Logitech 2012 Annual Report Download - page 253

Download and view the complete annual report

Please find page 253 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

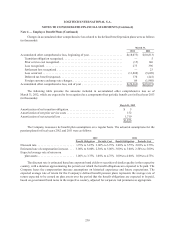

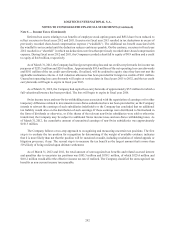

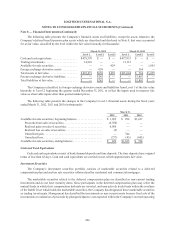

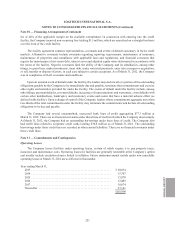

The aggregate changes in gross unrecognized tax benefits in fiscal years 2012, 2011 and 2010 were as follow

(in thousands):

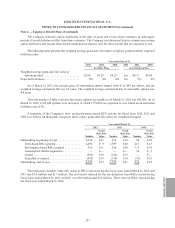

Balance as of March 31, 2009 ......................................................... $ 97,627

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,667)

Decreases in balances related to tax positions taken during prior periods.................... (229)

Increases in balances related to tax positions taken during prior periods .................... 2,690

Increases in balances related to tax positions taken during the current period ................ 17,207

Balance as of March 31, 2010 ......................................................... $113,628

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,760)

Settlements with tax authorities..................................................... (6,290)

Increases in balances related to tax positions taken during the current period ................ 27,550

Balance as of March 31, 2011 ......................................................... $130,128

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,760)

Increases in balances related to tax positions taken during the current period ................ 12,810

Balance as of March 31, 2012 ......................................................... $136,178

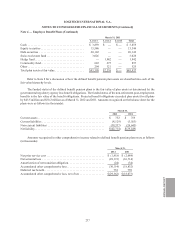

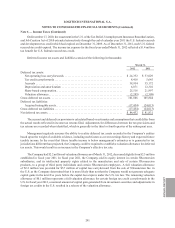

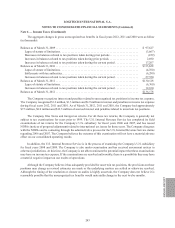

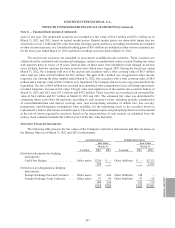

The Company recognizes interest and penalties related to unrecognized tax positions in income tax expense.

The Company recognized $1.2 million, $1.3 million and $1.9 million in interest and penalties in income tax expense

during fiscal years 2012, 2011 and 2010. As of March 31, 2012, 2011 and 2010, the Company had approximately

$7.5 million, $8.0 million and $12.5 million of accrued interest and penalties related to uncertain tax positions.

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally not

subject to tax examinations for years prior to 1999. The U.S. Internal Revenue Service has completed its field

examinations of tax returns for the Company’s U.S. subsidiary for fiscal years 2006 and 2007, and has issued

NOPAs (notices of proposed adjustment) related to international tax issues for those years. The Company disagrees

with the NOPAs and is contesting through the administrative process for the U.S. Internal Revenue Service claims

regarding 2006 and 2007. The Company believes the outcome of this examination will not have a material adverse

effect on our consolidated operating results.

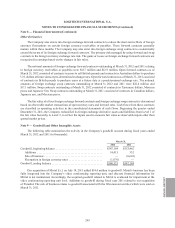

In addition, the U.S. Internal Revenue Service is in the process of examining the Company’s U.S. subsidiary

for fiscal years 2008 and 2009. The Company is also under examination and has received assessment notices in

other tax jurisdictions. At this time, the Company is not able to estimate the potential impact that these examinations

may have on income tax expense. If the examinations are resolved unfavorably, there is a possibility they may have

a material negative impact on our results of operations.

Although the Company believes it has adequately provided for uncertain tax positions, the provisions on these

positions may change as revised estimates are made or the underlying matters are settled or otherwise resolved.

Although the timing of the resolution or closure on audits is highly uncertain, the Company does not believe it is

reasonably possible that the unrecognized tax benefits would materially change in the next twelve months.

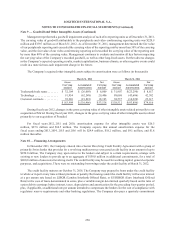

Note 6 — Income Taxes (Continued)

ANNUAL REPORT

243