Logitech 2014 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

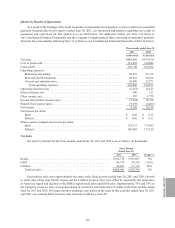

Retail units sold increased 2% and our overall retail average selling price decreased 2% in the three months

ended June 30, 2011 compared with the three months ended June 30, 2010. Sales of our retail products priced above

$100 represented approximately 15% of our total retail sales in both the three months ended June 30, 2011 and 2010.

Products priced below $40 represented approximately 57% of retail sales in the fiscal quarter ended June 30, 2011

compared with 61% in the fiscal quarter ended June 30, 2010. If foreign currency exchange rates had been the same

in three months ended June 30, 2011 and 2010, our constant dollar retail sales decrease would have been 5%.

Units sold to OEM customers declined 22% during the fiscal quarter ended June 30, 2011 compared with the

same period in the prior fiscal year, primarily due to decreased sales of our OEM mice and microphones for console

singing games. Sales of our OEM mice decreased 12% and units sold decreased 19% during the quarter compared

with the same period in the prior fiscal year. Microphone sales decreased by 91% in the three months ended June 30,

2011 compared with the three months ended June 30, 2010. Sales of OEM keyboards and desktops increased 17%

in dollars during the quarter compared with the prior year, with unit sales essentially flat between the two periods.

LifeSize net sales represent sales of video conferencing units and related software and services. Sales of our

LifeSize products increased 34% in the three months ended June 30, 2011 compared with the three months ended

June 30, 2010. Foreign currency exchange rates did not affect LifeSize sales.

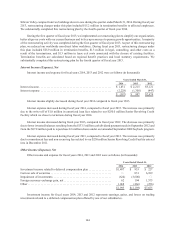

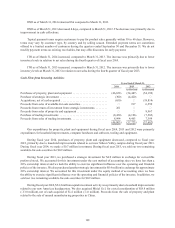

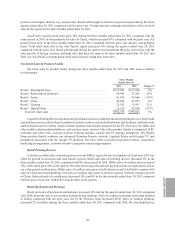

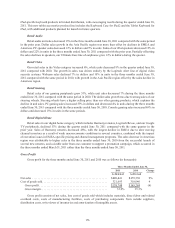

Retail Sales by Region

The following table presents the change in retail sales by region for the three months ended June 30, 2011

compared with the three months ended June 30, 2010.

Three months ended

June 30, 2011

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14)%

Americas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1%

Asia Pacific . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29%

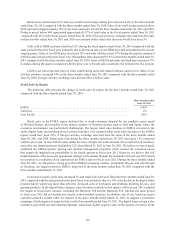

Retail sales in the EMEA region declined due to weak consumer demand for our products across much

of Western Europe, most notably in the mature markets of Southern Europe such as Italy and Spain, where the

economic environment was particularly challenging. The largest retail sales declines in EMEA occurred in the

audio, digital home and pointing devices product families. Our constant dollar retail sales decrease in the EMEA

region would have been 23%, if foreign currency exchange rates had been the same in the three months ended

June 30, 2011 and 2010. Retail units sold during the three months ended June 30, 2011 decreased 13% compared

with the prior year, in line with the sales dollar decrease. Despite the weak demand, the overall level of inventory

carried by our channel partners declined by 22% from March 31, 2011 to June 30, 2011. We believe we have largely

stabilized the EMEA-specific pricing and channel management programs which created the execution issues

that negatively impacted our profitability in the fourth quarter of fiscal year 2011. However, we believe that full

implementation of the necessary operational changes will continue through the remainder of fiscal year 2012 which

has resulted in a reduction of our expectation for EMEA sales in fiscal year 2012. During the three months ended

June 30, 2011, we did achieve strong growth in EMEA’s emerging markets, particularly Russia, and sell-through

in Germany, our largest market in EMEA, improved in the three months ended June 30, 2011 compared with the

three months ended March 31, 2011.

In Americas region, retail sales increased 1% and retail units sold were flat in the three months ended June 30,

2011 compared with the same period in the prior fiscal year, primarily due to a 36% sales decline in the digital home

product family, which was more than offset by increased sales of keyboards and desktops, pointing devices, and

gaming products. In the digital home category, sales of remote controls in first quarter of fiscal year 2011 included

the launch of several new remotes, including the Harmony 300 and the Harmony 650, whereas the same period

in fiscal year 2012 did not include any remote control product launches. In addition, one of our Americas region

customers placed a sizable order for remotes in the three months ended March 31, 2011, to support a promotion

campaign, which negatively impacted sales in the three months ended June 30, 2011. The digital home category also

includes Logitech Revue and related peripherals, which had slightly negative sales in the quarter, as returns of the

174