Qantas 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Notes to the Financial Statements

for the year ended 30 June 2006

An appropriate impairment charge is made if the carrying amount of a non-

current asset exceeds its recoverable amount. The impairment is expensed

in the financial year in which it occurs. An impairment loss is reversed if

there has been a change in the estimates used to determine the recoverable

amount. An impairment loss with respect to goodwill is not reversed.

(P) INVESTMENTS

Current Accounting Policy

The investment in Air New Zealand Limited (Air New Zealand) is classifi ed

as being available-for-sale and is stated at fair value, with any resultant

gain or loss recognised directly in equity, except for impairment losses.

If this investment is derecognised in the future, the cumulative gain or loss

previously recognised directly in equity would be transferred to profi t or loss.

Comparative Period Policy

All investments are recorded at the lower of cost and recoverable amount.

(Q) PROPERTY, PLANT AND EQUIPMENT

Owned Assets

Items of property, plant and equipment are stated at cost or deemed cost

less accumulated depreciation and impairment losses. Items of property,

plant and equipment are initially recorded at cost, being the fair value of

the consideration provided plus incidental costs directly attributable to the

acquisition. The cost of acquired assets includes: the initial estimate at the

time of installation and during the period of use, when relevant, of the

costs of dismantling and removing the items and restoring the site on

which they are located, and changes in the measurement of existing

liabilities recognised for these costs resulting from changes in the timing

or outflow of resources required to settle the obligation or from changes in

the discount rate. Certain items of property, plant and equipment that had

been revalued to fair value on or prior to 1 July 2004, the date of transition

to A-IFRS, are measured on the basis of deemed cost, being the revalued

amount at the date of that revaluation.

An element of the cost of an acquired aircraft is attributed on acquisition to

its service potential reflecting the maintenance condition of its engines and

airframe. This cost is depreciated over the shorter of the period to the next

major inspection event (usually between 8 and 12 years) or the remaining

life of the aircraft. The estimated standard cost of subsequent major

airframe and engine maintenance checks is capitalised and depreciated

over the shorter of the scheduled usage period to the next major inspection

event or the remaining life of the aircraft. Manpower costs in relation to

employees that are dedicated to major modifications to aircraft are

capitalised as part of the cost of the modification to which they relate.

Borrowing costs associated with the acquisition of qualifying assets such as

aircraft and the acquisition, construction or production of significant items

of other property, plant and equipment are capitalised as part of the cost of

the asset to which they relate.

When an obligation exists to dismantle and remove an item of property, the

present value of the estimated cost to restore the site is capitalised into the

cost of the asset to which they relate and a provision created. The

unwinding of the discount is treated as a finance charge.

Depreciation and Amortisation

Depreciation and amortisation are provided on a straight-line basis on all

items of property, plant and equipment except for freehold and leasehold

land. The depreciation and amortisation rates of owned assets are

calculated so as to allocate the costs or valuation of an asset, less any

estimated residual value, over the asset’s estimated useful life to the

Qantas Group. Assets are depreciated or amortised from the date of

acquisition or, with respect to internally constructed assets, from the time

an asset is completed and held ready for use. The costs of improvements

to assets are amortised over the remaining useful life of the asset or the

estimated useful life of the improvement, whichever is the shorter. Assets

under finance lease are amortised over the term of the relevant lease or,

where it is likely the Qantas Group will obtain ownership of the asset, the

life of the asset.

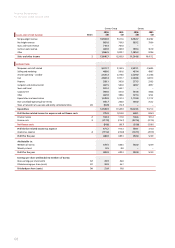

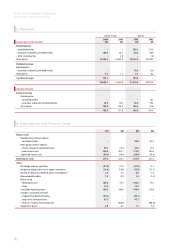

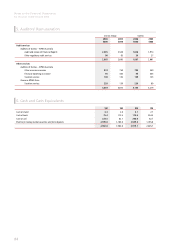

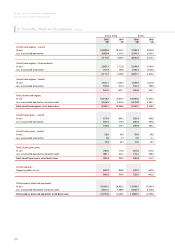

The principal asset depreciation and amortisation periods and estimated

residual value percentages are:

Years

Residual

Value

(%)

Buildings and leasehold improvements 10-50 0

Plant and equipment 3-40 0

Jet aircraft, engines and modifications 5-20 10-20

Non-jet aircraft, engines and modifi cations 5-20 0-20

Aircraft spare parts 15-20 0-20

Major aircraft inspections Inspection life 0

These rates are in line with those for the prior year.

Depreciation and amortisation rates and residual values are reviewed annually

and reassessed having regard to commercial and technological developments

and the estimated useful life of assets to the Qantas Group and the long-term

fl eet plan.

Leased and Hire Purchase Assets

Leased assets under which the Qantas Group assumes substantially all the

risks and benefits of ownership are classified as finance leases. Other leases

are classified as operating leases.

Linked transactions involving the legal form of a lease are accounted for

as one transaction when a series of transactions are negotiated as one or

take place concurrently or in sequence and cannot be understood

economically alone.

Finance leases are capitalised. A lease asset and a lease liability equal

to the present value of the minimum lease payments are recorded at the

inception of the lease. Any gains and losses arising under sale and

leaseback arrangements are deferred and amortised over the lease term

where the sale is not at fair value. Capitalised leased assets are amortised

on a straight-line basis over the period in which benefits are expected to

arise from the use of those assets. Lease payments are allocated between

the reduction in the principal component of the lease liability and

interest expense.

1. Statement of Signifi cant Accounting Policies continued