Qantas 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

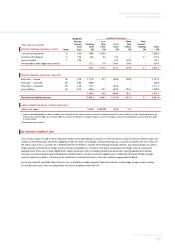

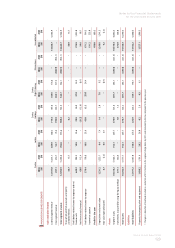

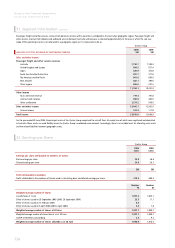

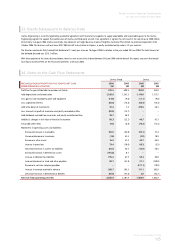

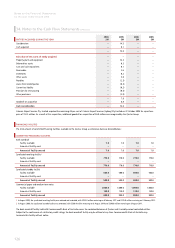

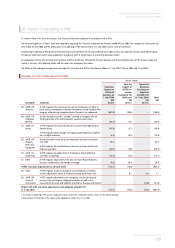

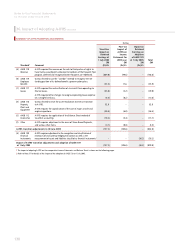

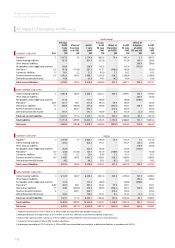

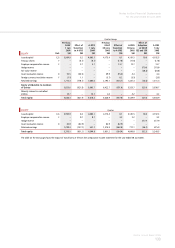

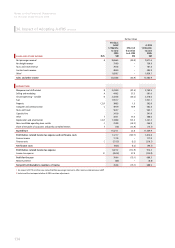

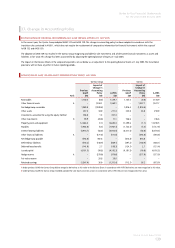

36. Impact of Adopting A-IFRS

As stated in Note 1(A), these are Qantas’ first Financial Statements prepared in accordance with A-IFRS.

The accounting policies in Note 1 have been applied in preparing the Financial Statements for the year ended 30 June 2006, the comparative information for

year ended 30 June 2005 and the preparation of an opening A-IFRS Balance Sheet at 1 July 2004 (Qantas’ date of transition).

In preparing its opening A-IFRS Balance Sheet and Financial Statements for the year ended 30 June 2005, Qantas has adjusted amounts reported previously

in Financial Statements which were prepared in accordance with its former basis of accounting (previous GAAP).

An explanation of how the transition from previous GAAP to A-IFRS has affected the financial position and financial performance of the Qantas Group and

Qantas is set out in the following tables and the notes that accompany the tables.

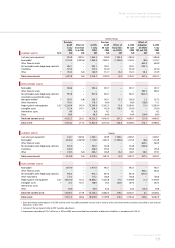

The tables on the subsequent pages show the impact of transition to A-IFRS on the Balance Sheets at 1 July 2004, 30 June 2005 and 1 July 2005.

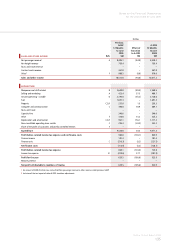

SUMMARY OF A-IFRS TRANSITION ADJUSTMENTS

Qantas Group

Standard1Comment

Transition

Impact on

Retained

Earnings at

1 July 2004

$M

(Dr)/Cr

Post-tax

Impact of

A-IFRS on

Income

Statement for

2005 year

$M

(Dr)/Cr

Impact on

Retained

Earnings on

Adoption

of AASB 139

at 1 July 2005

$M

(Dr)/Cr

Total

$M

(A) AASB 118

Revenue

A-IFRS required the revenue on the sale to third parties of rights to

have Qantas award points allocated to members of the Frequent Flyer

program, deferred and recognised when the points are redeemed. (669.0) (99.6) – (768.6)

(B) AASB 119

Employee

Benefits

Qantas elected to use the "corridor" method to recognise the net

funding position of its defined benefit superannuation plans.

(53.5) 17.6 – (35.9)

(C) AASB 117

Leases

A-IFRS required the reclassification of six aircraft from operating to

finance leases. (45.8) (3.2) – (49.0)

A-IFRS required other changes to recognise operating leases expense

on a straight-line basis. (6.4) (8.2) – (14.6)

(D) AASB 116

Property,

Plant and

Equipment

Qantas elected to reset the asset revaluation reserve on transition

to A-IFRS. 55.5 – – 55.5

A-IFRS requires the capitalisation of the cost of major aircraft and

engine inspections. (40.3) (6.0) – (46.3)

(E) AASB 112

Income Tax

A-IFRS requires the application of the Balance Sheet method of

tax-effect accounting. (10.3) (5.4) – (15.7)

(F) Other A-IFRS requires adjustment in the areas of Share-Based Payments,

business combinations and foreign exchange. (0.9) 29.8 – 28.9

A-IFRS transition adjustments to 30 June 2005 (770.7) (75.0) – (845.7)

(G) Other A-IFRS requires Qantas to recognise associate/jointly controlled

entities adjustments direct to retained earnings (refer Note 1(A)) – 0.1 1.0 1.1

(H) AASB 139

Financial

Instruments

A-IFRS requires adjustment to the recognition and classifi cation of

revenue, fuel and currency hedging transactions as well as the

measurement of assets and liabilities classifi ed as fi nancial instruments.

2 – – (37.0) (37.0)

Impact of A-IFRS transition adjustments and adoption of AASB 139

at 1 July 2005 (770.7) (74.9) (36.0) (881.6)

1 The impact of adopting A-IFRS on the comparative Income Statement and Balance Sheet is shown on the following pages.

2 Refer to Note 37 for details of the impact of the adoption of AASB 139 at 1 July 2005.