Logitech 2014 Annual Report Download - page 162

Download and view the complete annual report

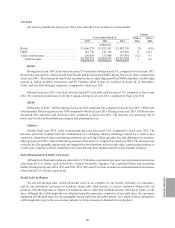

Please find page 162 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.There are two elements to the restatement related to the Revue product: (1) a lower of cost or market (“LCM”)

charge based on the net realizable value of finished goods and work in process on-hand inventory and non-

cancelable orders for such inventory, and (2) an excess and obsolescence charge for non-cancelable orders for

inventory components. The Audit Committee found that certain former members of the finance organization had

information that was not considered, that showed a future loss that was estimable and probable before the filing of

the Form 10-K on May 27, 2011 and that such loss was not recorded in our fiscal year 2011 financial statements.

Certain former members of the finance organization erroneously accounted for the LCM charge in fiscal year

2011 based on the current price or on price reductions instead of considering available contemporaneous evidence

of anticipated future price reductions and losses which were estimable and probable at the time. In addition, the

Audit Committee found that a management representation letter dated May 27, 2011 to our independent registered

public accounting firm incorrectly stated that probable future pricing adjustments were considered in the LCM

calculation. With respect to the Revue components, certain former members of the finance organization did not

consider all available information and therefore did not record a charge in the fourth quarter of fiscal year 2011 for

non-cancelable orders related to components considered excess and obsolete. The analysis erroneously assumed

the components would be manufactured into finished goods, though there was information available that showed

that the components would not be manufactured into finished goods. This information was not reflected in our

accounting or provided to our independent registered public accounting firm. The Audit Committee found that

there was not an adequate basis for the historical accounting treatment of the components in the fourth quarter of

fiscal year 2011.

Overview of Our Company

Logitech is a world leader in products that connect people to the digital experiences they care about. Spanning

multiple computing, communication and entertainment platforms, we develop and market innovative hardware

and software products that enable or enhance digital navigation, music and video entertainment, gaming, social

networking and audio and video communication over the Internet. We have two reporting segments: peripherals

and video conferencing.

Our peripherals segment encompasses the design, manufacturing and marketing of peripherals for PCs,

tablets and other digital platforms. Our products for home and business PCs include mice, trackballs, keyboards,

interactive gaming controllers, multimedia speakers, headsets and webcams. Our tablet accessory products include

keyboards, keyboard cases and covers, and smart phone accessories. Our Internet communications products include

webcams, conference cams and headsets. Our digital music products include wireless speakers, earphones, and

custom in-ear monitors. Our gaming products include mice, keyboards, headsets and gaming controllers. For home

entertainment and home control systems, we offer the Harmony line of advanced remote controls. Since fiscal year

2013, we have been exiting other non-strategic products, such as speaker docks and headphones, and continue to

evaluate non-strategic products as part of our ongoing efforts to strengthen our overall portfolio.

Within our peripherals segment, we classify our retail product categories as growth, profit maximization, and

non-strategic. Our growth product categories are: PC Gaming, Tablet & Other Accessories, and Mobile Speakers.

Our profit maximization categories are: Pointing Devices, PC Keyboards & Desktops, Audio-PC & Wearables,

Video, and Remotes.

Our brand, portfolio management, product development and engineering teams in our peripherals segment

are responsible for product strategy, technological innovation, product design and development and to bring our

products to market.

Our global marketing organization is responsible for developing and building the Logitech brand, consumer

insights, public relations, social media and digital marketing. Our regional retail sales and marketing activities are

organized into three geographic areas: Americas (North and South America), EMEA (Europe, Middle East and

Africa) and Asia Pacific (including, among other countries, China, Taiwan, Japan and Australia).

146