Logitech 2014 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The Company will recognize a benefit from share-based compensation in paid-in capital only if an

incremental tax benefit is realized after all other available tax attributes have been utilized. For income tax footnote

disclosure, the Company has elected to offset deferred tax assets from share-based compensation against the

valuation allowance related to the net operating loss and tax credit carryforwards from accumulated tax benefits.

The Company will recognize these tax benefits in paid-in capital when the deduction reduces cash taxes payable.

In addition, the Company has elected to account for the direct benefits of share-based compensation on the research

tax credit through continuing operations.

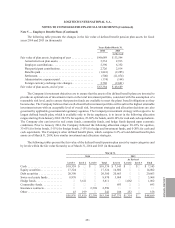

Product Warranty Accrual

The Company estimates cost of product warranties at the time the related revenue is recognized based on

historical and projected warranty claim rates, historical and projected costs, and knowledge of specific product

failures that are outside of the Company’s typical experience. Each quarter, the Company reevaluates estimates to

assess the adequacy of recorded warranty liabilities considering the size of the installed base of products subject

to warranty protection and adjusts the amounts as necessary. If actual product failure rates or repair costs differ

from estimates, revisions to the estimated warranty liabilities would be required and could materially affect the

Company’s results of operations.

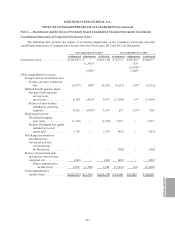

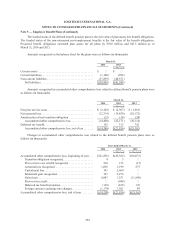

Comprehensive Income (Loss)

Comprehensive income (loss) is defined as the total change in shareholders’ equity during the period other

than from transactions with shareholders. Comprehensive income (loss) consists of net income (loss) and other

comprehensive income (loss). Other comprehensive income (loss) is comprised of foreign currency translation

adjustments from those entities not using the U.S. Dollar as their functional currency, unrealized gains and losses

on marketable equity securities, net deferred gains and losses and prior service costs for defined benefit pension

plans, and net deferred gains and losses on hedging activity.

Treasury Shares

The Company periodically repurchases shares in the market at fair value. Treasury shares repurchased are

recorded at cost as a reduction of total shareholders’ equity. Treasury shares held may be reissued to satisfy the

exercise of employee stock options and purchase rights, the vesting of restricted stock units, and acquisitions, or

may be cancelled with shareholder approval. Treasury shares that are reissued are accounted for using the first-in,

first-out basis.

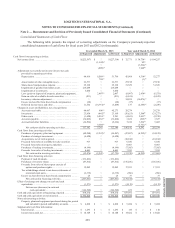

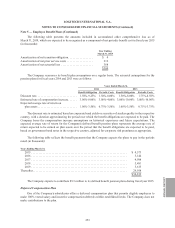

Derivative Financial Instruments

The Company enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables and to hedge against exposure to changes

in foreign currency exchange rates related to its subsidiaries’ forecasted inventory purchases. These forward

contracts generally mature within one to three months. The Company may also enter into foreign exchange swap

contracts to extend the terms of its foreign exchange forward contracts.

Gains and losses for changes in the fair value of the effective portion of the Company’s forward contracts

related to forecasted inventory purchases are deferred as a component of accumulated other comprehensive income

(loss) until the hedged inventory purchases are sold, at which time the gains or losses are reclassified to cost of

goods sold. Gains or losses for changes in the fair value on forward contracts that offset translation losses or gains

on foreign currency receivables or payables are recognized are included in other income (expense), net.

Note 3 — Summary of Significant Accounting Policies (Continued)

ANNUAl REPORT

243