Logitech 2014 Annual Report Download - page 281

Download and view the complete annual report

Please find page 281 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

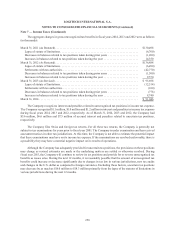

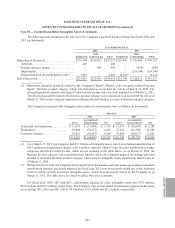

Peripherals

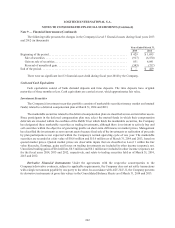

The Company performed its annual impairment analysis of the goodwill for its peripherals reporting unit as

of December 31, 2013 by performing a qualitative assessment and concluded that it was not more likely than not

that the fair value of its peripherals reporting units was less than its carrying amount. In assessing the qualitative

factors, the Company considered the impact of these key factors: change in industry and competitive environment,

growth in market capitalization of $2.2 billion as of December 31, 2013 from $1.2 billion as of December 31, 2012,

and forecasted budgeted-to- actual revenue performance for fiscal year 2014. The peripherals reporting unit had an

improvement in operating income from $35 million for the nine months ended December 31, 2012 to $117 million

for nine months ended December 31, 2013.

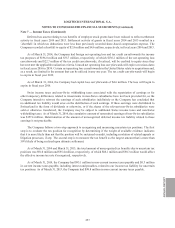

Video Conferencing

In the quarter ended September 30, 2013, the Company implemented a restructuring plan (“this Plan”)

associated with its video conferencing reporting unit to simplify its organization, better align costs with its current

business and free up resources to pursue growth opportunities. This Plan resulted in the reduction of personnel,

lease exit costs and the write-off of discontinued video conferencing products. In addition, actual performance

was significantly less than projected results for the periods since the prior annual goodwill impairment assessment

performed at December 31, 2012, due to the combination of a changing industry landscape caused by a shift to less

expensive cloud-based video conferencing solutions, an evolving Lifesize product line and challenges in execution.

These factors resulted in the Company concluding that it was more likely than not that the fair value of its video

conferencing reporting unit was less than its carrying amount. Therefore, the Company performed an interim Step

1 assessment of its video conferencing reporting unit at September 30, 2013.

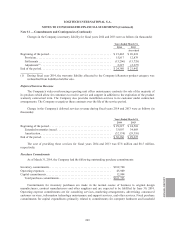

Step 1 assessment performed during the quarter ended September 30, 2013 involved measuring the

recoverability of goodwill by comparing the video conferencing reporting unit’s carrying amount, including

goodwill, to the fair value of the reporting unit. The fair value was estimated using both an income approach

employing a discounted cash flow model and a market approach. The market approach model was based on applying

certain revenue multiples of comparable companies to the respective revenue and earnings metrics of the reporting

unit. Step 1 assessment resulted in the Company determining that the video conferencing reporting unit passed

Step 1 test because the estimated fair value exceeded its carrying value by approximately 23%, thus not requiring

a Step 2 assessment of this reporting unit.

At December 31, 2013, the Company completed its annual impairment analysis for the goodwill of the video

conferencing reporting unit by performing Step 1 assessment as the qualitative factors that lead to the interim

assessment had not significantly improved.

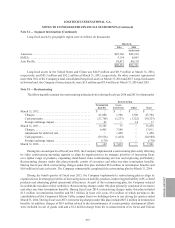

Key assumptions used in this Step 1 income approach analysis included the appropriate discount rates,

compound annual growth rate (“CAGR”) during the forecast period, and long-term growth rates for purposes of

determining a terminal value at the end of the discrete forecast period. Sensitivity assessment of key assumptions

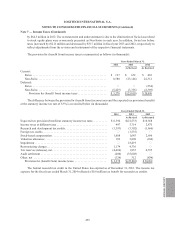

for the video conferencing reporting unit Step 1 test is presented below:

• CAGR assumption was 7.0% through fiscal year 2021, with a forecast decline in the remainder of fiscal

year 2014, and higher growth rates from fiscal years 2015 through 2019, reducing to a growth rate of 4% in

fiscal year 2021. The forecasted growth contrasts with the recent performance of the video conferencing

reporting unit, when the Company experienced a decline in revenue (see Note 14 for further details). A

hypothetical decrease to 1.4% in the CAGR rate, holding all other assumptions constant, would decrease

the fair value of the video conferencing reporting unit below its carrying value and hence would result in

the reporting unit failing Step 1 of the goodwill impairment test.

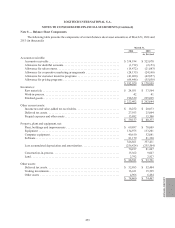

Note 10 — Goodwill and Other Intangible Assets (Continued)

ANNUAl REPORT

265