Logitech 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308

|

|

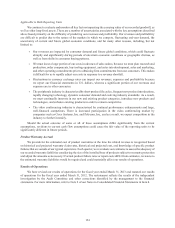

Applicable to Both Reporting Units

We continue to evaluate and monitor all key factors impacting the carrying value of our recorded goodwill, as

well as other long-lived assets. There are a number of uncertainties associated with the key assumptions described

above based primarily on the difficulty of predicting our revenues and profitability. Our revenues and profitability

are difficult to predict due to the nature of the markets in which we compete, fluctuating end-user demand, the

uncertainty of current and future global economic conditions, and for many other reasons, including, but not

limited to:

• Our revenues are impacted by consumer demand and future global conditions, which could fluctuate

abruptly and significantly during periods of uncertain economic conditions or geographic distress, as

well as from shifts in consumer buying patterns.

• We must incur a large portion of our costs in advance of sales orders, because we must plan research and

production, order components, buy tooling equipment, and enter into development, sales and marketing,

and other operating commitments prior to obtaining firm commitments from our customers. This makes

it difficult for us to rapidly adjust our costs in response to a revenue shortfall.

• Fluctuations in currency exchange rates can impact our revenues, expenses and profitability because

we report our financial statements in U.S. dollars, whereas a significant portion of our revenues and

expenses are in other currencies.

• The peripherals industry is characterized by short product life cycles, frequent new product introductions,

rapidly changing technology, dynamic consumer demand and evolving industry standards. As a result,

we must continually innovate in our new and existing product categories, introduce new products and

technologies, and enhance existing products in order to remain competitive.

• The video conferencing industry is characterized by continual performance enhancements and large,

well-financed competitors. There is increased participation in the video conferencing market by

companies such as Cisco Systems, Inc. and Polycom, Inc., and as a result, we expect competition in the

industry to further intensify.

Should the actual outcome of some or all of these assumptions differ significantly from the current

assumptions, revisions to current cash flow assumptions could cause the fair value of the reporting units to be

significantly different in future periods.

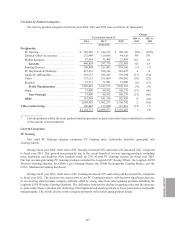

Product Warranty Accrual

We provide for the estimated cost of product warranties at the time the related revenue is recognized based

on historical and projected warranty claim rates, historical and projected cost, and knowledge of specific product

failures that are outside of our typical experience. Each quarter, we reevaluate our estimates to assess the adequacy of

our recorded warranty liabilities considering the size of the installed base of products subject to warranty protection

and adjust the amounts as necessary. If actual product failure rates or repair costs differ from estimates, revisions to

the estimated warranty liabilities would be required and could materially affect our results of operations.

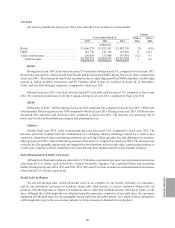

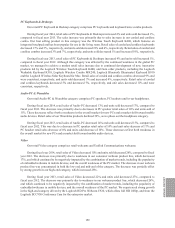

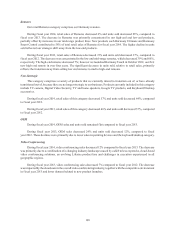

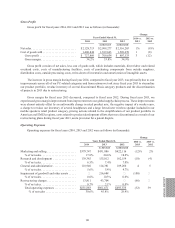

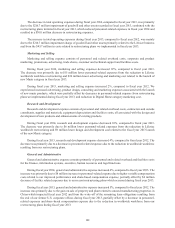

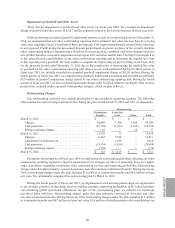

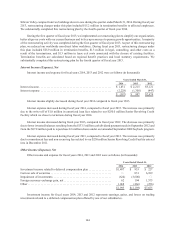

Results of Operations

We have revised our results of operations for the fiscal year ended March 31, 2013 and restated our results

of operations for the fiscal year ended March 31, 2012. The restatement reflects the results of the independent

investigation by the Audit Committee and other corrections identified by the management to the financial

statements. For more information, refer to Note 2 of our Notes to Consolidated Financial Statements in Item 8.

154