Logitech 2012 Annual Report Download - page 172

Download and view the complete annual report

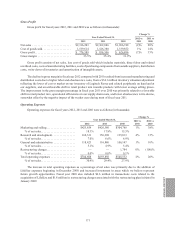

Please find page 172 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.jurisdictions. The Company is under examination in various tax jurisdictions. The Company is not able to estimate

the potential impact that these examinations may have on income tax expense. If the examinations are resolved

unfavorably, there is a possibility they may have a material negative impact on our results of operations.

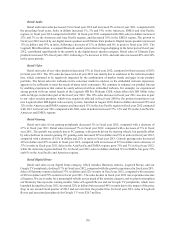

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with U.S. GAAP (generally

accepted accounting principles in the United States of America) requires the Company to make judgments, estimates

and assumptions that affect reported amounts of assets, liabilities, net sales and expenses, and the disclosure of

contingent assets and liabilities.

We consider an accounting estimate critical if it: (i) requires management to make judgments and estimates

about matters that are inherently uncertain; and (ii) is important to an understanding of Logitech’s financial

condition and operating results.

We base our estimates on historical experience and on various other assumptions we believe to be reasonable

under the circumstances. Although these estimates are based on management’s best knowledge of current events and

actions that may impact the Company in the future, actual results could differ from those estimates. Management

has discussed the development, selection and disclosure of these critical accounting estimates with the Audit

Committee of the Board of Directors.

We believe the following accounting estimates are most critical to our business operations and to an

understanding of our financial condition and results of operations, and reflect the more significant judgments and

estimates used in the preparation of our consolidated financial statements.

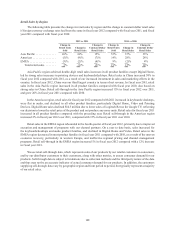

Accruals for Customer Programs

We record accruals for product returns, cooperative marketing arrangements, customer incentive programs and

pricing programs. An allowance against accounts receivable is recorded for accruals and program activity related

to our direct customers and those indirect customers who receive payments for program activity through our direct

customers. An accrued liability is recorded for accruals and program activity related to our indirect customers who

receive payments directly and do not have a right of offset against a receivable balance. The estimated cost of these

programs is recorded as a reduction of revenue or as an operating expense, if we receive a separately identifiable

benefit from the customer and can reasonably estimate the fair value of that benefit. Significant management

judgment and estimates must be used to determine the cost of these programs in any accounting period.

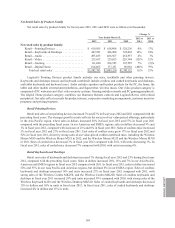

Returns. The Company grants limited rights to return product. Return rights vary by customer, and range from

just the right to return defective product to stock rotation rights limited to a percentage approved by management.

Estimates of expected future product returns are recognized at the time of sale based on analyses of historical return

trends by customer and by product, inventories owned by and located at distributors and retailers, current customer

demand, current operating conditions, and other relevant customer and product information. Return trends are

influenced by product life cycle status, new product introductions, market acceptance of products, sales levels,

product sell-through, the type of customer, seasonality, product quality issues, competitive pressures, operational

policies and procedures and other factors. Return rates can fluctuate over time, but are sufficiently predictable to

allow us to estimate expected future product returns.

Cooperative Marketing Arrangements. We enter into customer marketing programs with many of our

distribution and retail customers, and with certain indirect partners, allowing customers to receive a credit equal

to a set percentage of their purchases of the Company’s products, or a fixed dollar credit for various marketing

arrangements. The objective of these arrangements is to encourage advertising and promotional events to increase

sales of our products. Accruals for these marketing arrangements are recorded at the time of sale, or time of

commitment, based on negotiated terms, historical experience and inventory levels in the channel.

162