsequent 12 months, with any hedging outside these parameters requiring approval by the Board. During the year, the net gain arising from effective fuel

hedging was $345.9 million which has been recognised in fuel expenses (2005: total net gain from fuel hedging under previous GAAP $403.5 million). In

addition, a $32.6 million loss was recognised in Other expenses as ineffective fuel hedging in accordance with A-IFRS. For the year ended 30 June 2006, Other

financial assets and liabilities includes fuel derivatives totalling $246.6 million (asset). These are recognised at fair value in accordance with AASB 139.

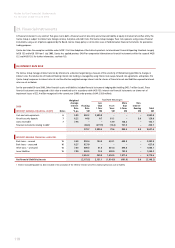

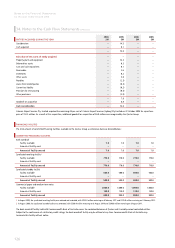

(D) CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by the counterparty during the term of the transaction or on settlement of the

transaction. Credit exposure is measured as the cost to replace existing transactions should a counterparty default. The Qantas Group conducts transactions

with the following major types of counterparties:

• trade debtor counterparties – the credit risk is the recognised amount, net of any impairment losses. As at 30 June 2006, this amounted to $1,074.3 million (2005:

$1,027.9 million). The Qantas Group has credit risk associated with travel agents, industry settlement organisations and credit provided to direct customers. The

Qantas Group minimises this credit risk through the application of stringent credit policies and accreditation of travel agents through industry programs; and

• other fi nancial asset counterparties – the Qantas Group restricts its dealings to counterparties that have acceptable credit ratings. Should the rating of a

counterparty fall below certain levels, internal policy dictates that approval by the Board is required to maintain the level of the counterparty exposure.

The Qantas Group minimises the concentration of credit risk by undertaking transactions with a large number of customers and counterparties in various

countries. As at 30 June 2006, the credit risk of the Qantas Group to Other financial asset counterparties amounted to $5,718.8 million (2005: $4,867.7

million) and was spread over a number of regions, including Australia, Asia, Europe and the United States.

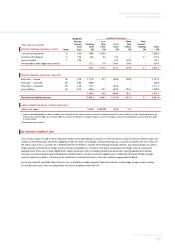

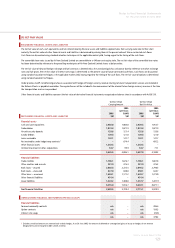

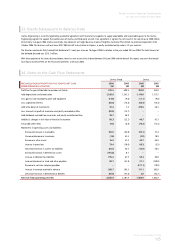

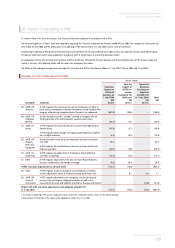

(E) CASH FLOW HEDGES

Any gains/losses on contracts entered into to hedge anticipated specific sales and purchases of goods and services, together with the cost of the contracts,

are recognised in the Financial Statements at the time the underlying transaction occurs. For further information, see Note 1(F).

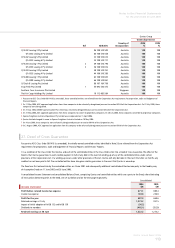

At 30 June 2006, the Qantas Group and Qantas held various types of derivative financial instruments that were designated as cash flow hedges of future

forecast transactions.

These were:

• hedging of certain foreign currency revenue receipts and operational payments by future debt repayments in foreign currency and exchange derivative contracts

(forwards, swaps or options) hedging future foreign exchange risk;

• hedging of future jet fuel purchases by forward crude, gasoil and jet kerosene derivative contracts and options;

• hedging of future interest payments by interest rate derivative contracts (forwards, swaps or options); and

• hedging of future capital expenditure payments by foreign exchange derivative contracts (forwards or options).

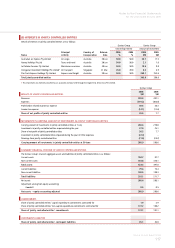

To the extent that the hedges were assessed as highly effective, changes in fair value are included in the hedge reserve. The periods in which the related cash

flows are expected to occur are summarised below:

2006

$M

Qantas Group

Less than 1 Year 1 to 5 Years More than 5 Years Total

Contracts to hedge future foreign currency payments (62.0) (90.6) (80.4) (233.0)

Contracts to hedge future aviation fuel payments (169.9) (28.5) – (198.4)

Contracts to hedge future interest payments (13.6) (24.4) (5.2) (43.2)

Contracts to hedge future capital expenditure payments 5.1 (5.0) – 0.1

(240.4) (148.5) (85.6) (474.5)

Related deferred tax charge 142.3

Total net gain included within hedge reserve (332.2)