Logitech 2014 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

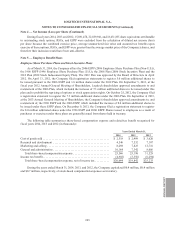

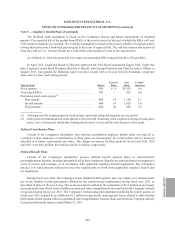

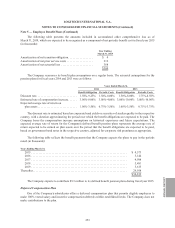

The following table summarizes total unamortized share-based compensation expense and the remaining

months over which such expense is expected to be recognized, on a weighted-average basis by type of grant (in

thousands, except number of months):

March 31, 2014

Unamortized

Expense

Remaining

Months

Stock options and ESPP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 980 17

Premium-priced stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 789 19

Market-based stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,304 9

Time-based RSUs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,379 22

Market-based RSUs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,901 27

$45,353

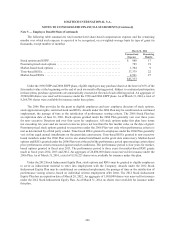

Under the 1996 ESPP and 2006 ESPP plans, eligible employees may purchase shares at the lower of 85% of the

fair market value at the beginning or the end of each six-month offering period. Subject to continued participation

in these plans, purchase agreements are automatically executed at the end of each offering period. An aggregate of

29,000,000 shares was reserved for issuance under the 1996 and 2006 ESPP plans. As of March 31, 2014, a total of

8,266,700 shares were available for issuance under these plans.

The 2006 Plan provides for the grant to eligible employees and non- employee directors of stock options,

stock appreciation rights, restricted stock and RSUs. Awards under the 2006 Plan may be conditioned on continued

employment, the passage of time or the satisfaction of performance vesting criteria. The 2006 Stock Plan has

an expiration date of June 16, 2016. Stock options granted under the 2006 Plan generally vest over three years

for non- executive Directors and over four years for employees. All stock options under this plan have terms

not exceeding ten years and are issued at exercise prices not less than the fair market value on the date of grant.

Premium-priced stock options granted to executives under the 2006 Plan vest only when performance criteria is

met as determined by a third party vendor. Time-based RSUs granted to employees under the 2006 Plan generally

vest in four equal annual installments on the grant date anniversary. Time-based RSUs granted to non-executive

board members under the 2006 Plan vest in one annual installment on the grant date anniversary. Market-based

options and RSUs granted under the 2006 Plan vest at the end of the performance period upon meeting certain share

price performance criteria measured against market conditions. The performance period is four years for market-

based options granted in fiscal year 2013. The performance period is three years for market-based RSU grants

made in fiscal years 2014, 2013 and 2012. An aggregate of 24,800,000 shares was reserved for issuance under the

2006 Plan. As of March 31, 2014, a total of 9,136,223 shares were available for issuance under this plan.

Under the 2012 Stock Inducement Equity Plan, stock options and RSUs may be granted to eligible employees

to serve as inducement material to enter into employment with the Company. Awards under the 2012 Stock

Inducement Equity Plan may be conditioned on continued employment, the passage of time or the satisfaction of

performance vesting criteria, based on individual written employment offer letter. The 2012 Stock Inducement

Equity Plan has an expiration date of March 28, 2022. An aggregate of 1,800,000 shares was reserved for issuance

under the 2012 Stock Inducement Equity Plan. As of March 31, 2014, no shares were available for issuance under

this plan.

Note 5 — Employee Benefit Plans (Continued)

246