Logitech 2012 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

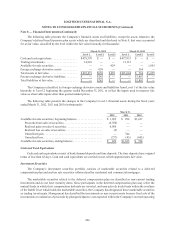

Management performed a goodwill impairment analysis of each of its reporting units as of December 31, 2011.

The carrying value of goodwill attributable to the peripherals and video conferencing reporting units was $220.9

million and $339.7 million as of March 31, 2012. As of December 31, 2011, management determined the fair value

of our peripherals reporting unit exceeded the carrying value of the reporting unit by more than 30% of the carrying

value, and the fair value of our video conferencing reporting unit exceeded the carrying value of the reporting unit

by more than 80% of the carrying value. Management continues to evaluate and monitor all key factors impacting

the carrying value of the Company’s recorded goodwill, as well as other long-lived assets. Further adverse changes

in the Company’s expected operating results, market capitalization, business climate, or other negative events could

result in a material non-cash impairment charge in the future.

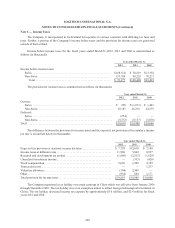

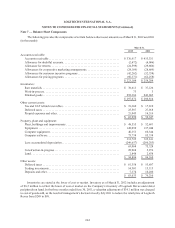

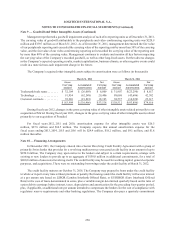

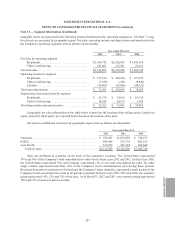

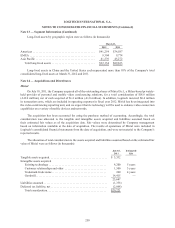

The Company’s acquired other intangible assets subject to amortization were as follows (in thousands):

March 31, 2012 March 31, 2011

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Trademark/trade name . . . . . . . $ 32,104 $ (26,095) $ 6,009 $ 31,907 $(23,290) $ 8,617

Technology . . . . . . . . . . . . . . . . 91,954 (62,548) 29,406 88,068 (45,686) 42,382

Customer contracts .......... 39,926 (21,823) 18,103 38,537 (14,920) 23,617

$ 163,984 $(110,466) $53,518 $158,512 $(83,896) $74,616

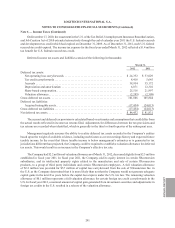

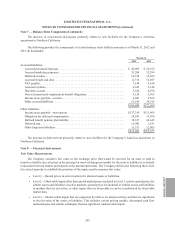

During fiscal year 2012, changes in the gross carrying value of other intangible assets related primarily to our

acquisition of Mirial. During fiscal year 2011, changes in the gross carrying value of other intangible assets related

primarily to our acquisition of Paradial.

For fiscal years 2012, 2011 and 2010, amortization expense for other intangible assets was $26.5

million, $27.8 million and $14.5 million. The Company expects that annual amortization expense for the

fiscal years ending 2013, 2014, 2015 and 2016 will be $24.4 million, $18.2 million, and $9.1 million, and $1.8

million thereafter.

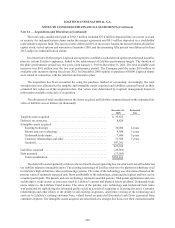

Note 10 — Financing Arrangements

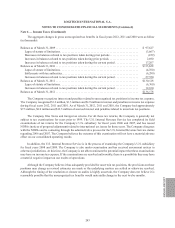

In December 2011, the Company entered into a Senior Revolving Credit Facility Agreement with a group of

primarily Swiss banks that provides for a revolving multicurrency unsecured credit facility in an amount of up to

$250.0 million. The Company may, upon notice to the lenders and subject to certain requirements, arrange with

existing or new lenders to provide up to an aggregate of $150.0 million in additional commitments, for a total of

$400.0 million of unsecured revolving credit. The credit facility may be used for working capital, general corporate

purposes, and acquisitions. There were no outstanding borrowings under the credit facility at March 31, 2012.

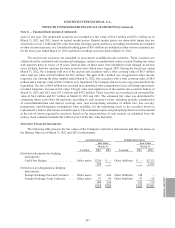

The credit facility matures on October 31, 2016. The Company may prepay the loans under the credit facility

in whole or in part at any time without premium or penalty. Borrowings under the credit facility will accrue interest

at a per annum rate based on LIBOR (London Interbank Offered Rate), or EURIBOR (Euro Interbank Offered

Rate) in the case of loans denominated in euros, plus a variable margin determined quarterly based on the ratio of

senior debt to earnings before interest, taxes, depreciation and amortization for the preceding four-quarter period,

plus, if applicable, an additional rate per annum intended to compensate the lenders for the cost of compliance with

regulatory reserve requirements and other banking regulations. The Company also pays a quarterly commitment

Note 9 — Goodwill and Other Intangible Assets (Continued)

250