Logitech 2012 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

not using the U.S. dollar as their functional currency, unrealized gains and losses on marketable equity securities,

net deferred gains and losses and prior service costs for defined benefit pension plans, and net deferred gains and

losses on hedging activity.

Treasury Shares

The Company periodically repurchases shares in the market at fair value. Treasury shares repurchased are

recorded at cost, as a reduction of total shareholders’ equity. Treasury shares held may be reissued to satisfy the

exercise of employee stock options and purchase rights, the vesting of restricted stock units, and acquisitions, or

may be cancelled with shareholder approval.

Derivative Financial Instruments

The Company enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables and to hedge against exposure to changes

in foreign currency exchange rates related to its subsidiaries’ forecasted inventory purchases. These forward

contracts generally mature within one to three months. The Company may also enter into foreign exchange swap

contracts to extend the terms of its foreign exchange forward contracts.

Gains and losses in the fair value of the effective portion of our forward contracts related to forecasted

inventory purchases are deferred as a component of accumulated other comprehensive loss until the hedged

inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. Gains or

losses in fair value on forward contracts which offset translation losses or gains on foreign currency receivables or

payables are recognized in earnings monthly and are included in other income (expense), net.

Recent Accounting Pronouncements

In September 2011, the FASB issued ASU 2011-08, Intangibles—Goodwill and Other (Topic 350).

ASU 2011-08 provides entities the option to first assess qualitatively whether it is necessary to perform the two-

step goodwill impairment test. If an entity concludes, as a result of its qualitative assessment, that it is more likely

than not that the fair value of a reporting unit is less than its carrying amount, the quantitative two-step goodwill

impairment test is required. An entity may elect to bypass the qualitative assessment and proceed to perform the

first step of the two-step goodwill impairment test. ASU 2011-08 is effective for annual and interim goodwill

impairment tests performed for fiscal years beginning after December 15, 2011. The Company will adopt ASU

2011-08 in the first quarter of fiscal year 2013. The adoption of ASU 2011-08 is not expected to have a material

impact on the consolidated financial statements and footnote disclosures.

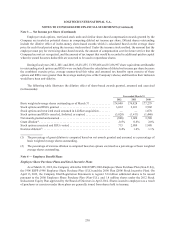

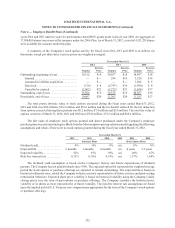

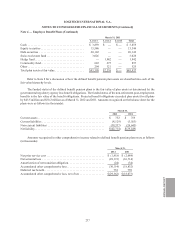

Note 3 — Net Income per Share

The computations of basic and diluted net income per share for the Company were as follows (in thousands

except per share amounts):

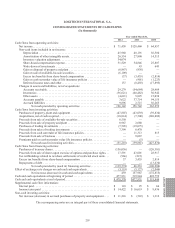

Year ended March 31,

2012 2011 2010

Net income—basic and diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 71,458 $128,460 $ 64,957

Weighted average shares—basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174,648 176,928 177,279

Effect of dilutive stock options ..................................... 943 1,862 2,061

Weighted average shares—diluted .................................. 175,591 178,790 179,340

Net income per share—basic ...................................... $ 0.41 $ 0.73 $ 0.37

Net income per share—diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.41 $ 0.72 $ 0.36

Note 2 — Summary of Significant Accounting Policies (Continued)

ANNUAL REPORT

229