Logitech 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overview of Factors Considered by Committee

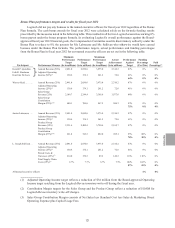

The Compensation Committee considers a variety of factors when determining total executive

compensation, including:

• Competitive considerations.

• Subjective elements, such as the scope of the executive’s role, experience and skills, the individual’s

performance during the prior fiscal year and potential for future contribution to Logitech.

• The performance of Logitech in the prior fiscal year.

• Logitech’s performance relative to the Company’s compensation peer group and the overall

technology industry.

• Accrued and realized gains from past equity incentive awards.

Competitive considerations

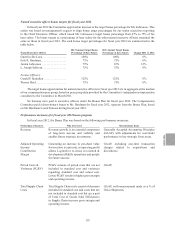

We attempt to compensate our executive officers competitively relative to industry peers. Both peer group

and broader industry compensation survey data is used by our Compensation Committee when setting Logitech’s

executive compensation, as well as to assist the Compensation Committee in the evaluation of the design of bonus

plan and equity compensation programs.

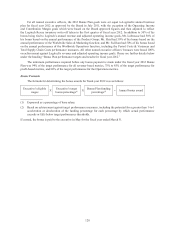

Prior to the start of fiscal year 2012, the Compensation Committee asked the Committee’s independent

compensation consultant, Radford, to review the composition of Logitech’s compensation peer group,

which was established in partnership with Fred W. Cook Consulting in March 2008, and re-evaluated by

Fred W. Cook in March 2010, to ensure the companies included remained appropriate for Logitech’s use in executive

compensation benchmarking.

In February 2011, Radford evaluated the current compensation peer group and made recommendations based

on the criteria of (i) involvement in the PC-based consumer electronics industry, or (ii) revenues approximately

equal to Logitech’s and a presence near Silicon Valley in the San Francisco Bay Area. Although Logitech is a Swiss

company, Logitech primarily competes for executive management talent with technology companies in the United

States, and particularly in the high-technology area of Silicon Valley. As a result, our compensation peer group

consists primarily of U.S. public technology companies.

While the composition of the new compensation peer group remains substantially the same as our prior

peer group, Radford recommended, and the Committee approved, the removal of 6 companies whose revenues

were significantly above or below our target annual revenue range of $1 billion to $3 billion, and the addition of

5 companies who met our peer company criteria. Additionally, over the past 18 months, 4 of the companies in our

prior peer group were removed due to acquisition. For fiscal year 2012, the compensation peer group consisted of:

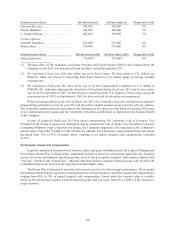

Activision Blizzard, Inc. Electronic Arts, Inc. Plantronics

Agilent Technologies, Inc. Intuit, Inc. Polycom, Inc.

Analog Devices, Inc. Lexmark International, Inc. SanDisk Corporation

Autodesk, Inc. NetApp, Inc. Take-Two Interactive

BMC Software, Inc. Nuance Communications, Inc. VeriFone Systems, Inc.

Brocade Communications Systems, Inc. NVIDIA Corporation

The Committee believes the updated compensation peer group is more representative of the companies with

which Logitech competes for talent and, accordingly, benchmarks its compensation against. The peer group used

in fiscal year 2012 has average annual revenues, net income and market capitalization that are closer to Logitech’s

current financial performance, than the peer group established in March 2008.

At the time the fiscal year 2012 executive compensation review was performed, in March 2012, Logitech

ranked at approximately the 40th percentile among the peer group for revenues, at approximately the 20th percentile

for market capitalization and below the 25th percentile for operating income.

128