Logitech 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Trends Specific to our Video Conferencing Segment

The trend among businesses and institutions to use video conferencing offers a long-term growth opportunity

for us. However, the overall video conferencing industry has experienced a slowdown in recent quarters. In

addition, there has been an increase in the competitive environment. This situation resulted in a $214.5 million

goodwill impairment charge in fiscal year 2013. During the quarters ended March 31, 2013 and September 30, 2013,

we implemented restructuring plans affecting our video conferencing operating segment to align its organization to

its strategic priorities of increasing focus on a tighter range of products, expanding cloud-based video conferencing

services and improving profitability. We believe the growth in our video conferencing segment depends in part on

our ability to increase sales to enterprises with existing installed bases of equipment supplied by our competitors

and to enterprises that may purchase such competitor equipment in the future. We believe the ability of our Lifesize

products to interoperate with the equipment of other telecommunications, video conferencing or telepresence

equipment suppliers to be a key factor in purchasing decisions by current or prospective Lifesize customers. In

addition, Lifesize has broadened its product portfolio to include infrastructure, cloud services and other offerings

which require different approaches to developing customer solutions. We are also seeking to offer Lifesize products

designed to enhance the use of mobile devices in video conferencing applications.

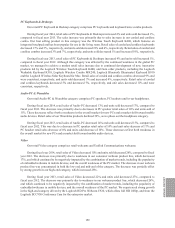

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with U.S. GAAP (Generally

Accepted Accounting Principles in the United States of America) requires us to make judgments, estimates

and assumptions that affect reported amounts of assets, liabilities, net sales and expenses, and the disclosure of

contingent assets and liabilities.

We consider an accounting estimate critical if it: (i) requires management to make judgments and estimates

about matters that are inherently uncertain; and (ii) is important to an understanding of our financial condition and

operating results.

We base our estimates on historical experience and on various other assumptions we believe to be reasonable

under the circumstances. Although these estimates are based on management’s best knowledge of current events

and actions that may impact us in the future, actual results could differ from those estimates. Management has

discussed the development, selection and disclosure of these critical accounting estimates with the Audit Committee

of the Board of Directors.

We believe the following accounting estimates are most critical to our business operations and to an

understanding of our financial condition and results of operations, and reflect the more significant judgments and

estimates used in the preparation of our consolidated financial statements.

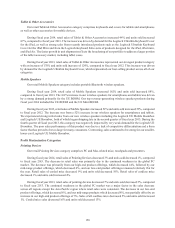

Accruals for Customer Programs

We record accruals for product returns, cooperative marketing arrangements, customer incentive programs

and pricing programs. An allowance against accounts receivable is recorded for accruals and program activity

related to our direct customers and those indirect customers who receive payments for program activity through

our direct customers. An accrued liability is recorded for accruals and program activity related to our indirect

customers who receive payments directly and do not have a right of offset against a receivable balance. The

estimated cost of these programs is recorded as a reduction of revenue, as cost of sales or as an operating expense,

if we receive a separately identifiable benefit from the customer and can reasonably estimate the fair value of that

benefit. Significant management judgment and estimates must be used to determine the cost of these programs in

any accounting period.

150