Qantas 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Qantas Annual Report 2006

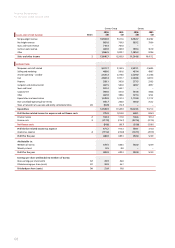

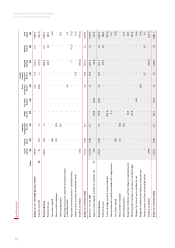

Notes to the Financial Statements

for the year ended 30 June 2006

Qantas Airways Limited (Qantas) is a company limited by shares

incorporated in Australia whose shares are publicly traded on the ASX and

which is subject to the operation of the Qantas Sale Act.

The consolidated Financial Report of Qantas for the year ended 30 June

2006 comprises Qantas and its controlled entities (together referred to as

the Qantas Group) and the Qantas Group’s interest in associates and jointly

controlled entities.

The Financial Report of Qantas for the year ended 30 June 2006 was

authorised for issue in accordance with a resolution of the Directors on

28 August 2006.

(A) STATEMENT OF COMPLIANCE

The Financial Report is a general purpose financial report which has been

prepared in accordance with Australian Accounting Standards (AASB)

adopted by the Australian Accounting Standards Board and the

Corporations Act. International Financial Reporting Standards (IFRS) form

the basis of AASBs adopted by the Australian Accounting Standards Board

and for the purpose of this report are called Australian equivalents to IFRS

(A-IFRS) to distinguish from previous Australian GAAP (previous GAAP). The

Financial Reports and Notes of the Qantas Group also comply with IFRSs

and interpretations adopted by the International Accounting Standards

Board. The Qantas Financial Report and Notes do not comply with IFRSs, as

Qantas has elected to apply the relief provided to Parent entities by AASB

132 Financial Instruments: Presentation and Disclosure in respect of certain

disclosure requirements.

This is Qantas’ first Financial Report prepared in accordance with A-IFRS

and AASB 1 First-time Adoption of A-IFRS has been applied. An explanation

of how the transition to A-IFRS has affected the reported Income

Statements, Balance Sheets, Statements of Changes in Equity and Cash

Flow Statements of the Qantas Group and Qantas is provided in Note 36.

(B) BASIS OF PREPARATION

The Financial Report is presented in Australian dollars and has been

prepared on the basis of historical costs except in accordance with relevant

accounting policies where assets and liabilities are stated at their fair

values. Assets classified as held for sale are stated at the lower of carrying

amount and fair value less costs to sell.

Qantas is a company of the kind referred to in Australian Securities

Investment Commission (ASIC) Class Order 98/100 dated 10 July 1998

(updated by CO 05/641 effective 28 July 2005 and CO 06/51 effective

31 January 2006) and in accordance with the Class Order, amounts in the

Financial Report have been rounded to the nearest hundred thousand

dollars, unless otherwise stated.

The accounting policies set out below have been applied consistently to all

periods presented in the consolidated Financial Report and in preparing an

opening A-IFRS Balance Sheet at 1 July 2004 for the purposes of the

transition to A-IFRS, except where stated.

Qantas has elected to early adopt the following accounting standards

and amendments:

• AASB 119 Employee Benefi ts (December 2004);

• AASB 2004-1 Amendments to Australian Accounting Standards (December

2004) amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004), AASB 116 Property,

Plant and Equipment and AASB 138 Intangible Assets;

• AASB 2004-2 Amendments to Australian Accounting Standards (December

2004) amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004), AASB 121 The

Effects of Changes in Foreign Exchange Rates, AASB 131 Interests in Joint

Ventures, AASB 134 Interim Financial Reporting, AASB 139 Financial

Instruments: Recognition and Measurement and AASB 141 Agriculture;

• AASB 2004-3 Amendments to Australian Accounting Standards (December

2004) amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004), AASB 101

Presentation of Financial Statements and AASB 124 Related Party Disclosures;

• AASB 2005-1 Amendments to Australian Accounting Standards (May 2005)

amending AASB 139 Financial Instruments: Recognition and Measurement;

• AASB 2005-2 Amendments to Australian Accounting Standards (June 2005)

amending AASB 1023 General Insurance Contracts;

• AASB 2005-3 Amendments to Australian Accounting Standards (June 2005)

amending AASB 119 Employee Benefi ts (December 2004);

• AASB 2005-4 Amendments to Australian Accounting Standards (June 2005)

amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004), AASB 132 Financial

Instruments: Disclosure and Presentation, AASB 139 Financial Instruments:

Recognition and Measurement, AASB 1023 General Insurance Contracts and

AASB 1038 Life Insurance Contracts;

• AASB 2005-5 Amendments to Australian Accounting Standards (June 2005)

amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004) and AASB 139

Financial Instruments: Recognition and Measurement;

• AASB 2005-6 Amendments to Australian Accounting Standards (June 2005)

amending AASB 3 Business Combinations;

• AASB 2005-7 Amendments to Australian Accounting Standards (June 2005)

amending AASB 134 Interim Financial Reporting;

• AASB 2005-8 Amendments to Australian Accounting Standards (June 2005)

amending AASB 1 First-time Adoption of Australian Equivalents to

International Financial Reporting Standards (July 2004);

• AASB 2005-11 Amendments to Australian Accounting Standards (September

2005) amending AASB 101 Presentation of Financial Statements, AASB 112

Income Taxes, AASB 132 Financial Instruments: Disclosure and Presentation,

AASB 133 Earnings per Share, AASB 139 Financial Instruments: Recognition

and Measurement and AASB 141 Agriculture;

• AASB 2006-1 Amendments to Australian Accounting Standards (January

2006) amending AASB 121 The Effects of Changes in Foreign Exchange Rates;

• UIG 4 Determining whether an Arrangement Contains a Lease;

• UIG 8 Scope of AASB 2 Share-Based Payment; and

• UIG 9 Reassessment of Embedded Derivatives.

The following standards and amendments were available for early adoption

but have not been applied by the Qantas Group in these Financial Statements:

• AASB 7 Financial Instruments: Disclosures (August 2005) replacing the

presentation requirements of financial instruments in AASB 132, AASB 7

is applicable for annual reporting periods beginning on or after

1 January 2007;

1. Statement of Signifi cant Accounting Policies