Logitech 2012 Annual Report Download - page 182

Download and view the complete annual report

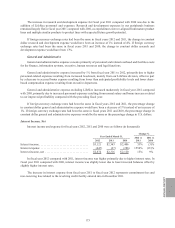

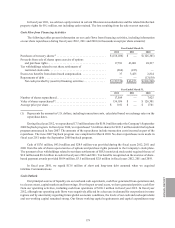

Please find page 182 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On April 25, 2012, we announced a restructuring plan to reduce operating costs and improve financial

results. We estimate pre-tax restructuring charges related to employee termination costs, contract termination

costs, and other associated costs of approximately $25 million to $40 million will be incurred in connection with

the restructuring plan, which is expected to be completed within fiscal year 2013.

We refer to our operating expenses excluding the impact of foreign currency exchange rates as constant

dollar operating expenses. Constant dollar operating expenses are a non-GAAP financial measure, which is

information derived from consolidated financial information but not presented in our financial statements prepared

in accordance with U.S. GAAP. Our management uses these non-GAAP measures in its financial and operational

decision-making, and believes these non-GAAP measures, when considered in conjunction with the corresponding

GAAP measures, facilitate a better understanding of changes in operating expenses. Constant dollar operating

expenses are calculated by translating prior period operating expenses in each local currency at the current period’s

average exchange rate for that currency.

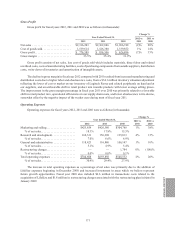

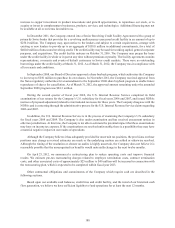

Marketing and Selling

Marketing and selling expense consists of personnel and related overhead costs, corporate and product

marketing, promotions, advertising, trade shows, customer and technical support and facilities costs.

Marketing and selling expense increased 1% in fiscal year 2012 compared with 2011, primarily from higher

personnel-related expenses resulting from increased headcount for LifeSize, the enterprise market team, and the

Asia Pacific region, higher infrastructure costs to support the additional headcount, and the settlement of a customer

bankruptcy dispute. These increases were substantially offset by a decrease in variable demand generation activities

compared with fiscal year 2011, and a decrease in accrued bonus expense resulting from lower than anticipated

profitability levels.

The increase in marketing and selling expense in fiscal year 2011 compared with fiscal year 2010 resulted

primarily from the addition of LifeSize sales and marketing personnel in December 2009, variable demand

generation activities, and increased personnel costs. In fiscal year 2011, we invested approximately $32 million in

variable demand generation activities focused on Harmony remotes and Logitech Revue. Non-LifeSize personnel

costs increased due to a 14% increase in headcount, partly to support the expansion of sales efforts in China, and

normal salary and bonus increases compared with fiscal year 2010.

If foreign currency exchange rates had been the same in fiscal years 2012 and 2011, the percentage change in

constant dollar marketing and sales expense would have been a decrease of 1% instead of an increase of 1%. The

percentage changes in constant dollar marketing and selling expense for fiscal years 2011 and 2010 compared with

the preceding years were the same as the percentage changes in U.S. dollars.

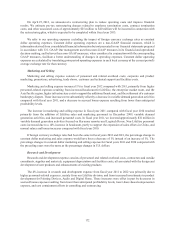

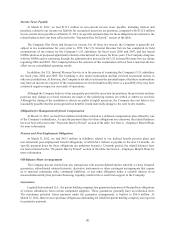

Research and Development

Research and development expense consists of personnel and related overhead costs, contractors and outside

consultants, supplies and materials, equipment depreciation and facilities costs, all associated with the design and

development of new products and enhancements of existing products.

The 4% increase in research and development expense from fiscal year 2011 to 2012 was primarily due to

higher personnel-related expenses, mainly from our LifeSize division, and from increased investments in product

development for Pointing Devices, Audio and Digital Home. These increases were offset in part by decreases in

accrued bonus expense resulting from lower than anticipated profitability levels, lower share-based compensation

expense, and cost containment efforts in consulting and outsourcing.

172