Logitech 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The provision for income taxes consists of income and withholding taxes. Logitech operates in multiple

jurisdictions and its profits are taxed pursuant to the tax laws of these jurisdictions. The Company’s effective

income tax rate may be affected by changes in or interpretations of tax laws in any given jurisdiction, utilization of

net operating loss and tax credit carryforwards, changes in geographical mix of income and expense, and changes

in management’s assessment of matters such as the ability to realize deferred tax assets.

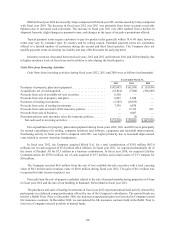

The change in the effective income tax rate to 21.7% in fiscal year 2012 compared with 13.5% in 2011 is

primarily due to the mix of income and losses in the various tax jurisdictions in which the Company operates, and a

discrete tax benefit of $7.2 million in fiscal year 2011 from the closure of income tax audits in certain jurisdictions.

The change in the effective income tax rate to 13.5% in fiscal year 2011 compared with 22.3% in fiscal year 2010 is

primarily due to discrete tax benefits of $13.5 million from the expiration of statutes of limitations and the closure

of income tax audits in certain jurisdictions in fiscal year 2011.

On December 17, 2010, the enactment in the U.S. of the Tax Relief, Unemployment Insurance Reauthorization,

and Job Creation Act of 2010 extended retroactively through the end of calendar year 2011 the U.S. federal research

and development tax credit which had expired on December 31, 2009. As of December 31, 2011, such U.S. federal

research tax credit expired. The income tax expense for the fiscal year ended March 31, 2012 reflected a $1.4 million

tax benefit for U.S. federal research tax credit.

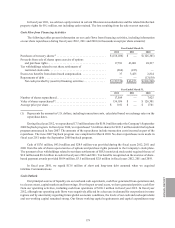

As of March 31, 2012 and 2011, the total amount of unrecognized tax benefits and related accrued interest

and penalties due to uncertain tax positions was $143.3 million and $138.1 million, of which $125.4 million and

$118.2 million would affect the effective income tax rate if recognized.

The Company recognizes interest and penalties related to unrecognized tax positions in income tax expense.

As of March 31, 2012, accrued interest and penalties related to uncertain tax positions decreased to $7.5 million

from $8.0 million as of March 31, 2011.

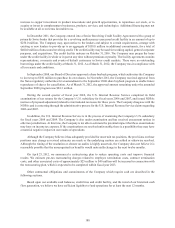

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally not

subject to tax examinations for years prior to 1999. The U.S. Internal Revenue Service has completed its field

examinations of tax returns for the Company’s U.S. subsidiary for fiscal years 2006 and 2007, and has issued

NOPAs (notices of proposed adjustment) related to international tax issues for those years. The Company disagrees

with the NOPAs and is contesting through the administrative process for the U.S. Internal Revenue Service claims

regarding 2006 and 2007. The Company believes the outcome of this examination will not have a material adverse

effect on our consolidated operating results.

In addition, the U.S. Internal Revenue Service is in the process of examining the Company’s U.S. subsidiary

for fiscal years 2008 and 2009. The Company is also under examination and has received assessment notices in

other tax jurisdictions. At this time, the Company is not able to estimate the potential impact that these examinations

may have on income tax expense. If the examinations are resolved unfavorably, there is a possibility they may have

a material negative impact on our results of operations.

Although the Company believes it has adequately provided for uncertain tax positions, the provisions on these

positions may change as revised estimates are made or the underlying matters are settled or otherwise resolved.

Although the timing of the resolution or closure on audits is highly uncertain, the Company does not believe it is

reasonably possible that the unrecognized tax benefits would materially change in the next twelve months.

ANNUAL REPORT

175