Logitech 2014 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

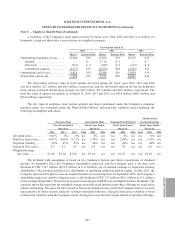

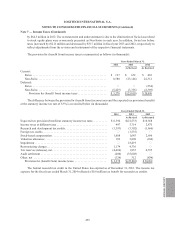

Note 5 — Employee Benefit Plans (Continued)

The dividend yield assumption is based on the Company’s history and future expectations of dividend

payouts. The expected life of the market-based RSUs is the service period at the end of which the RSUs will vest

if the market conditions are satisfied. The volatility assumption is based on the actual volatility of Logitech’s daily

closing share price over a look-back period equal to the years of expected life. The risk free interest rate is derived

from the yield on U.S. Treasury Bonds for a term of the same number of years as the expected life.

As of March 31, 2014, the grant date fair values of outstanding RSUs ranged from $6 to $20 per RSU.

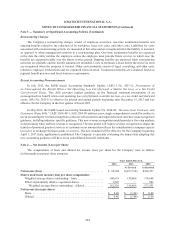

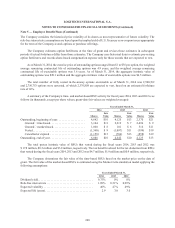

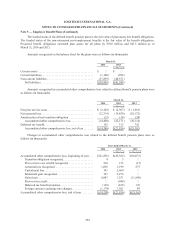

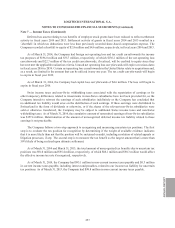

In April 2012, Logitech’s Board of Directors approved the 2012 Stock Inducement Equity Plan. Under this

plan, Logitech’s newly hired President, Bracken P. Darrell, who became President and Chief Executive Officer in

January 2013, was granted the following equity incentive awards with a ten year term (in thousands, except per

share exercise price and vesting period):

Type of Grant Shares

Exercise

Price

Fair

Value

Vesting(1)

(in years)

Stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 $ 8 $1,820 4.0

Time based RSUs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100 — 803 4.0

Premium-priced stock options(2):

First tranche . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 14 1,100 2.5

Second tranche . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 16 1,024 3.0

Third tranche . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 20 896 3.9

(1) Vesting period for premium-priced stock options represents estimated requisite service period.

(2) Each grant of premium-priced stock options will vest in full if and only when Logitech’s average closing share

price, over a consecutive ninety-day trading period, meets or exceeds the exercise price of the grant.

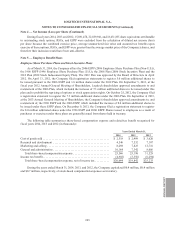

Defined Contribution Plans

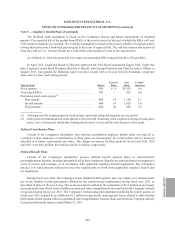

Certain of the Company’s subsidiaries have defined contribution employee benefit plans covering all or

a portion of their employees. Contributions to these plans are discretionary for certain plans and are based on

specified or statutory requirements for others. The charges to expense for these plans for fiscal years 2014, 2013

and 2012, were $6.6 million, $6.9 million and $11.6 million, respectively.

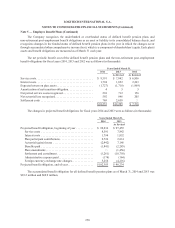

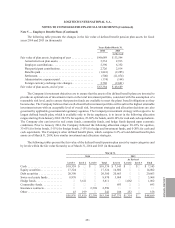

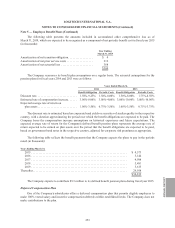

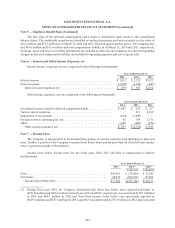

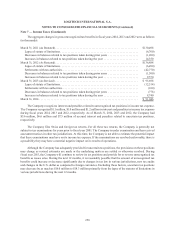

Defined Benefit Plans

Certain of the Company’s subsidiaries sponsor defined benefit pension plans or non-retirement

post-employment benefits covering substantially all of their employees. Benefits are provided based on employees’

years of service and earnings, or in accordance with applicable employee benefit regulations. The Company’s

practice is to fund amounts sufficient to meet the requirements set forth in the applicable employee benefit and

tax regulations.

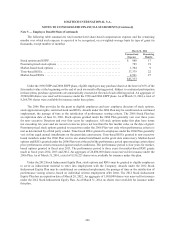

During fiscal year 2013, the Company’s Swiss defined benefit pension plan was subject to re-measurement

due to the number of plan participants affected by the restructurings implemented during fiscal year 2013, as

described in Note 15, Restructuring. The re-measurement resulted in the realization of $2.2 million in previously

unrecognized losses which resided within accumulated other comprehensive loss and which the Company entirely

recognized during fiscal year 2013. The Company’s restructuring plan implemented during the fourth quarter of

fiscal year 2013 resulted in an additional $1.2 million in previously unrecognized losses related to affected plan

participants which resided within accumulated other comprehensive income (loss) and which the Company entirely

recognized during the quarter ended March 31, 2013.

ANNUAl REPORT

249