Logitech 2014 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

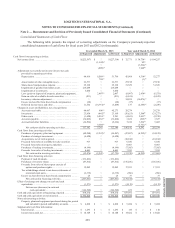

In accordance with ASC Topic 350-10 (“ASC 350-10”) as it relates to Goodwill and Other Intangible Assets,

the Company conducts its annual goodwill impairment analysis as of December 31 each year and as necessary if

changes in facts and circumstances indicate that it is more likely than not that the fair value of its reporting units

may be less than its carrying amount. Events or changes in facts and circumstances that might indicate potential

impairment of goodwill include company-specific factors, including, but not limited to, stock price volatility, market

capitalization relative to net book value, and projected revenue, market growth and operating results. Determining

the number of reporting units and the fair value of a reporting unit requires the Company to make judgments and

involves the use of significant estimates and assumptions. The Company has two reporting units: peripherals and

video conferencing. The allocation of assets and liabilities to each of the reporting units also involves judgment

and assumptions.

FASB ASC 350-20 permits the Company to make a qualitative assessment of whether it is more likely than not

that a reporting unit’s fair value is less than its carrying amount before applying the two-step goodwill impairment

test. If an entity concludes that it is not more likely than not that the fair value of a reporting unit is less than its

carrying amount, it would not be required to perform the two-step impairment test for that reporting unit. The

Company may elect to proceed directly to Step 1 without performing a qualitative assessment.

Step 1 of the two-step impairment test involves measuring the recoverability of goodwill at the reporting

unit level by comparing the reporting unit’s carrying amount, including goodwill, to the estimated fair value of the

reporting unit. The fair value is estimated using an income approach employing a discounted cash flow (“DCF”)

and a market-based model. The DCF model is based on projected cash flows from the Company’s most recent

forecast (“assessment forecast”) developed in connection with each of its reporting units to perform the goodwill

impairment assessment. The assessment forecast is based on a number of key assumptions, including, but not

limited to, discount rate, compound annual growth rate (“CAGR”) during the forecast period, and terminal value.

The terminal value is based on an exit price at the end of the assessment forecast using an earnings multiple

applied to the final year of the assessment forecast. The discount rate is applied to the projected cash flows to

reflect the risks inherent in the timing and amount of the projected cash flows, including the terminal value, and

is derived from the weighted average cost of capital of market participants in similar businesses. The market

approach model is based on applying certain revenue and earnings multiples of comparable companies relevant

to each of the Company’s reporting units to the respective revenue and earnings metrics of its reporting units. To

test the reasonableness of the fair values indicated by the income approach and the market-based approach, the

Company also assess the implied premium of the aggregate fair value over the market capitalization considered

attributable to an acquisition control premium, which is the price in excess of a stock market’s price that investors

would typically pay to gain control of an entity. The DCF model and the market approach require the exercise of

significant judgment, including assumptions about appropriate discount rates, long-term growth rates for purposes

of determining a terminal value at the end of the discrete forecast period, economic expectations, timing of expected

future cash flows, and expectations of returns on equity that will be achieved. Such assumptions are subject to

change as a result of changing economic and competitive conditions. If the carrying amount of the reporting unit

exceeds its fair value as determined by these assessments, goodwill is considered impaired, and Step 2 of the

analysis is performed to measure the amount of impairment loss. Step 2 measures the impairment loss by allocating

the reporting unit’s fair value to its assets and liabilities other than goodwill, comparing the resulting implied fair

value of goodwill with its carrying amount, and recording an impairment charge for the difference.

Note 3 — Summary of Significant Accounting Policies (Continued)

ANNUAl REPORT

241