Qantas 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

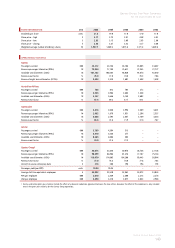

138

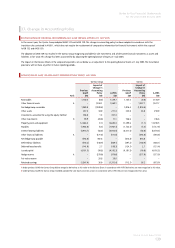

Notes to the Financial Statements

for the year ended 30 June 2006

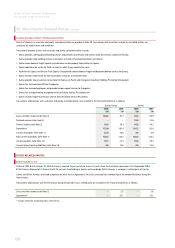

(F) OTHER

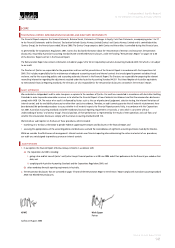

AASB 2 Share Based Payments: as permitted by AASB 1 Qantas has not

applied AASB 2 retrospectively to share based payments made prior to 7

November 2002. It therefore does not apply to Entitlements issued under

the Qantas Long-Term Executive Incentive Program (QLTEIP).

AASB 3 Business Combinations: as permitted by AASB 1, Qantas has

applied this standard prospectively. Amortisation of goodwill on acquisition

ceased on 1 July 2004. For the year ended 30 June 2005, goodwill

amortised under previous GAAP was $28.5 million (Qantas: $nil) inclusive

of $13.4 million goodwill amortisation in associate and jointly controlled

entity investments.

AASB 121 Foreign Exchange: as permitted by AASB 1, Qantas has reset the

foreign currency translation reserve to zero on adoption of this standard.

AASB 123 Borrowing Costs: as permitted by AASB 123, Qantas has

continued to capitalise borrowing costs associated with the acquisition of

qualifying assets such as aircraft and terminals.

AASB 127 Consolidations: to comply with the intent of UIG 112, Qantas has

consolidated the Qantas Deferred Share Plan Trust (QDSPT). The QDSPT

holds shares in Qantas on behalf of participants (who are Qantas

employees), which will be classified as Treasury Shares on consolidation.

AASB 136 Impairment of Assets: under previous GAAP, Qantas used

discounted cash flows to assess the value in use of non-current assets.

Qantas tested all non-current assets for impairment on the transition to

A-IFRS regardless of the existence of indicators of impairment. No change

in the carrying value of non-current assets was required on the adoption

of AASB 136.

AASB 138 Intangible Assets: intangible assets with an indefinite life, such

as purchased airport landing slots, are not amortised but are tested for

impairment each reporting period.

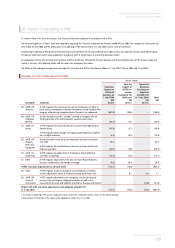

Financial Instruments

The transition to AASB 132 Financial Instruments: Disclosure and

Presentation and AASB 139 Financial Instruments: Recognition and

Measurement applied to Qantas effective from 1 July 2005. The Qantas

Group has chosen not to restate comparative information with respect to

AASB 132 and AASB 139.

Qantas risk management practices will continue to be determined on an

economic basis under A-IFRS. It is expected that this approach will result in

some transactions failing the AASB 139 hedge effectiveness criteria from

time to time. If hedging transactions are deemed ineffective under AASB

139, changes in the fair value of these transactions are to be recognised in

the Income Statement as they occur, potentially causing earnings volatility.

Two areas of Qantas’ risk management practice that were significantly

impacted by the requirements of AASB 139 are options and fuel hedging.

Options

AASB 139 allows the option value be separated into its intrinsic and non-

intrinsic components and only the intrinsic value is designated as a hedging

instrument. The intrinsic value of the option must therefore be separated

and designated as the hedge instrument, with all other components of the

option value (being primarily time value and volatility) being fair valued to

the Income Statement over the life of the option.

Options form a significant part of Qantas’ hedging strategy for foreign

exchange revenue, capital expenditure, fuel and interest rate exposures.

The changes in fair value of the non-intrinsic component of an option may

cause periods of volatility in the Income Statement for Qantas.

Aviation Fuel

AASB 139 permits hedge accounting for all financial exposures on a

component basis. Non-financial assets or liabilities such as aviation fuel,

however, are treated differently under the standard. Designation of

components of risk embedded in a commodity exposure are not permitted

under AASB 139. Accordingly, components of aviation fuel expense (for

example, crude oil) may not be hedged independently and achieve hedge

accounting under AASB 139. The total exposure (ie aviation fuel) must be

hedged in its entirety.

Qantas achieved hedge accounting for aviation fuel risk management

transactions in the majority of instances. However, given the high volatility

of fuel markets, the AASB 139 effectiveness test may not be met from time

to time and on these occasions changes in the fair value of hedging

instruments may cause volatility in the Income Statement.

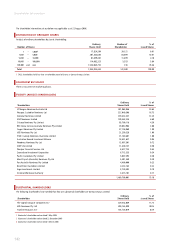

36. Impact of Adopting A-IFRS continued