Entergy 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

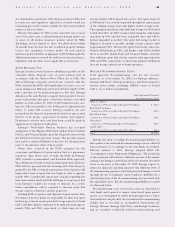

Other Derivatives

Entergy also holds derivative instruments such as natural gas

and electricity options and forwards that are not accounted for

as hedges. These instruments are entered into to optimize

asset values or limit risks.

Fair Values

COMMODITY INSTRUMENTS – Fair value estimates of Energy

Commodity Services’ commodity instruments are made at

discrete points in time based on relevant market information.

Market quotes are used in determining fair value whenever

they are available. When market quotes are not available (e.g.,

in the case of a long-dated commodity contract), other

information is used, including transactional data and internally

developed models. Fair value estimates based on these other

methodologies are necessarily subjective in nature and involve

uncertainties and matters of significant judgment. Therefore,

actual results may differ from these estimates. At December 31,

2002 and 2001, the fair values of Energy Commodity Services’

energy-related commodity contracts accounted for on a mark-

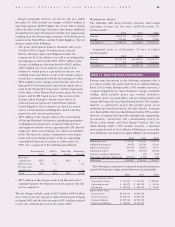

to-market basis were as follows (in thousands):

2002 2001

Assets Liabilities Assets Liabilities

Consolidated

subsidiaries $ 4,071 $ 8,395 $ 59,996 $ 18,882

Equity method

investees(1) $754,678 $663,765 $774,509 $667,752

(1) As required by equity method accounting principles, only Entergy’s net

investment in these investees is reflected in its balance sheet, and these assets

and liabilities are not reflected in Entergy’s balance sheet. See Note 13 to the

consolidated financial statements for more information on Entergy’s equity

method investees.

Following are the cumulative periods in which the net mark-

to-market assets would be realized in cash if they are held to

maturity and market prices are unchanged (in millions):

Maturities and Sources

for Fair Value of Trading 2005-

Contracts at December 31, 2002 2003 2004 2006 Total

Prices actively quoted $45.0 $45.1 $(20.2) $69.9

Prices provided by

other sources 24.4 3.3 1.9 29.6

Prices based on models (13.3) 1.3 3.4 (8.6)

Total $56.1 $49.7 $(14.9) $90.9

FINANCIAL INSTRUMENTS –The estimated fair value of Entergy’s

financial instruments is determined using bid prices reported by

dealer markets and by nationally recognized investment

banking firms. The estimated fair value of derivative financial

instruments is based on market quotes. Considerable judgment

is required in developing some of the estimates of fair value.

Therefore, estimates are not necessarily indicative of the

amounts that Entergy could realize in a current market

exchange. In addition, gains or losses realized on financial

instruments held by regulated businesses may be reflected in

future rates and therefore do not necessarily accrue to the

benefit or detriment of stockholders.

Entergy considers the carrying amounts of most of its financial

instruments classified as current assets and liabilities to be a

reasonable estimate of their fair value because of the short

maturity of these instruments. Additional information regarding

financial instruments and their fair values is included in Notes 5,

6, and 7 to the consolidated financial statements.

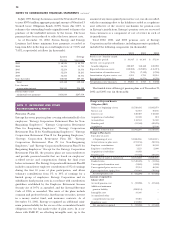

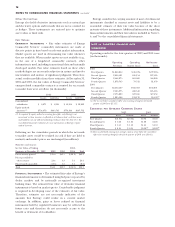

NOTE 16. QUARTERLY FINANCIAL DATA

(UNAUDITED)

Operating results for the four quarters of 2002 and 2001 were

(in thousands):

Operating Operating Net Income

Revenues Income (Loss) (Loss)

2002:

First Quarter $1,860,834 $(45,675) $(72,983)

Second Quarter 2,096,581 496,154 247,585

Third Quarter 2,468,875 663,689 366,800

Fourth Quarter 1,878,745 73,512 81,670

2001:

First Quarter $2,652,427 $360,967 $160,871

Second Quarter 2,506,275 480,549 245,583

Third Quarter 2,576,889 607,656 317,454

Fourth Quarter 1,885,308 124,170 26,599(a)

(a) Net income before cumulative effect of accounting change for the fourth

quarter of 2001 was $3,117.

EARNINGS PER AVERAGE COMMON SHARE

2002 2001

Basic Diluted Basic Diluted

First Quarter $(0.36) $(0.36) $0.70 $0.69

Second Quarter $ 1.08 $ 1.06 $1.08 $1.06

Third Quarter $ 1.61 $ 1.59 $1.41 $1.39

Fourth Quarter $ 0.36 $ 0.35 $0.10(b) $0.09(b)

(b) Basic and diluted earnings per average common share before the cumulative

effect of accounting change for the fourth quarter of 2001 was ($0.01).

78

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS concluded